Best Crypto to Buy Now 2026: DeepSnitch AI Tops Lists as Pi Network Price Crashes, EU Tightens Sanctions to Curb Russia’s Use of Crypto

According to reports, the EU plans to ban all crypto transactions with Russia in a new sanctions package. The aim is to close loopholes, though experts question how effectively such measures can be enforced.

Although the crypto space is crowded, DeepSnitch AI (DSNT) stands out by pairing real utility with real momentum. The price has already climbed 164% to $0.03985, with over $1.58M raised, and it is not slowing down.

Traders are calling it the best crypto to buy now, this cycle, for over 100X-300X returns. Presently, the team has extended the launch window to give more people a chance to get in. On top of that, DeepSnitch AI has launched a new tiered bonus system where larger buyers can get over 300% bonuses.

EU expands Russia sanctions to address crypto loopholes

The European Union is preparing a new sanctions package for Russia. The move is aimed at closing cryptocurrency loopholes that officials say Russia is using to bypass existing restrictions.

This ban is part of its upcoming 20th sanctions package, expected to be adopted on February 24. Unlike previous measures targeting specific entities, the proposal would broadly restrict crypto channels to prevent bypassing.

An internal European Commission document warned that sanctioning individual service providers often leads to new ones emerging. However, analysts question whether a comprehensive crypto ban can be fully enforced.

Best crypto to buy now 2026: Can DeepSnitch AI outshine these two competitors?

1. DeepSnitch AI (DSNT) joins the top trending coins this week after 164% pump

One of the top cryptocurrencies to buy today might be DeepSnitch AI. The presale giant has gained a lot of traction, topping crypto headlines and presale posts.

Thanks to this high investor interest, DeepSnitch AI is currently in the fifth phase of its presale and is now valued at $0.03985. Rumors are saying that popular exchanges might list DSNT this quarter.

Such an exchange listing would increase adoption and also affect price positively, making DeepSnitch AI the best crypto to buy now.

Apart from the returns, DeepSnitch AI is offering DSNT holders access to advanced trading tools. The platform’s goal is to turn raw on-chain data and social signals into actionable insights.

Its suite of AI agents can help identify unusual wallet movements, contract risks, and sentiment shifts before they hit mainstream awareness. Meanwhile, SolidProof and Coinsult have audited the project’s smart contract, reporting no critical vulnerabilities.

Furthermore, the project has published a detailed roadmap and token utility framework with transparency in allocations. For investors seeking up to 300X gains, the best crypto to buy now could be DeepSnitch AI.

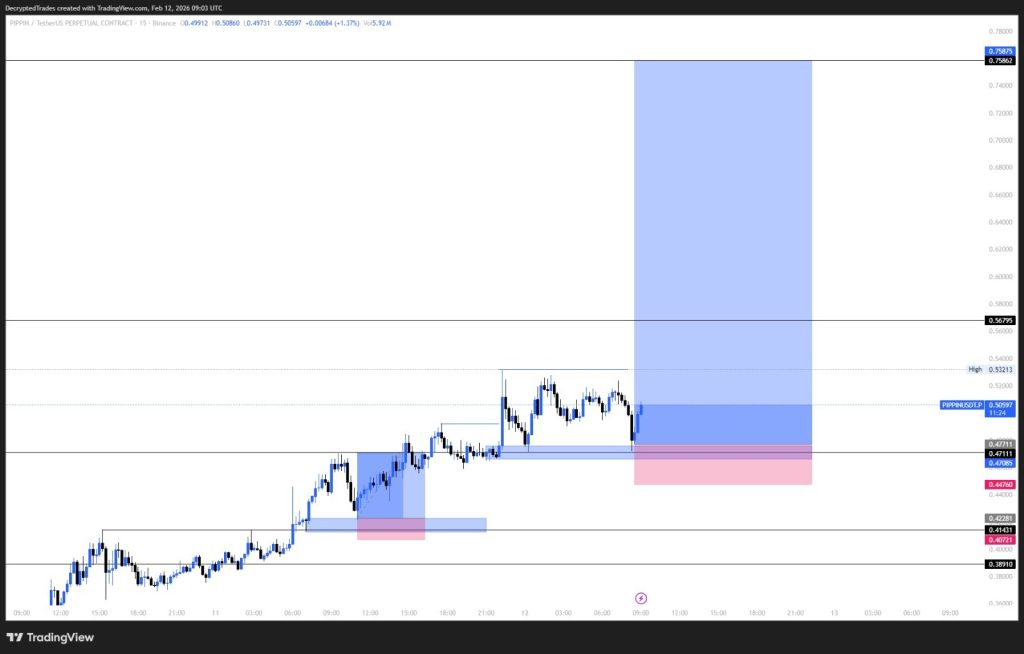

2. Pippin breaks out of the consolidation phase

Pippin is one of the trending coins this week, per CoinGecko. Its price has surged by 171.4% on the weekly chart, with many analysts alleging cases of manipulation.

The cryptocurrency has broken out of a consolidation phase around $0.17-$0.20, which began in the first week of February. As of February 12, the Pippin coin was trading at $0.47 after a minor correction from $0.55. Going forward, analysts forecast that the Pippin price may soar to $0.7 -$1.00 soon.

3. Pi Network price crashes to a new all-time low

The Pi Network coin has been on a steep decline in the past month, falling from $0.20 to an all-time low of $0.13. CoinGecko data indicates the Pi Network price has dipped by 10.2% on the weekly chart.

The downtrend follows numerous token unlocks, which have affected investors’ sentiment. As of February 12, the Pi Network crypto was trading at $0.13.

The RSI has dropped into the oversold region and now reads 25. Still, CoinCodex forecast that the Pi Network price might pump to $ 0.36.

Final verdict

While the Pippin price is up, the value of Pi Network could decline to low levels. Meanwhile, many traders have tagged DeepSnitch AI the best crypto to buy now.

DeepSnitch AI is expected to give investors much higher returns of over 300X, given its rising demand, clear roadmap, and AI utility. Early buyers can still take advantage of 30%–300% bonuses, stacking their bags at the current price of $0.03985.

This could be the best time to join the presale as prices increase from time to time. Once the DeepSnitch AI price increases, the same capital buys fewer tokens. So, you might want to act now.

Visit the official website for more information, and join X and Telegram for community updates.

FAQs

1. What is the best crypto to buy now?

DeepSnitch AI is a good option to consider given its fast-rising presale momentum and connection to the AI market. Many experienced traders have dubbed it the next crypto to 100X soon.

2. What is the best cryptocurrency for beginners?

Many traders say DeepSnitch AI might be the best crypto for beginners due to its early-stage advantage, low price, and high potential returns. It is currently one of the trending coins this week and might record a 100X pump soon.

3. What is the cheapest but best crypto to buy now?

DeepSnitch AI could be one of the top choices to consider right now for future gains, given its low market cap and price of $0.03985. Market traders say its price might soar by 1,000X in 2026, making it one of the top cryptocurrencies to buy today.

The post Best Crypto to Buy Now 2026: DeepSnitch AI Tops Lists as Pi Network Price Crashes, EU Tightens Sanctions to Curb Russia’s Use of Crypto appeared first on CaptainAltcoin.

You May Also Like

Yunfeng Financial appoints Jiang Guofei as Chairman of Web3 Development Committee

Crucial ETH Unstaking Period: Vitalik Buterin’s Unwavering Defense for Network Security