CFTC Digital Asset Regulation: Urgent Call as Commissioner Johnson Departs

BitcoinWorld

CFTC Digital Asset Regulation: Urgent Call as Commissioner Johnson Departs

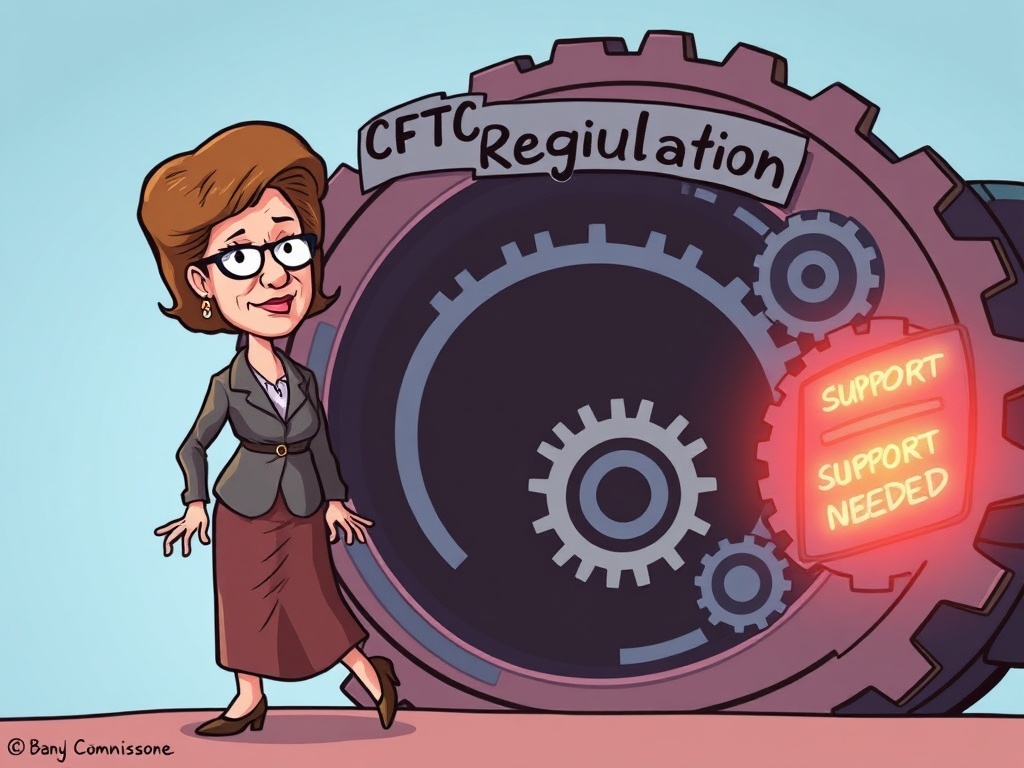

The landscape of CFTC digital asset regulation is at a pivotal juncture. Commissioner Kristin Johnson, a significant voice at the U.S. Commodity Futures Trading Commission (CFTC), will step down on September 3. Her departure marks a critical moment for the agency, especially as it navigates its evolving role in overseeing the rapidly expanding digital assets sector. Johnson’s exit leaves Acting Chair Caroline Pham as the sole leader, raising questions about the future direction of crypto oversight and the agency’s capacity to manage it effectively.

What Does Commissioner Johnson’s Departure Mean for CFTC Digital Asset Regulation?

Kristin Johnson’s role as the sole Democratic commissioner provided a crucial perspective within the CFTC. Her upcoming departure on September 3, as reported by Bloomberg, signifies a shift in the agency’s internal dynamics. This transition leaves Acting Chair Caroline Pham to lead the commission alone, at least temporarily. The immediate implication is a potential impact on the CFTC’s approach to various regulatory matters, including its growing responsibilities concerning digital assets.

Johnson’s statement announcing her resignation highlighted a key concern: the CFTC needs more support to fulfill its expanded mandate. This includes its increasingly vital role in regulating the complex world of digital assets. Her call underscores the immense pressure and the significant resources required for effective oversight in this innovative, yet often volatile, market.

Why is Enhanced CFTC Digital Asset Regulation So Crucial?

