Bio Protocol surges amid whale buying frenzy, but 1 risk remains

Bio Protocol price surged to a record high as recent momentum continued and whale accumulation accelerated.

- Bio Protocol price surged to a record high this week.

- Whales have intensified their accumulation.

- There is a risk of a reversal as it has become overbought.

Bio Protocol (BIO) jumped to a high of $0.2390, up more than 450% from its lowest level this year. Its 24-hour volume surged 120% to $872 million, surpassing its market capitalization of $374 million.

The surge comes as investors cheer the upcoming launch of Aubrai, Bio Protocol’s first decentralized scientific agent. Developed in collaboration with VitaDAO, Aubrai aims to advance research in human longevity and anti-aging.

The ignition sale will launch on Monday, August 25, with a fully diluted valuation of $269,000. After the sale, the AUBRAI token will list with a valuation of nearly $900,000.

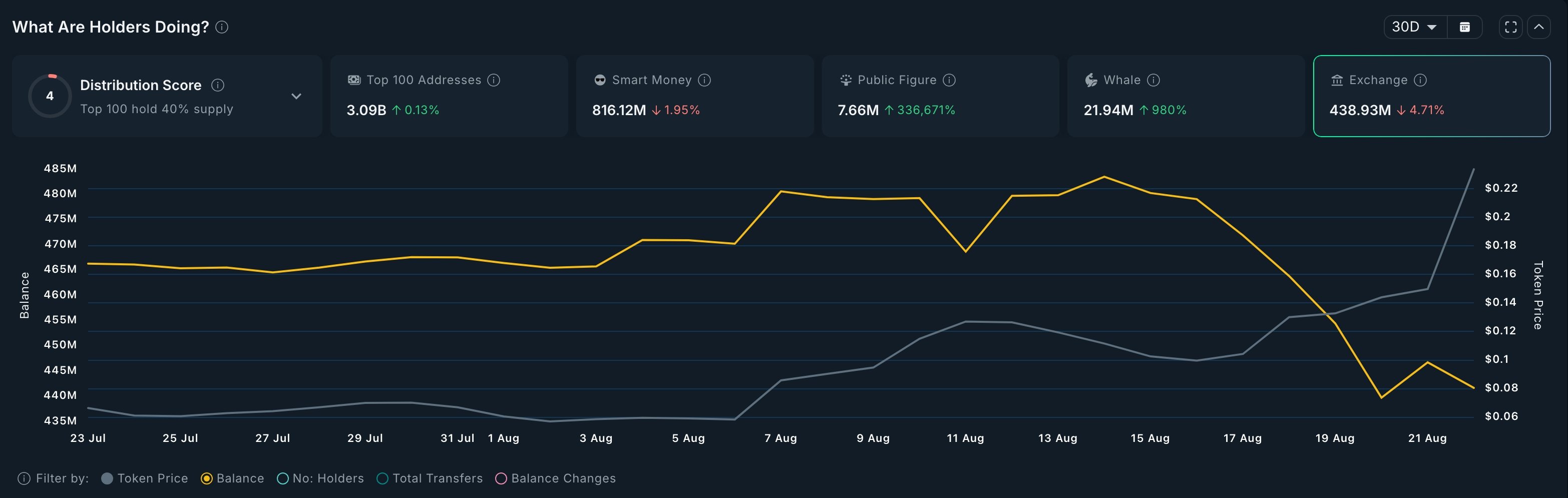

Bio Protocol price also climbed as third-party data showed persistent whale accumulation. According to Nansen, whales now hold more than 21.94 million BIO tokens, a 980% increase in the past 30 days.

Whale accumulation suggests these investors see long-term potential for the token. Exchange outflows have also continued, falling from 483 million on Thursday last week to 439 million today.

Whales likely view Bio Protocol as a disruptor in the decentralized science (DeSci) industry. The platform enables scientists worldwide to fund their research and development through decentralized autonomous organizations. These DAOs raise funds via token sales and allocate capital to biotech projects aligned with their mission.

For example, Cerebrum DAO recently approved its first funding worth $80,000 for Percepta, which focuses on memory loss.

Some ecosystem DAOs have already achieved multimillion-dollar valuations. HairDAO has a market cap of $66.5 million, while VitaDAO, ValleyDAO, and Vita-Fast hold valuations of $59 million, $22.4 million, and $9.95 million, respectively.

Bio Protocol price technical analysis

The daily timeframe shows that the BIO price has rocketed higher this week. It jumped above the resistance at $0.10, the neckline of the double-bottom pattern at $0.0433.

BIO price also jumped above the resistance at $0.1433, the previous all-time high. It has moved above the 50-day moving average, which has provided it with strong support.

The risk, however, is that the Bio Protocol price has become highly overbought. The Relative Strength Index moved to the extreme overbought point at 82, while the Stochastic has jumped to 94.

Therefore, the token will likely pull back soon as investors start to take profits. If this happens, the key prices to watch will be at $0.1435 and $0.1012.

You May Also Like

XRP Enters ‘Washout Zone,’ Then Targets $30, Crypto Analyst Says

Republicans are 'very concerned about Texas' turning blue: GOP senator