Chainlink partners with Japan’s SBI Group, focusing on DeFi use cases

- Chainlink announced a partnership with Japan’s SBI Group conglomerate with $200 billion in assets.

- The partnership will focus on tokenizing RWAs, funds, stocks, and other DeFi use cases such as stablecoins.

- The Japanese financial giant has over $200 billion in assets.

Chainlink (LINK) edges higher by over 1% at press time on Monday with the announcement of securing a partnership with Japan’s financial conglomerate SBI Group. The firm, with over $200 billion in assets, will focus on decentralized finance (DeFi) product offerings.

Furthermore, the Chainlink network continues to experience heightened activity, with the LINK supply in profit remaining elevated.

Chainlink and SBI Group in new venture

Chainlink and SBI Group have entered into a new partnership, following the successful delivery of an automated fund administration and transfer agency solution for the Monetary Authority of Singapore's (MAS) Project Guardian, alongside UBS Asset Management.

The Oracle network-financial firm partnership will focus on DeFi use cases, including stablecoins and tokenized stocks, funds, and other real-world assets (RWAs), such as bonds and real estate. To tap into the DeFi world, SBI Group will leverage Chainlink’s Cross-Chain Interoperability Protocol (CCIP), SmartData (NAV), and Proof of Reserve to unlock secondary market liquidity.

Yoshitaka Kitao, Representative Director, Chairman, President & CEO of SBI Holdings, stated:

“Chainlink is a natural partner for SBI, complementing our financial footprint with their market-leading interoperability and reliability on-chain. With our combined strengths, we are delighted to be working together on developing groundbreaking, secure, compliance-focused solutions, including powering compliant cross-border transactions using stablecoins, that accelerate the widespread adoption of digital assets in Japan and the region.”

Chainlink on-chain data reflect optimism

Santiment data shows the supply of LINK token in profit (bought at a price lower than the current market value) is at 95.04%, up from 80.57% on August 1. Typically, elevated levels of supply in profit indicate increased investor confidence and an uptrend in motion.

