Why Is Crypto Up Today? Bitcoin Surges as Iran-Israel Conflict Entering Day 4

As geopolitical tensions escalate in the Middle East, many investors are left wondering: why is crypto up today? Despite a brief weekend dip triggered by the conflict between Israel and Iran, Bitcoin (BTC) has rebounded strongly, now trading above $107,000.

However, for those familiar with Bitcoin’s behavior during past international crises, this recovery isn’t entirely surprising. Historically, BTC tends to experience a heavy but short-lived drop in response to major global events, only to bounce back quickly and often reclaim more than it initially lost.

The Israel-Iran Escalation Is Probably Far From Over, But Bitcoin Is Already Recovering

The initial sell-off began late Friday after Israel attacked Iran on a “pre-emptive” strike against military targets, killing 128 civilians in that first attack. Israeli Prime Minister Benjamin Netanyahu defended the strikes by claiming Iran was nearing the capability to build nuclear weapons.

An interesting fact is that while Israel has repeatedly warned that Iran is close to developing nuclear weapons, a claim made consistently for over three decades, it has itself acquired a nuclear arsenal without officially acknowledging it. Unlike Iran, Israel has never signed the Nuclear Non-Proliferation Treaty (NPT) and is widely believed to possess dozens of nuclear warheads developed outside the framework of international oversight.

Bitcoin fell as low as $103,000 in those first hours after the attack before bouncing modestly to $104,000 over the weekend. At first glance, the conflict appeared to weigh on BTC sentiment. But when global markets reopened Sunday night, Bitcoin quickly reversed course, reclaiming momentum and trading above $107,000.

