Binance User Statistics 2026: Growth Secrets

The world of cryptocurrency has experienced exponential growth, with Binance taking center stage as a leading platform. Since its inception in 2017, Binance has transformed the landscape of digital trading. Whether you’re a seasoned crypto investor or just stepping into the blockchain realm, it’s impossible to ignore the impressive milestones Binance has achieved over the past few years. Today, let’s take a deep dive into the statistics behind Binance’s user growth, global impact, and market dominance.

Editor’s Choice

- Binance’s median daily spot trading volume reached approximately $16.3 billion, about 5x higher than the second-largest exchange, underscoring its market dominance.

- Binance controls around 39.2% of the global centralized exchange market share in early 2026, maintaining clear leadership over competing platforms.

- Binance handles roughly 35%–45% of global Bitcoin and Ethereum trading volume, securing more than $170 billion in customer assets on the platform.

- Binance topped CoinMarketCap’s January 2026 exchange reserve rankings with about $155.6 billion in exchange-held assets, reflecting strong custodial depth.

- Binance’s combined daily spot and derivatives volume exceeds $217 billion, keeping it the largest cryptocurrency exchange by both user count and trading activity.

Recent Developments

- opBNB now processes over 4,500 transactions per second while keeping average fees below $0.005 per transaction, significantly improving BNB Chain scalability.

- BNB Chain’s 2026 roadmap targets 20,000 TPS and sub-second finality through software optimizations and a dual-client architecture.

- Binance increased institutional users by 14% year over year and boosted institutional trading volume by 13%, strengthening its institutional desk expansion.

- Binance now supports over 200 public companies with Bitcoin exposure through its institutional services, expanding its presence in traditional finance.

- In January 2026, Binance introduced at least 6 new spot trading pairs and expanded Trading Bots access to all global spot users at launch.

- Binance allocates 20% of its net profit to quarterly BNB repurchase and burn programs, moving closer to its 100 million target supply.

- Binance’s Proof of Reserves shows over $170 billion in safeguarded customer assets, supported by top exchange reserve rankings.

- Binance’s latest listings roadmap features multiple new tokens offering up to 79% APY staking incentives alongside deflationary tokenomics to attract yield-focused users.

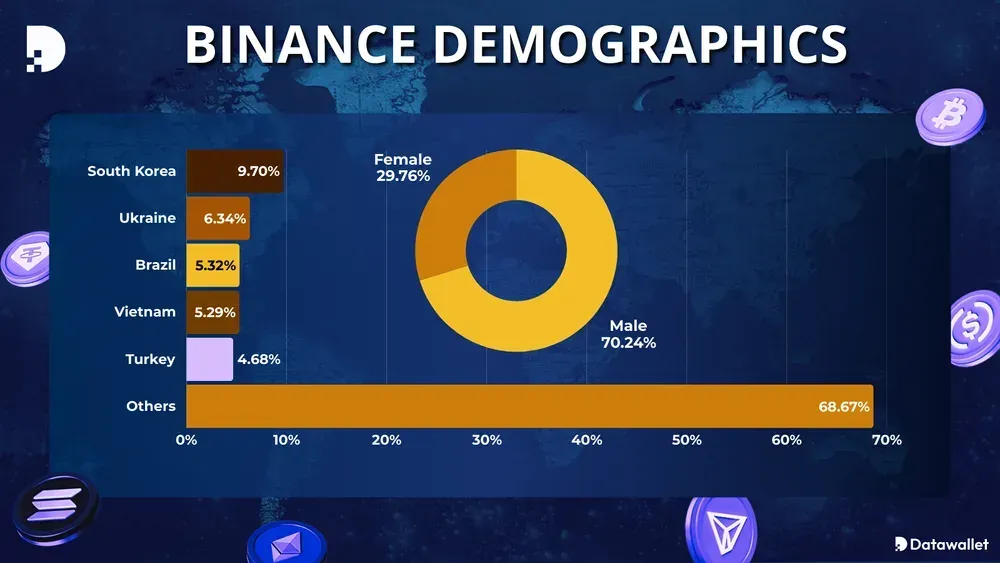

Binance User Demographics Overview

- Male users dominate Binance’s user base at 70.24%, indicating a strong gender imbalance toward male participation in crypto trading.

- Female users account for 29.76%, showing growing but still significantly lower engagement compared to male users.

- South Korea leads among identifiable countries with 9.70% of users, highlighting its strong crypto adoption and trading culture.

- Ukraine contributes 6.34% of Binance users, reflecting notable usage despite regional economic challenges.

- Brazil represents 5.32% of the platform’s users, underscoring Latin America’s expanding crypto market.

- Vietnam closely follows at 5.29%, consistent with Southeast Asia’s high retail crypto participation.

