Fed’s favorite inflation gauge surges 0.4% in July, cementing a September rate cut

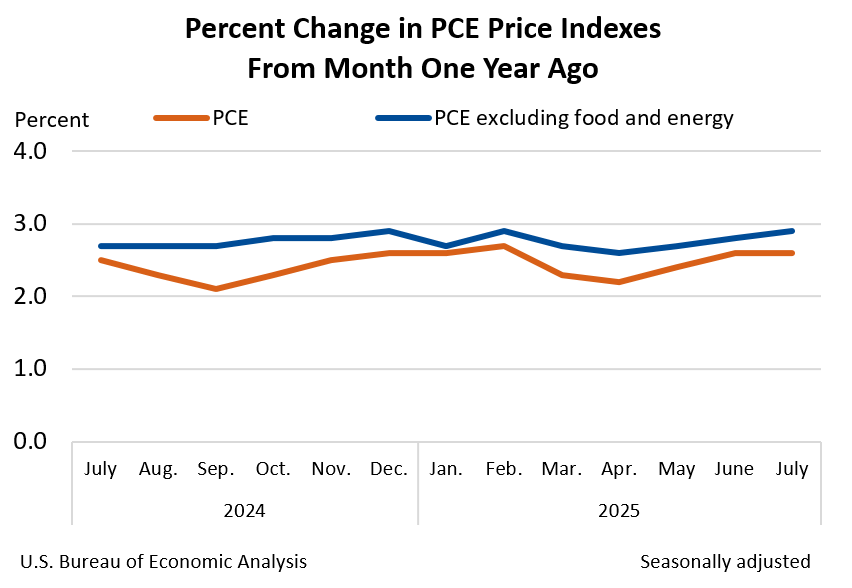

The U.S. economy just gave the Federal Reserve its next move. The Personal Consumption Expenditures price index, the central bank’s preferred tool for tracking inflation, climbed 0.4% in July, confirming that pricing pressures haven’t gone away.

The data came directly from the U.S. Bureau of Economic Analysis and now feeds into a broader story: the Fed is almost certainly cutting rates in September.

Stripping out food and energy, the core PCE index still rose 0.3%, month-on-month. That’s not soft enough to call a win, and not hard enough to justify staying on pause.

Over the last year, the broader PCE index is up 2.6%, and core is running even hotter at 2.9%.

With those numbers in play and signs of a softening labor market, Christopher Waller, a Fed governor and current contender to replace Jerome Powell, is done waiting.

Waller backs September cut as labor market wobbles

Waller, speaking Thursday night in Miami, said he’s fully behind a 25 basis point cut when the Fed meets on September 16–17. “Based on what I know today, I would support a 25 basis point cut at the Committee’s meeting,” he said.

But he didn’t stop there. He also flagged concerns that job losses may already be happening under the radar. Citing Bureau of Labor Statistics revisions, he warned that “the economy may have lost jobs over the past several months.”

Waller added that he’s not convinced the Fed should wait to see the wreckage.

He said the Fed still has room to act and that it should use its tools before things worsen. “So, let’s get on with it,” he said. A basis point equals 0.01%, which makes Waller’s proposed cut equal to a quarter-point. That kind of move would take the current 4.25% to 4.5% range down to 4–4.25%.

He was also one of two governors who dissented during the July FOMC meeting, refusing to support the decision to leave rates unchanged. It was the first time in over 30 years that multiple Fed governors opposed a committee decision, signaling growing division inside the Fed.

Consumer activity rises with income and spending surge

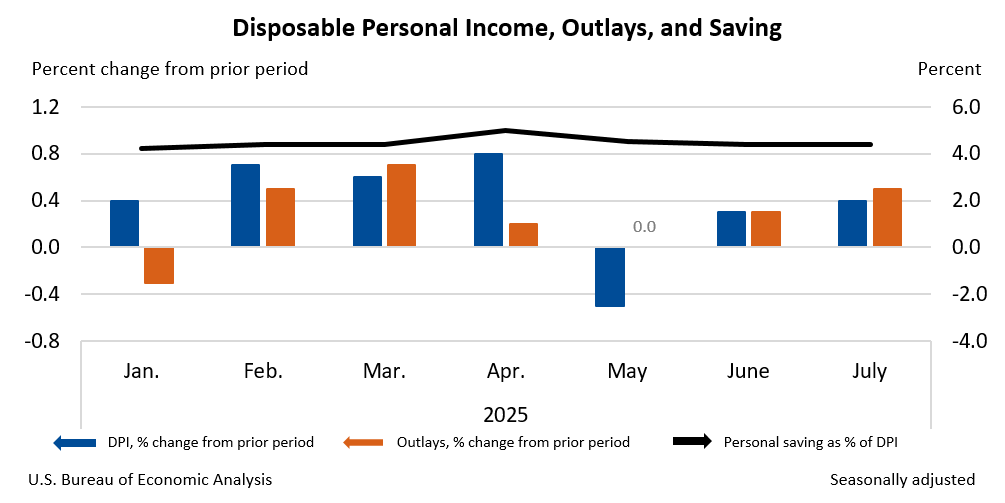

While the Fed talks monetary policy, consumers aren’t sitting still. Personal income increased $112.3 billion in July, a 0.4% rise over June. Disposable personal income, which accounts for taxes, rose $93.9 billion, also 0.4%. Americans spent more too.

Personal consumption expenditures grew by $108.9 billion, or 0.5%, across the board. That spending was split between $60.2 billion on services and $48.7 billion on goods. But even with more money coming in, people are saving less.

Personal outlays, which include spending, interest, and transfer payments, increased $110.9 billion. The personal saving rate now sits at 4.4%, with $985.6 billion saved in total for the month.

Adjusted for inflation, real disposable income only rose 0.2%, and real PCE, consumer spending after accounting for price changes, was up 0.3%. The gap between nominal and real values shows inflation is still cutting into purchasing power, though not as badly as last year.

The data shows consumers are still spending, even as price increases creep back in. That supports Waller’s urgency. The risk, from his view, isn’t runaway inflation, but a sudden crack in the labor market that could throw everything off balance.

With the August nonfarm payrolls report expected to be weak, the Fed may have all the justification it needs.

If you're reading this, you’re already ahead. Stay there with our newsletter.

You May Also Like

Woman shot 5 times by DHS to stare down Trump at State of the Union address

What is Play-to-Earn Gaming? Unlocking New Possibilities