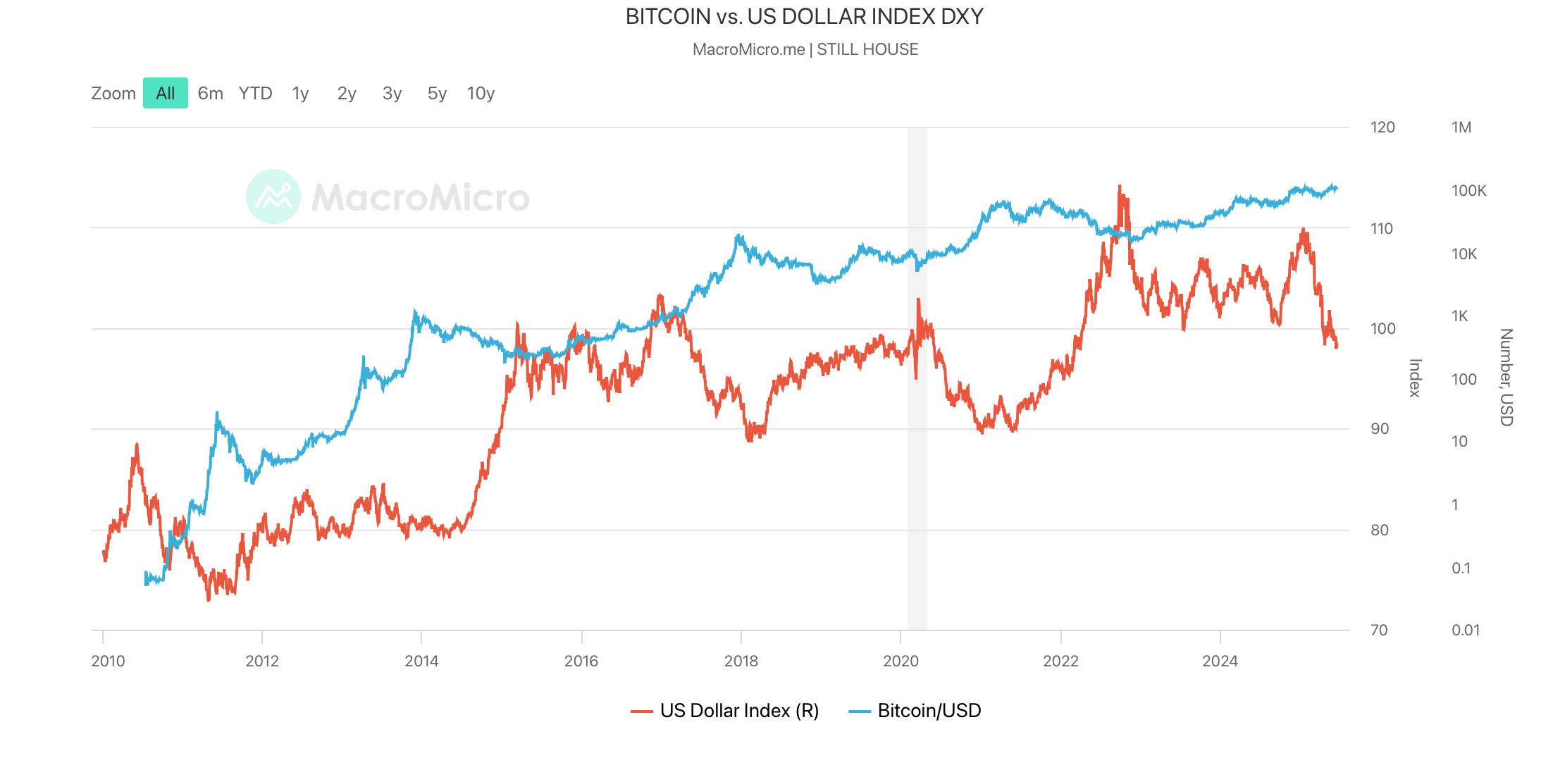

This rebound closely tracks the movement of the U.S. Dollar Index (DXY), which fell to 98 at Monday’s open. Since Bitcoin tends to move inversely to the dollar, this drop acted as a tailwind for crypto prices. In other words, one major reason why crypto is up today is simple: the dollar is down.

(Source)

So far, markets appear to view the current Israel-Iran escalation as localized. The U.S. has not entered the conflict, at least not directly, and Russia has declined to support Iran militarily, helping to ease fears of a broader regional war. This perception has likely contributed to the calm in both equity and crypto markets.

This status quo could change abruptly: nearly 30 U.S. Air Force refueling tankers are heading east across the Atlantic, sparking speculation of a military buildup. Analysts suggest they may support Israel amid rising tensions with Iran or participate in NATO drills. Their destination remains unclear, with possible stops in Europe or the Middle East bases.

It’s also important to consider timing. Bitcoin had recently surged toward new highs. A correction was due, and geopolitical uncertainty merely served as a trigger. The rebound suggests strong underlying demand for digital assets after the initial panic has faded.

In short, Bitcoin’s rebound is being driven by a combination of factors:

Bitcoin investor Anthony Pompliano pointed out that similar setups in the past quickly reversed. He referenced an incident in October 2024, when Iran launched hundreds of rockets at Israel in retaliation for the assassinations of Hamas and Hezbollah leaders and a senior IRGC commander. At that time, Bitcoin also dipped by around 3%, but within 48 hours, it had outperformed both gold and oil.

“This initial reaction is exactly what happened last time,” Pompliano noted. “Bitcoin ended up outperforming the other two over the first 48 hours in that situation.”