- Turkey accounts for 4.68%, driven by currency volatility and demand for alternative assets.

- A substantial 68.67% of users fall into the “Other” category, demonstrating Binance’s highly diversified global footprint beyond the top markets.

(Reference: Datawallet)

(Reference: Datawallet)

Usage and Activity Statistics

- 300 million global users reached by early 2026.

- Binance processed an average of 12.28 million transactions per day on Smart Chain as of February 2026.

- 58.81 million visits to binance.com in December 2025 with an average session of 11:22.

- Binance Pay processed $121 billion in transaction volume with 1.36 billion transactions.

- 14% year-over-year increase in institutional users in 2026.

- Average daily Smart Chain transactions reached 19.69 million on February 5, 2026.

- Global NFT sales projected to decline 37% to $5.6 billion amid supply growth.

- 280+ million registered users served globally as of early 2026.

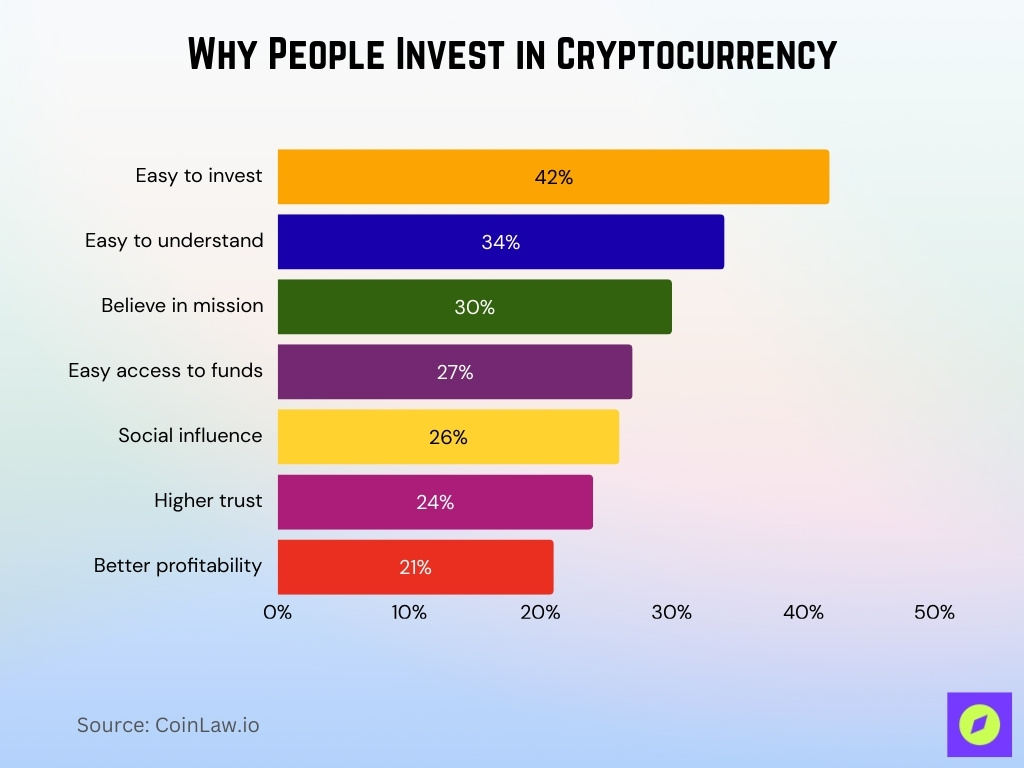

Why People Invest in Cryptocurrency

- The top motivation is convenience, with 42% saying crypto is easier to invest in, highlighting the appeal of low barriers to entry.

- 34% believe cryptocurrency is easier to understand, suggesting improving awareness and education around digital assets.

- A significant 30% invest because they believe in crypto’s mission, reflecting ideological support for decentralization and financial innovation.

- 27% value easier access to their money, emphasizing crypto’s advantage in liquidity and borderless transactions.

- Social proof plays a role, as 26% invest after seeing friends’ and family members’ success with cryptocurrencies.

- Trust is a factor for some investors, with 24% saying they trust crypto more, possibly due to dissatisfaction with traditional financial systems.

- Profit potential ranks lower than expected, with only 21% citing higher profitability than traditional investments as their primary reason.

(Reference: Forbes)

(Reference: Forbes)

Binance USD (BUSD) Market Capitalization

- Market capitalization stands at $40.02 million.

- Circulating supply of 40.03 million BUSD tokens.

- 24-hour trading volume at $1.24 million.

- 24-hour volume reached $1.55 million recently.

- Trading volume declined 73.30% in the last 24 hours to $4,028.

- Price stable at $0.999672 with $40.01 million cap.