LINK supply in profit. Source: Santiment

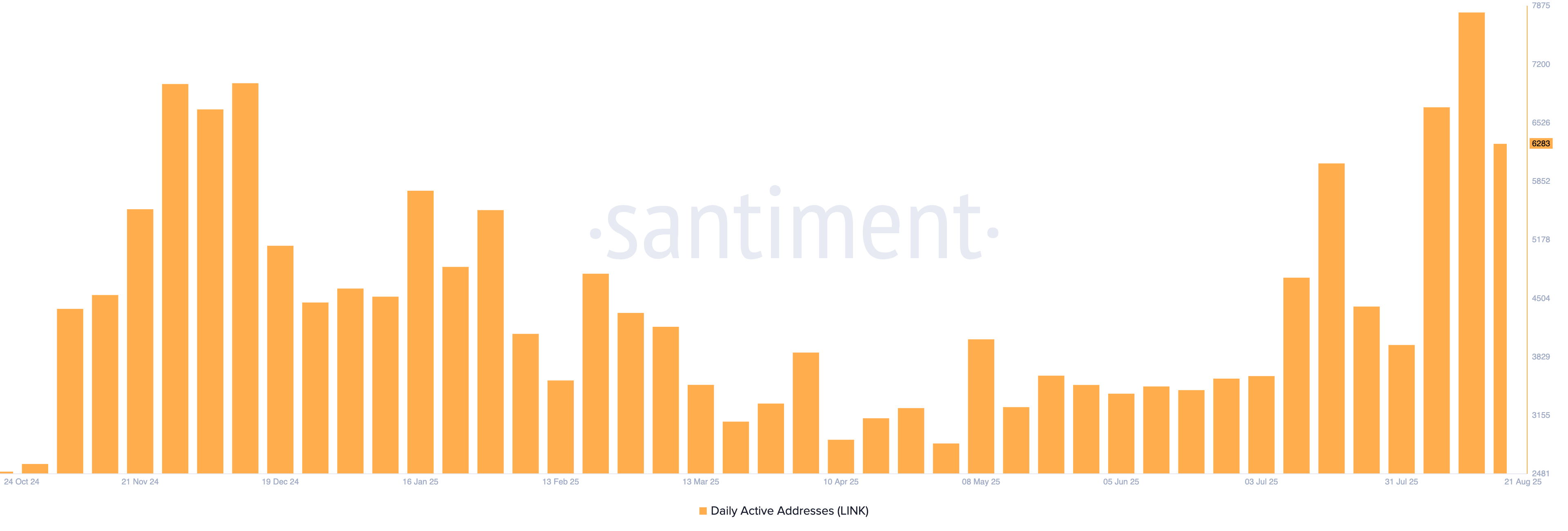

Amid the risk-on sentiment, network activity on Chainlink remains at higher levels compared to the slump from March to July. The daily active addresses maintained an average of 7,797 last week, the highest in 2025.

Daily active addresses. Source: Santiment

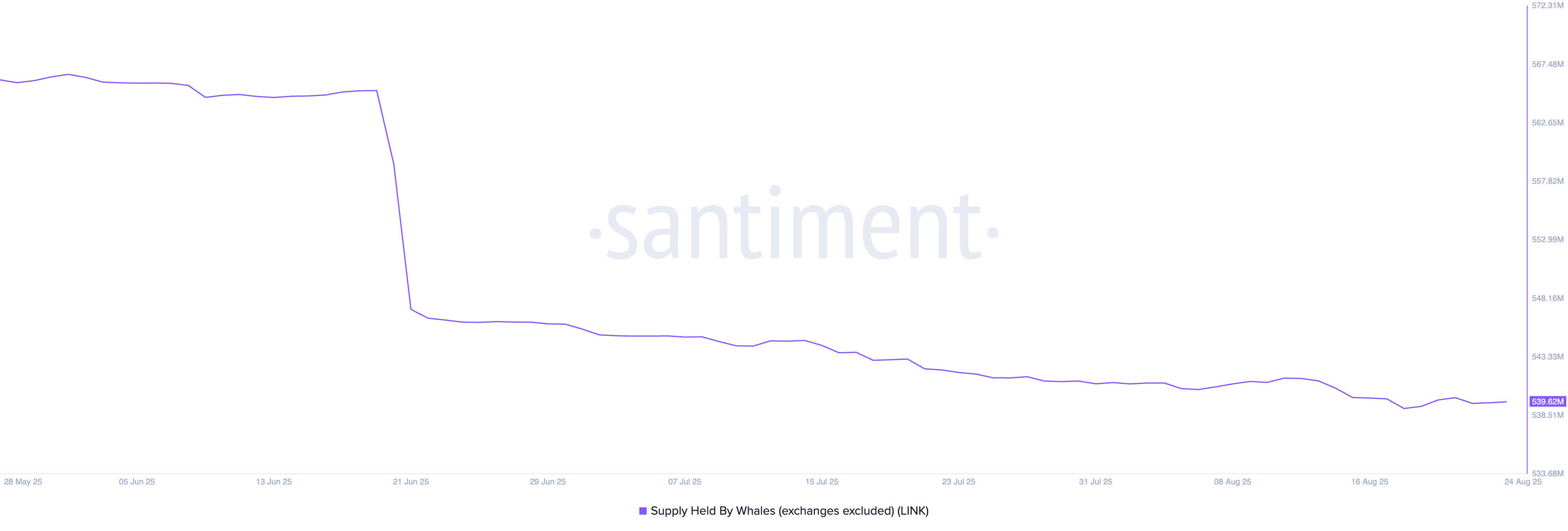

Still, the large-wallet investors, popularly known as whales, offload their holdings, reaching a record low of 539.07 million LINK tokens on August 18. At present, it stands at 539.62 million tokens.

LINK supply held by whales. Source: Santiment

You May Also Like

Shibarium May No Longer Turbocharge Shiba Inu Price Rally, Here’s Reason

👨🏿🚀TechCabal Daily – When banks go cashless