Fed Rate Cut: Why September’s Crucial Move Looks Unlikely

BitcoinWorld

Fed Rate Cut: Why September’s Crucial Move Looks Unlikely

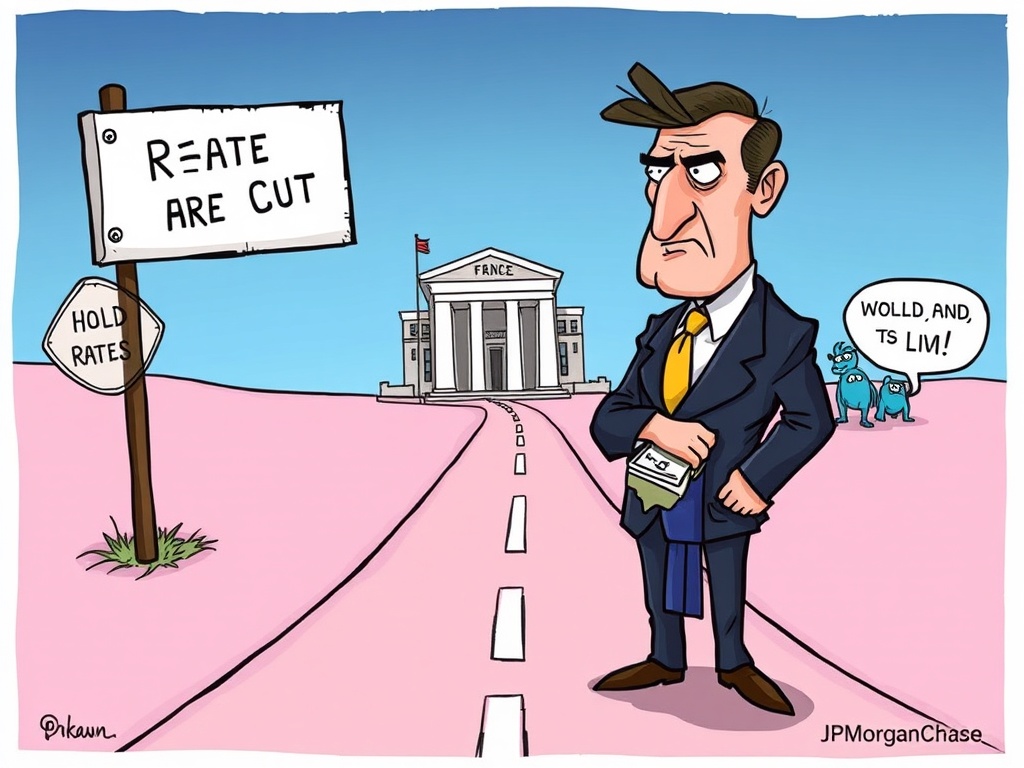

The anticipation around a potential Fed rate cut has been a hot topic, especially for those watching the markets, including the dynamic world of cryptocurrencies. Recently, Wall Street giant JPMorganChase delivered a dose of reality, suggesting that a September Fed rate cut is highly improbable. This perspective challenges the earlier hints from Federal Reserve Chair Jerome Powell about a possible shift towards easing monetary policy.

Why a September Fed Rate Cut Seems Remote

JPMorganChase’s analysis, as reported by South Korean outlet News1, points to several factors making an immediate easing unlikely. Despite some growing calls for lower rates, the bank believes the Federal Open Market Committee (FOMC) will choose to hold steady.

- Dovish Voices vs. Consensus: The committee saw a change with Stephen Miran joining, replacing Adriana Kugler. Miran’s presence is seen as adding more “dovish” voices, meaning those who favor lower interest rates. However, this doesn’t guarantee a consensus.

- Powell’s Swing Vote: With a more diverse range of opinions, a unanimous decision becomes less likely. This scenario often leaves Chair Powell with a crucial “swing vote,” making his decision pivotal.

- Persistent Inflation Risks: Most significantly, JPMorgan argues that ongoing inflation risks remain a major deterrent. The Fed’s primary mandate is price stability, and until inflation is firmly under control, a proactive Fed rate cut is difficult to justify.

This cautious stance highlights the complex balancing act the Federal Reserve faces between supporting economic growth and taming rising prices. Many market participants are eager for a Fed rate cut, hoping it will stimulate economic activity and potentially benefit risk assets like crypto.

