Viral Bitcoin Hyper Presale Aims to Supercharge Bitcoin’s Future

Bitcoin might still be the undisputed heavyweight of crypto, but it’s showing its age.

While it dominates as a store of value, it struggles when used as actual money. Slow transactions, high fees, and a lack of smart contract support keep it from being more than digital gold.

Enter Bitcoin Hyper ($HYPER), a new Layer-2 project that has already raised $12.5M in its presale, with tokens priced at $0.012815.Investors are piling in because Bitcoin Hyper promises to do what Bitcoin has never been able to: make the king of crypto fast, scalable, and programmable.

The Problem: Bitcoin’s Old Baggage

Bitcoin has been around for over a decade, and its biggest flaws are no secret. Anyone who has tried sending $BTC during peak hours knows how painful it can be.

Transactions can take minutes, sometimes hours, to settle. Fees spike to the point where sending $20 of Bitcoin could cost $10 in charges. That makes small payments impractical and discourages everyday use.

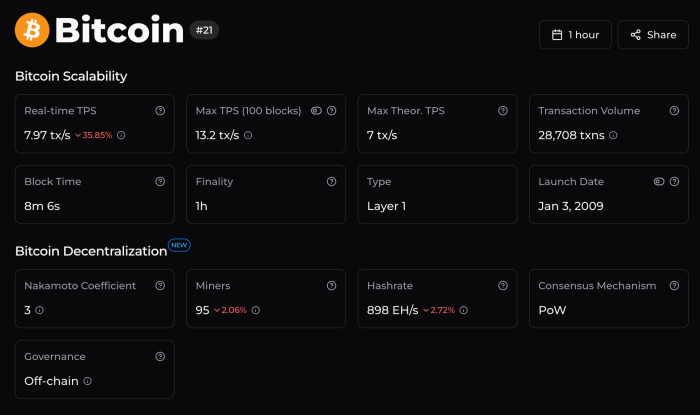

The scalability gap is even clearer when compared to traditional finance. Bitcoin processes about seven transactions per second. Visa, meanwhile, averages around 65K TPS and can scale even higher during peak loads.

For Bitcoin to serve billions of people worldwide, it would need to close that gap, but it can’t on its base layer. Then there’s programmability.

Ethereum and Solana power the world of DeFi, NFTs, and meme coins because they can run smart contracts.Bitcoin, on the other hand, has no easy way to host decentralized apps. Developers have either avoided it or been forced into complex workarounds.

The result: Bitcoin remains the safest blockchain, but one with limited usability in modern Web3.

The Solution: Bitcoin Hyper ($HYPER)

Bitcoin Hyper ($HYPER) was created to fix these pain points once and for all.

It’s a high-speed, low-cost Layer-2 that sits on top of Bitcoin and makes it usable in ways it has never been before.

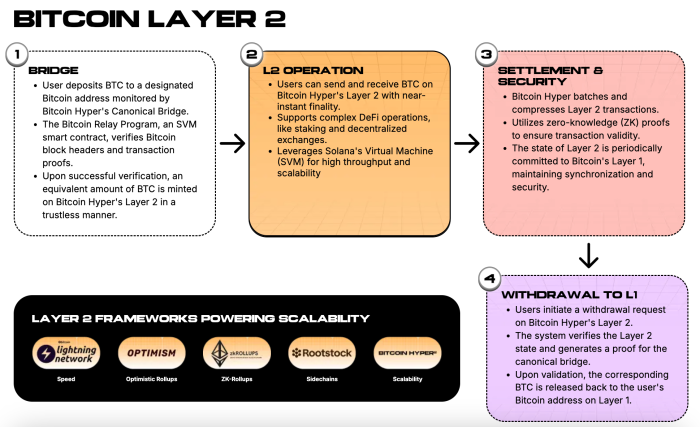

At its core is the Canonical Bridge. People lock their $BTC on the Bitcoin base chain, which then mints wrapped Bitcoin (WBTC) on Bitcoin Hyper’s Layer-2.

That WBTC can be used instantly for payments, gaming, DeFi, or even launching new crypto tokens. When you want your $BTC back, you simply burn your WBTC and unlock the original coins.

What makes Bitcoin Hyper stand out is its integration with the Solana Virtual Machine (SVM). This means it can run Solana programs directly, bringing Solana-level speed into the Bitcoin ecosystem.

Developers can port their apps seamlessly, and users get lightning-fast transactions with low fees.

Imagine taking Bitcoin’s trusted engine and strapping on a turbocharger – that’s what Bitcoin Hyper is doing.The implications are massive. With this Layer 2, Bitcoin could finally scale to everyday payments and programmable money, while retaining its core strength as the most secure blockchain.

If it succeeds, Bitcoin’s role in the crypto world could expand dramatically, cementing it as both digital gold and usable digital cash.

Why Investors Are Betting on $HYPER

The excitement around Bitcoin Hyper isn’t just about technology.

The presale is already a viral event, having crossed $12.5M raised. Right now, you can buy $HYPER for just $0.012815. Investors see the potential for this to be one of the best crypto presales in 2025.

The $HYPER token powers the entire network. It’s used to pay gas fees, earn staking rewards, unlock premium dApps, and fuel developer grants.

Governance is also part of the roadmap, giving holders a say in the project’s future direction. Early buyers can already stake their tokens and earn yields that beat most other new crypto launches on the market.

Beyond token utility, the market backdrop adds weight. The Bitcoin payments market is projected to hit $3.7T by 2031. Bitcoin Hyper doesn’t need to dominate that market – it only needs to carve out a slice.That’s still a multi-billion-dollar opportunity. With $HYPER already featured in Best Wallet’s curated ‘Upcoming Tokens’ section, it’s clear the project is being taken seriously.

For investors who are tired of pure speculation on meme coins and want exposure to a project solving real problems, Bitcoin Hyper looks like one of the best altcoins to watch.

Bitcoin Hyper’s Big Moment

Bitcoin Hyper ($HYPER) is a bold attempt to make Bitcoin as fast and flexible as the younger chains dominating Web3.

By solving Bitcoin’s biggest issues, it has the potential to expand Bitcoin’s role in ways most thought impossible.

With $12.5M already raised, viral momentum, and strong investor interest, $HYPER could be the next crypto to explode.

This article is for informational purposes only and is not financial advice. Always do your own research (DYOR) before investing in crypto.

You May Also Like

XRP Enters ‘Washout Zone,’ Then Targets $30, Crypto Analyst Says

Republicans are 'very concerned about Texas' turning blue: GOP senator