The call for greater support for the CFTC’s expanded role, particularly in CFTC digital asset regulation, is not without merit. The digital asset space, encompassing cryptocurrencies, stablecoins, and NFTs, continues to grow in sophistication and market capitalization. Without clear and robust regulatory frameworks, investors and markets face heightened risks. Johnson’s advocacy emphasizes the need for proactive, well-resourced oversight to protect consumers and maintain market integrity.

Effective regulation can offer several benefits:

- Investor Protection: Safeguarding individuals from fraud, manipulation, and opaque practices.

- Market Stability: Establishing clear rules helps prevent systemic risks and fosters a more predictable environment.

- Innovation Growth: A well-defined regulatory perimeter can actually encourage responsible innovation by providing certainty for businesses.

- Global Competitiveness: Clear frameworks can position the U.S. as a leader in the digital economy.

The challenges in this area are substantial, ranging from defining which digital assets fall under CFTC jurisdiction to developing appropriate enforcement mechanisms for novel technologies. These complexities demand a well-supported and knowledgeable regulatory body.

Navigating the Future of CFTC Digital Asset Regulation

As the CFTC moves forward, the focus on CFTC digital asset regulation will undoubtedly intensify. Industry stakeholders, policymakers, and market participants will closely monitor how the agency adapts to this new leadership structure and addresses Johnson’s concerns. The dialogue around legislative clarity for digital assets is ongoing, and the CFTC’s stance will play a significant role in shaping these discussions.

Actionable insights for the industry include:

- Staying informed about evolving CFTC guidance and enforcement actions.

- Engaging with regulators to provide constructive feedback on proposed rules.

- Prioritizing robust internal compliance frameworks that anticipate future regulatory demands.

The agency’s capacity to effectively regulate digital assets depends not only on its internal leadership but also on the support it receives from Congress and the broader government to secure necessary funding and legislative authority. This period of transition highlights the urgent need for a cohesive and well-supported strategy for digital asset oversight.

Conclusion: Commissioner Kristin Johnson’s impending departure from the CFTC underscores a critical juncture for CFTC digital asset regulation. Her final call for increased support for the agency’s expanded role in overseeing digital assets serves as a powerful reminder of the challenges and opportunities ahead. As the CFTC navigates this transition under Acting Chair Caroline Pham, the crypto industry and policymakers must recognize the imperative of robust, well-resourced regulation to foster a secure and innovative digital economy. The future of digital asset markets hinges on these crucial decisions.

Frequently Asked Questions About CFTC Digital Asset Regulation

- Who is Kristin Johnson and what was her role at the CFTC?

Kristin Johnson served as a Democratic Commissioner at the U.S. Commodity Futures Trading Commission (CFTC), a key agency overseeing derivatives markets, including certain digital assets. - Why is Commissioner Johnson stepping down?

Commissioner Johnson is stepping down on September 3. While her specific reasons for resignation were not fully detailed in the report, her departure statement emphasized the need for more support for the CFTC’s expanded role, particularly in digital asset regulation. - What is the CFTC’s role in digital asset regulation?

The CFTC primarily regulates commodity derivatives markets. It has asserted jurisdiction over certain digital assets deemed commodities, like Bitcoin and Ethereum, when they are traded in futures or other derivatives markets. - What does her departure mean for the future of crypto regulation?

Her departure leaves Acting Chair Caroline Pham as the sole leader, potentially impacting the agency’s internal dynamics and approach to digital asset oversight. It also highlights the ongoing need for increased resources and legislative clarity for effective CFTC digital asset regulation. - Who will lead the CFTC after her departure?

Upon Kristin Johnson’s departure, Acting Chair Caroline Pham will temporarily lead the U.S. Commodity Futures Trading Commission as the sole remaining commissioner.

If you found this article insightful, please consider sharing it with your network on social media to spread awareness about the evolving landscape of digital asset regulation!

To learn more about the latest crypto market trends, explore our article on key developments shaping digital assets regulatory frameworks.

This post CFTC Digital Asset Regulation: Urgent Call as Commissioner Johnson Departs first appeared on BitcoinWorld and is written by Editorial Team

You May Also Like

Trump’s 'desperate' push to rename landmarks for himself is a 'growing problem': analysis

Can XRP Repeat Its 300% Surge and Reach $5? Analysts Weigh In