Altcoin Sell Pressure Hits 5-Year High as $209B Outflow Crushes Altcoin Season Hopes

The post Altcoin Sell Pressure Hits 5-Year High as $209B Outflow Crushes Altcoin Season Hopes appeared first on Coinpedia Fintech News

Altcoin sell pressure has reached its highest level in 5 years, with over $209 billion flowing out of the altcoin market. This massive capital outflow signals weakening investor confidence and reduces the chances of a near-term altcoin season

As liquidity moves to Bitcoin or exits crypto, investors question if the altcoin season will still happen or is altcoins season is dead?

Altcoin Sell Pressure Reaches 5-Year Extreme

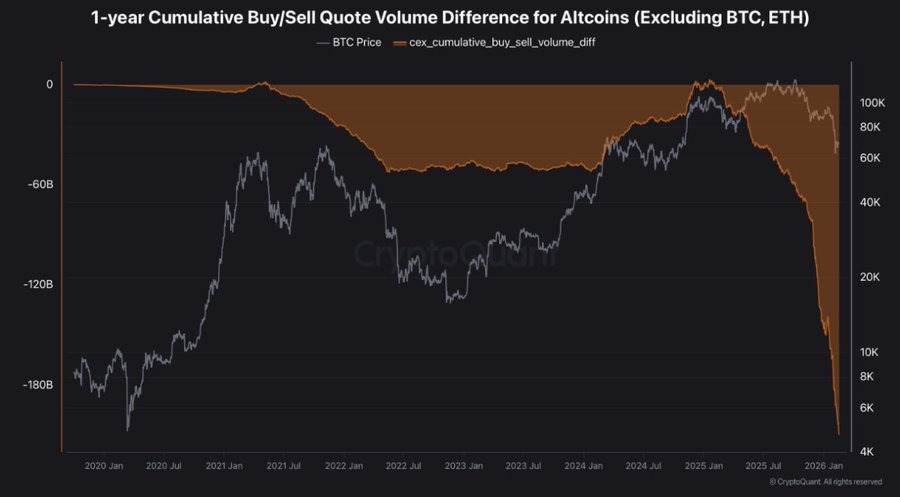

According to data shared by CryptoQuant, the 1-year cumulative buy/sell volume difference for altcoins has dropped to negative.

That means there has been $209 billion more selling than buying on centralized exchanges over the past 13 months. Back in January 2025, this number was close to zero, showing that buyers and sellers were almost balanced.

Since then, the trend has moved only one way, steady net selling. This suggests demand has slowly dried up while supply continued to hit the market.

Further CryptoQuant analyst noted that this is not just a short-term dip. Instead, it reflects more than a year of continuous selling pressure.

“Retail is out. Smart money rotated. No institutional alt accumulation in sight. This is not a dip. It’s 13 months of continuous net selling on CEX spot.”

Bitcoin Price Drop Drives Capital Away From Altcoins

During this period, the Bitcoin price has also corrected sharply, seeing a nearly 22.4% drop in the first quarter of 2026. As of now, Bitcoin is trading close to $68,800, which is about 43% lower than its previous peak of over $126,000 in October 2025.

However, the damage in altcoins appears far more severe.

More than 75 altcoins are currently down between 20% and 90% from their recent highs. This shows that while Bitcoin price has pulled back, altcoins have suffered much deeper losses.

The data suggests capital may have rotated away from altcoins, leaving the sector with limited fresh demand.

Altcoin Season Index Shows No Clear Breakout

The Altcoin Season Index has recently risen to around 35, gaining a few points. While this signals a slight recovery, it remains far below the 75 level needed to confirm a true altcoin season.

For that to happen, about 75% of the top 100 cryptocurrencies must outperform Bitcoin over 90 days.

As of now, the total altcoin market cap, excluding Bitcoin and Ethereum, stands at around $712 billion.

You May Also Like

USD Sentiment Turns Bearish, Stablecoins and Crypto Could Be Affected

Here’s How Consumers May Benefit From Lower Interest Rates