Tesla stock faces bearish breakdown as growth slows — Musk views aren’t helping

Tesla stock price remains in a deep correction after falling by about 17% from its all-time high, a drop that has erased over $130 billion in value.

- Tesla stock has dropped by 17 percent from its all-time high.

- The company’s business is facing major headwinds as growth stalls.

- It has formed a head-and-shoulders pattern on the daily timeframe chart.

Tesla’s shares have retreated as the company faces major headwinds, including rising competition in the electric vehicle market and slowing revenue growth.

Its most recent results showed that total revenues dropped by 3% in the fourth quarter to $24 billion. Its automotive revenue fell 11% to $17.6 billion, while its energy generation and storage revenue rose 25% to $3.8 billion.

Tesla’s growth could face challenges as competition intensifies in key markets such as the U.S., Europe, and China.

Rivian surpassed Wall Street’s fourth-quarter expectations and projected a major boost in 2026 vehicle deliveries, targeting 62,000–67,000 units—a 47%–59% increase over 2025. Its stock surged over 28% on Friday following the announcement.

And in China, local brands like Nio, XPeng, Xiaomi, and BYD are flourishing. For example, a report released on Friday showed that Xiaomi’s YU7 outsold Tesla’s Model Y in China for the first time.

The competition is also rising in other markets, including in the United States, where the upcoming R2 will pose a risk to its sales. Rivian predicts that its sales will jump by 53% this year.

Tesla is also facing competition in Europe, which is aiming to reduce tariffs on Chinese companies like Nio and BYD.

Most notably, Tesla has become one of the most overvalued companies in the U.S., with a forward PE ratio of 202, which is much higher than the S&P 500 Index average of 22.

One of the main reasons Tesla is attracting this premium valuation is its investments in AI and robotics. It recently invested $2 billion in xAI and is preparing to launch the Optimus robots. Optimus will be a humanoid used by manufacturers to handle unsafe and repetitive tasks.

The risk, however, is that Optimus will take time to generate meaningful revenue and profits for the company.

Tesla stock price technical analysis

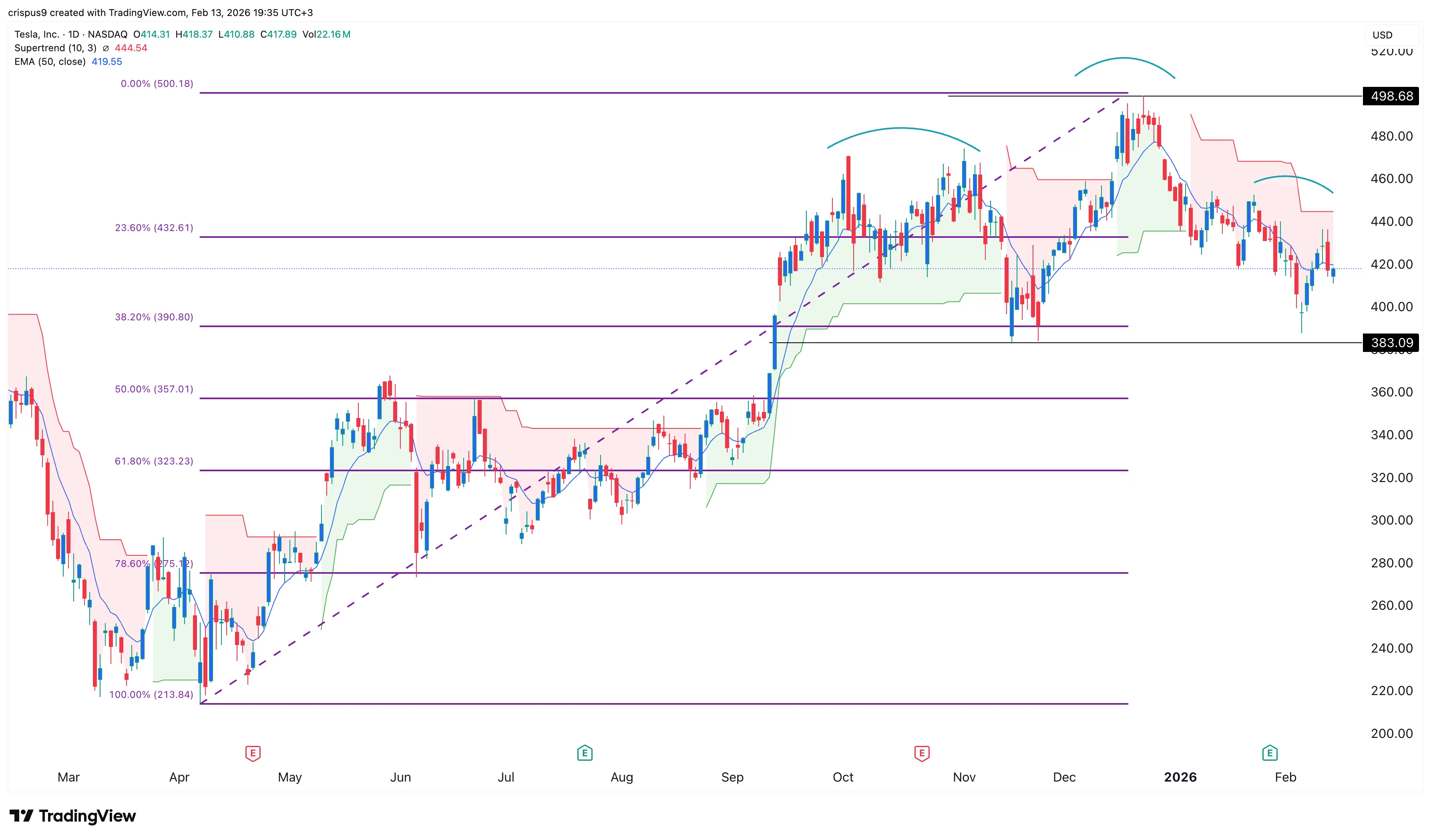

The daily timeframe chart shows that TSLA’s stock price peaked at $500 in December and has since retreated to $417. It has flipped the Supertrend indicator from green to red and moved below the 50-day Exponential Moving Average.

Most importantly, the stock has formed a head-and-shoulders pattern, with the neckline at $383. Therefore, the stock will likely have a strong bearish breakout in the near term. This outlook will be confirmed if it drops below the neckline at $383.

A drop below that price will indicate further downside, potentially to the 50% Fibonacci Retracement level at $357.

The Musk Factor

Tesla CEO Elon Musk has increasingly amplified anti-immigrant and far-right content on social media, with critics saying his recent posts show a more explicit engagement with white nationalist narratives than in the past.

Observers, including former homeland security official William Braniff, argue that Musk has echoed “textbook” white supremacist conspiracy theories such as the so-called “great replacement,” while lending those ideas the visibility of his more than 200 million followers.

Analysts say this shift has deepened concerns about his public persona, with some warning that Musk’s political rhetoric and polarizing online presence are increasingly shaping perceptions of Tesla — potentially alienating portions of the electric vehicle maker’s customer base and weighing on sales in certain markets.

You May Also Like

Raydium’s 200% volume spike tests RAY’s breakout strength – Here’s why

Vitalik Buterin lays out new Ethereum roadmap at EDCON