- 4.04 million holders worldwide.

- Daily transactions are around 2,000.

Centralized Exchange (CEX) Market Share

- Binance dominates with 38.0% market share of CEX trading volume.

- OKX secures 7.1% share, ranking third in recent data.

- Bybit holds approximately 11% adjusted share based on volume rankings.

- Bitget captures 7.2% market share in spot trading.

- MEXC Global accounts for 5.2% of global CEX volume.

- Gate.io trails with 9.0% share, second in April rankings.

- Crypto.com maintains 2.40% steady portion amid competition.

Revenue and Profit

- $34 trillion total trading volume generated substantial fee revenue in 2025.

- Spot trading volume exceeded $7.1 trillion, boosting fee income.

- Binance prevented $6.69 billion in potential fraud losses for users.

- Binance Earn distributed $1.2 billion in rewards to users.

- BNB Chain revenue reached $62 million in January.

- Binance Alpha distributed $782 million in airdrop rewards.

- Institutional trading volume grew 21% year-over-year.

- OTC fiat trading volume surged 210%.

Top Fintech App Downloads

- Binance app exceeds 100 million downloads on Google Play.

- Bybit app reaches 10 million+ downloads worldwide.

- Revolut app downloaded 15 million times in the UK alone through January.

- OKX is trusted by 100 million+ users globally via the app.

- Crypto.com app serves 150 million+ users worldwide.

- Binance.US enables trading for millions with high ratings.

Security and Compliance Initiatives

- SAFU fund converted to $1 billion in Bitcoin with 15,000 BTC holdings.

- Commitment to replenish SAFU if the value drops below $800 million.

- Launched Web3 security center with AI fraud detection.

- SlowMist completed a comprehensive security audit of Binance Wallet.

- Increased investments in security, compliance, and education were announced for the year.

- $1 million bug bounty program for vulnerability reporting.

- 0.016-0.023% of volume linked to illicit sources industry-wide.

- Hiring for Crypto Security Engineer roles with a focus on custody.

Frequently Asked Questions (FAQs)

BNB Chain reached 5 million daily active users.

Daily new registrations exceed 150,000 during peaks.

Binance has surpassed 300 million registered users globally.

Conclusion

Binance’s growth trajectory shows no signs of slowing down as it continues to dominate the cryptocurrency exchange market globally. Despite facing regulatory challenges, Binance has strengthened its platform through compliance initiatives, security upgrades, and innovative new features. The platform is well-positioned for further expansion today. Its emphasis on user security, global accessibility, and product diversity ensures that Binance remains at the forefront of the evolving digital finance landscape.

The post Binance User Statistics 2026: Growth Secrets appeared first on CoinLaw.

You May Also Like

The Role of Blockchain in Building Safer Web3 Gaming Ecosystems

- Immutable Ownership of Assets Blockchain records can be manipulated by anyone. If a player owns a sword, skin, or plot of land as an NFT, it is verifiably in their ownership, and it cannot be altered or deleted by the developer or even hacked. This has created a proven track record of ownership, providing control back to the players, unlike any centralised gaming platform where assets can be revoked.

- Decentralized Infrastructure Blockchain networks also have a distributed architecture where game data is stored in a worldwide network of nodes, making them much less susceptible to centralised points of failure and attacks. This decentralised approach makes it exponentially more difficult to hijack systems or even shut off the game’s economy.

- Secure Transactions with Cryptography Whether a player buys an NFT or trades their in-game tokens for other items or tokens, the transactions are enforced by cryptographic algorithms, ensuring secure, verifiable, and irreversible transactions and eliminating the risks of double-spending or fraudulent trades.

- Smart Contract Automation Smart contracts automate the enforcement of game rules and players’ economic exchanges for the developer, eliminating the need for intermediaries or middlemen, and trust for the developer. For example, if a player completes a quest that promises a reward, the smart contract will execute and distribute what was promised.

- Anti-Cheating and Fair Gameplay The naturally transparent nature of blockchain makes it extremely simple for anyone to examine a specific instance of gameplay and verify the economic outcomes from that play. Furthermore, multi-player games that enforce smart contracts on things like loot sharing or win sharing can automate and measure trustlessness and avoid cheating, manipulations, and fraud by developers.

- Cross-Platform Security Many Web3 games feature asset interoperability across platforms. This interoperability is made viable by blockchain, which guarantees ownership is maintained whenever assets transition from one game or marketplace to another, thereby offering protection to players who rely on transfers for security against fraud. Key Security Dangers in Web3 Gaming Although blockchain provides sound first principles of security, the Web3 gaming ecosystem is susceptible to threats. Some of the most serious threats include:

Aussivo Debuts Verification Layer For Cloud at Token2049, Pioneering Blockchain Transparency