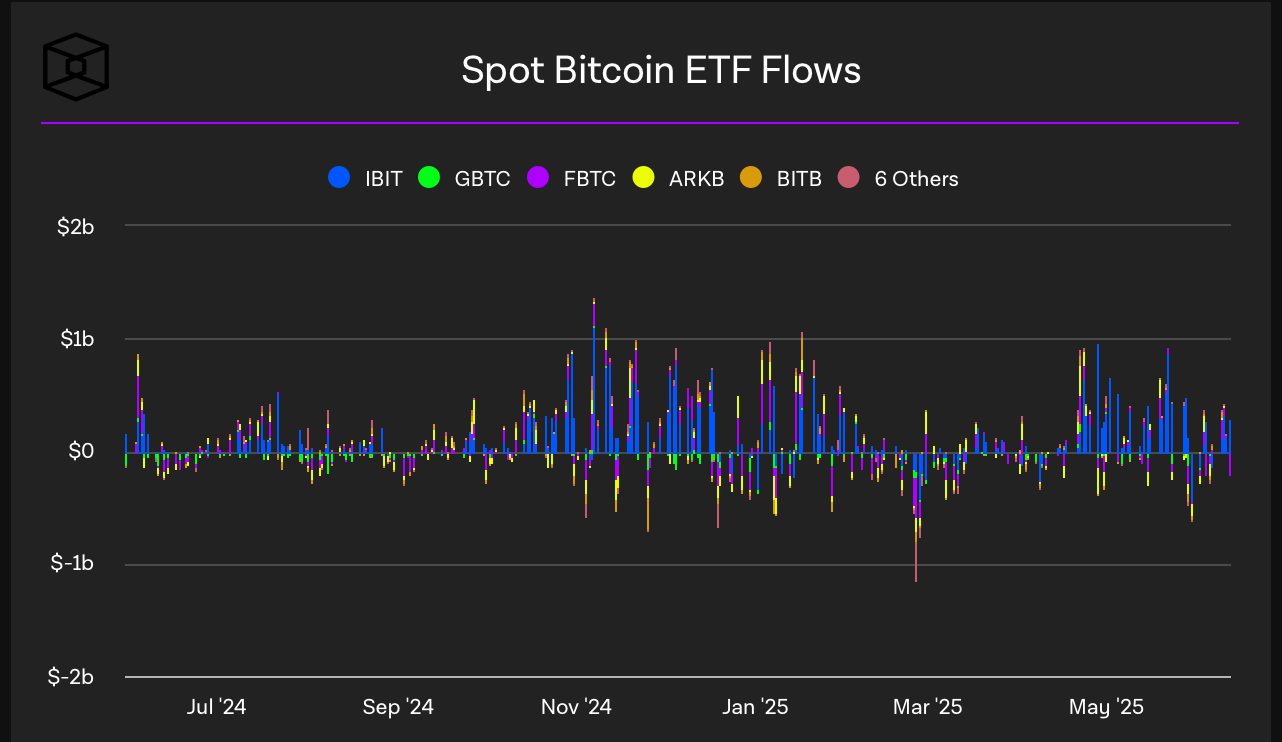

Why Is Crypto Up Today? Institutional Demand Returns: Spot Bitcoin ETFs See $1.37B Inflows

Last week, Bitcoin spot ETFs recorded over $1 billion in inflows, signaling a strong resurgence after two consecutive outflows. This rebound came despite BTC’s muted price action for most of the week, initially slowing inflows.

Between June 9 and 13, Bitcoin-backed funds recorded $1.37 billion in net inflows, the first positive weekly result after two straight weeks of capital leaving crypto funds. This trend highlights how sensitive ETF flows remain to Bitcoin’s price trajectory.

(Source)

Multiple large BTC buys suggest strong institutional accumulation. BlackRock iShares Bitcoin Trust ($IBIT) took first place among spot Bitcoin ETFs, with a $240.14 million inflow on June 13. The strong capital movement marks the highest single-day inflow for IBIT in recent weeks. This surge contributed to the total net Bitcoin ETF inflow of $302.77 million across all funds.

Despite a volatile weekend shaped by global conflict, Bitcoin has again proven its resilience. With a weakening dollar, strong institutional demand, and a historical tendency to rebound during geopolitical uncertainty, crypto markets are showing why many investors now see Bitcoin as a strategic asset to accumulate.

EXPLORE: Seriously WTF Happened to Altcoin Season? Gold Reaches ATH As Crypto Crashes

The post Why Is Crypto Up Today? Bitcoin Surges as Iran-Israel Conflict Entering Day 4 appeared first on 99Bitcoins.

You May Also Like

Bitcoin ETFs Outpace Ethereum With $2.9B Weekly Surge

CME Group to launch options on XRP and SOL futures