Unpacking the Fed’s Dilemma: Inflation vs. Easing

The Federal Reserve’s decisions are never simple. On one hand, persistent high interest rates can slow down economic growth, impacting everything from consumer spending to business investments. On the other hand, cutting rates too soon could reignite inflation, erasing progress made over the past year.

The Fed carefully monitors a wide array of economic data, including:

- Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE) for inflation.

- Employment figures, such as the unemployment rate and job growth.

- GDP growth, indicating overall economic health.

These indicators provide a clearer picture of whether the economy can withstand current rates or if an adjustment, like a Fed rate cut, is truly necessary. JPMorgan’s view suggests that the current data still points towards caution rather than immediate action.

What Does This Mean for Your Portfolio?

For investors, particularly in the volatile cryptocurrency market, the Fed’s monetary policy has significant implications. Higher interest rates generally make traditional, less risky investments more attractive, potentially drawing capital away from speculative assets like crypto. Conversely, a Fed rate cut often signals a more accommodative environment, which can fuel enthusiasm for riskier assets.

If JPMorgan’s prediction holds true, and a September Fed rate cut doesn’t materialize, investors might need to brace for continued market stability or even some headwinds. It underscores the importance of a well-diversified portfolio and staying informed about macroeconomic trends.

Looking Ahead: The Path to a Fed Rate Cut

While September might be off the table, the discussion around a future Fed rate cut is far from over. The Fed’s stance is data-dependent, meaning future economic reports will heavily influence their decisions. Should inflation show sustained and significant declines, or if the labor market weakens unexpectedly, the pressure for easing will undoubtedly grow.

Key takeaways for investors:

- Stay Informed: Keep a close eye on upcoming inflation reports and Fed speeches.

- Assess Risk: Understand how different interest rate scenarios could impact your investments.

- Long-Term View: Avoid making hasty decisions based on short-term predictions.

The journey to a more relaxed monetary policy will likely be gradual, with the Federal Reserve prioritizing long-term economic stability over quick adjustments.

Summary: JPMorganChase’s assessment provides a crucial reality check for those anticipating a September Fed rate cut. Citing persistent inflation risks and a more divided FOMC, the bank suggests the Federal Reserve will likely maintain its current policy. This cautious approach emphasizes the Fed’s commitment to price stability, urging investors to consider the broader economic landscape when making financial decisions, especially concerning risk assets like cryptocurrencies.

Frequently Asked Questions (FAQs)

Q1: Why does JPMorganChase think a September Fed rate cut is unlikely?

JPMorganChase believes a September Fed rate cut is unlikely due to persistent inflation risks, a more diverse range of opinions within the FOMC making a unanimous decision less probable, and the critical swing vote held by Chair Jerome Powell.

Q2: Who is Stephen Miran and how does his presence affect the Fed’s decision?

Stephen Miran recently joined the FOMC, replacing Adriana Kugler. His presence adds more “dovish” voices to the committee, meaning those who generally favor lower interest rates. However, this increased diversity of opinion can make achieving a consensus on a Fed rate cut more challenging.

Q3: What are “dovish voices” in the context of the Federal Reserve?

“Dovish voices” refer to members of the Federal Reserve’s policy-making committee who tend to favor lower interest rates and a more accommodative monetary policy to stimulate economic growth, even if it means tolerating slightly higher inflation.

Q4: How do the Fed’s interest rate decisions impact the cryptocurrency market?

When the Fed raises interest rates, traditional, less risky investments become more attractive, potentially drawing capital away from speculative assets like cryptocurrencies. Conversely, a Fed rate cut can signal a more accommodative environment, which often encourages investment in riskier assets, including crypto.

Q5: What economic data does the Fed consider when deciding on a Fed rate cut?

The Fed considers a broad range of economic data, including inflation indicators like the Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE), employment figures (unemployment rate, job growth), and Gross Domestic Product (GDP) growth, to gauge the overall health of the economy and guide its monetary policy decisions.

If you found this analysis insightful, please share it with your network! Understanding the Federal Reserve’s stance on a potential Fed rate cut is vital for anyone navigating today’s financial markets. Spread the word and help others stay informed.

To learn more about the latest crypto market trends, explore our article on key developments shaping Bitcoin price action.

This post Fed Rate Cut: Why September’s Crucial Move Looks Unlikely first appeared on BitcoinWorld and is written by Editorial Team

You May Also Like

GCC and India to sign terms for start of free trade talks

PEPE Holders Looking For The Next 100x Crypto Set Their Sights On Layer Brett Presale