UAE Expands Bitcoin Bet Beyond $900 Million

The United Arab Emirates has quietly built one of the largest sovereign Bitcoin exposures in the world, with total holdings now surpassing $900 million as of February 2026.

Through a combination of direct ETF stakes and indirect mining-linked exposure, Abu Dhabi–based entities have steadily increased their allocation throughout 2025 and into early 2026.

Unlike short-term institutional flows seen elsewhere, the UAE’s positioning reflects a structured, long-term diversification strategy rather than tactical trading.

Source: https://www.sec.gov/edgar/search/#/q=bitcoin&dateRange=c

Source: https://www.sec.gov/edgar/search/#/q=bitcoin&dateRange=c

Mubadala and ADIC Lead the Accumulation

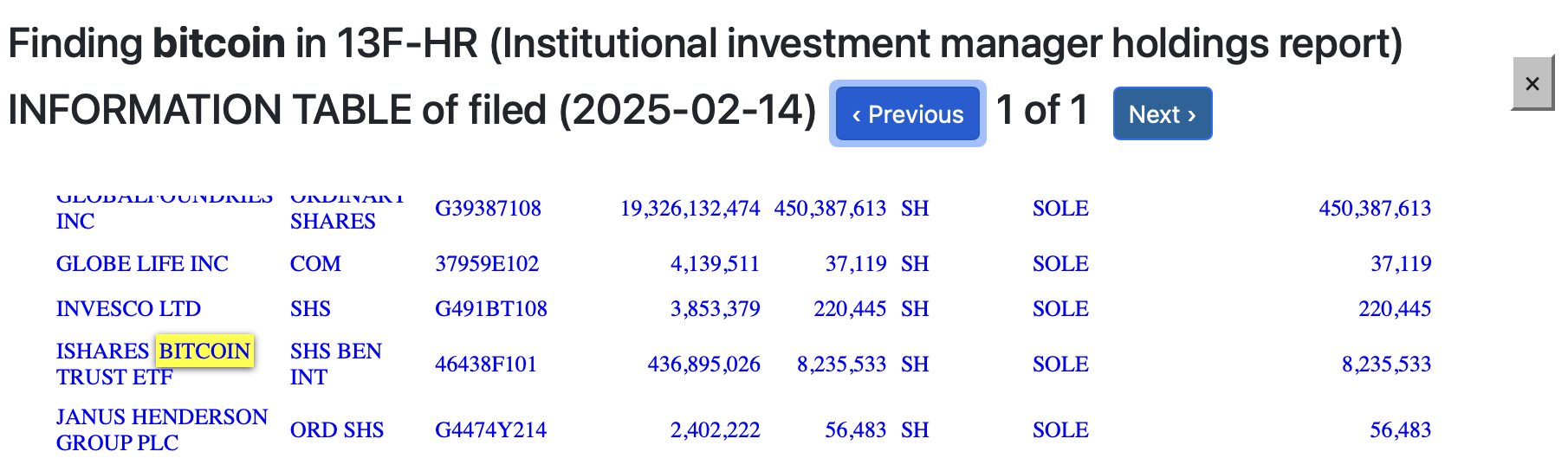

At the center of this expansion is Mubadala Investment Company, one of Abu Dhabi’s primary sovereign wealth funds. In early 2025, Mubadala disclosed approximately $437 million in exposure to BlackRock’s iShares Bitcoin Trust (IBIT), marking one of the largest state-backed ETF allocations at the time.

Momentum accelerated in late 2025 when the Abu Dhabi Investment Council (ADIC), an arm linked to Mubadala, significantly increased its IBIT position. Reports from that period indicate ADIC tripled its stake to nearly 8 million shares, valued at approximately $518 million at the time of disclosure.

By mid-February 2026, combined sovereign holdings from UAE entities exceeded 16 million shares in Bitcoin ETFs, pushing aggregate exposure beyond the $900 million mark.

This positioning places the UAE among the most consistent state-level allocators to regulated Bitcoin investment vehicles.

Strategic Framing: “Digital Gold” Allocation

Fund representatives have framed Bitcoin not as a speculative asset, but as a strategic reserve component. Officials have described it as a “long-term store of value similar to gold,” signaling that the allocation is intended to remain part of a permanent diversification framework.

The growth trajectory illustrates a clear pattern:

- Q4 2024: Initial sovereign positioning begins

- Q1 2025: Mubadala discloses ~$437M exposure

- Q3 2025: ADIC expands stake toward ~$518M

- February 2026: Combined exposure surpasses ~$900M

The steady increase suggests conviction rather than reactive buying.

Holding Through Market Stress

Notably, the UAE maintained its exposure during a period of heightened market stress in February 2026, when the Crypto Fear & Greed Index dropped to extreme fear levels near 9. While many institutional investors reduced risk during that phase, sovereign holdings remained intact.

Beyond ETFs, Abu Dhabi has also indirectly expanded its Bitcoin footprint through state-linked mining initiatives, including partnerships between ADQ and Marathon Digital Holdings. This adds operational exposure alongside financial allocation.

Taken together, the UAE’s approach signals a shift from opportunistic participation toward structured treasury integration. Instead of treating Bitcoin as a trading asset, the country appears to be positioning it as a long-term reserve layer within a broader sovereign portfolio strategy.

The post UAE Expands Bitcoin Bet Beyond $900 Million appeared first on ETHNews.

You May Also Like

World Order Shift Sparks New Crypto Cycle, Analyst Predicts

A Netflix ‘KPop Demon Hunters’ Short Film Has Been Rated For Release