Michael Saylor’s Strategy May Enter the S&P 500 as Early as Friday

Strategy (Nasdaq: MSTR) is one of the few high-performing equities shortlisted for inclusion in what many consider to be the top stock index.

Saylor’s Bitcoin Bet Could Land Strategy in the S&P 500 by Friday

The S&P 500, which tracks the performance of America’s top 500 companies, will be announcing new additions to its index on Friday, and Michael Saylor’s bitcoin treasury firm Strategy (Nasdaq: MSTR) is one of the leading favorites among a handful of companies eligible to be included in the prestigious cohort.

Every three months or so, a quarterly rebalancing of the S&P 500 takes place, and new firms are announced then added while others are removed; usually on a Friday. In July, Jack Dorsey’s Bitcoin technology company Block (NYSE: XYZ) was added to the index, and now other firms such as Strategy, Robinhood, and Applovin, are all vying for inclusion.

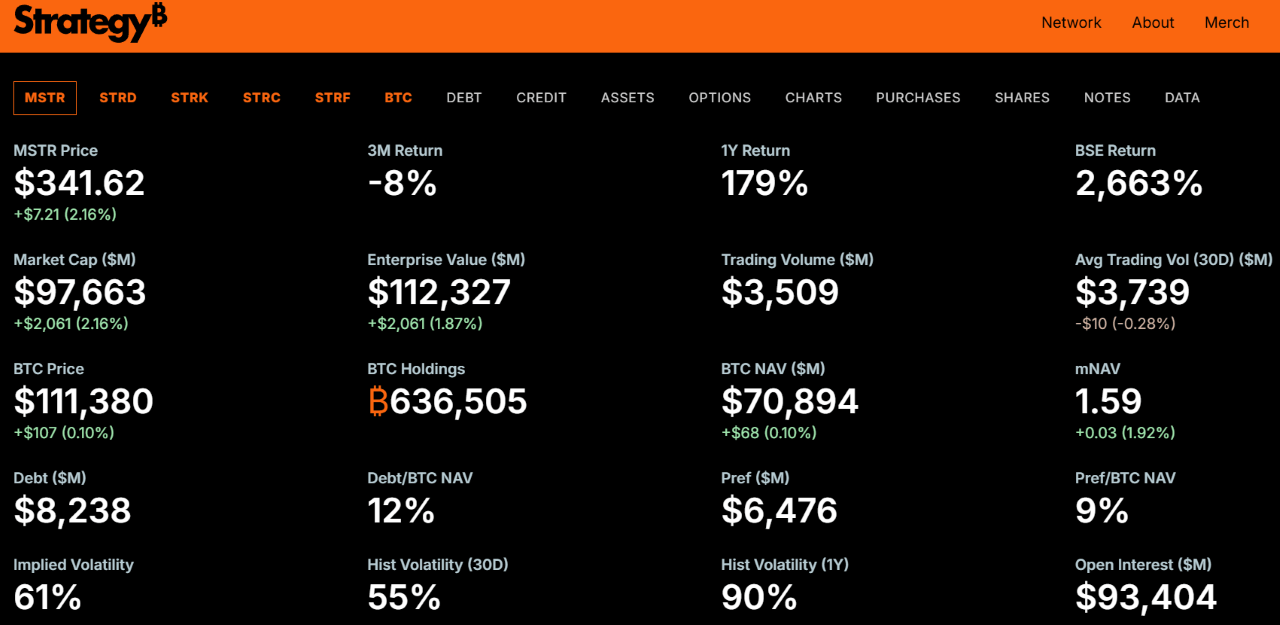

(MSTR was one of the best-performing stocks of 2024 and the company meets all of the eligibility requirements for inclusion in the S&P 500 / strategy.com)

(MSTR was one of the best-performing stocks of 2024 and the company meets all of the eligibility requirements for inclusion in the S&P 500 / strategy.com)

MSTR was one of the best-performing stocks in 2024. The company currently holds 636,505 BTC worth nearly $71 billion at the time of writing. The stock has a market capitalization of just under $98 billion. To be included in the S&P 500, a firm must meet the following criteria:

- The company must be domiciled in the U.S.

- Market capitalization must equal or exceed $22.7 billion

- Monthly trading volume must be equal to or greater than 250,000 shares for each of the six months leading up to the inclusion date

- Liquidity ratio must exceed 75%

- Shares must be listed on a stock exchange such as the NYSE or Nasdaq

- Shares must in an eligible form, such as common stock

Strategy meets all of these requirements, and some bitcoiners say MSTR’s inclusion on Friday is not only likely, but also paradigm-shifting. “This isn’t just another index shuffle,” said Adam Livingston, author of The Bitcoin Wizard. “It is the moment where every 401K, robo-advisor, and pension fund accidentally ends up hodling bitcoin.”

You May Also Like

The Role of Blockchain in Building Safer Web3 Gaming Ecosystems

- Immutable Ownership of Assets Blockchain records can be manipulated by anyone. If a player owns a sword, skin, or plot of land as an NFT, it is verifiably in their ownership, and it cannot be altered or deleted by the developer or even hacked. This has created a proven track record of ownership, providing control back to the players, unlike any centralised gaming platform where assets can be revoked.

- Decentralized Infrastructure Blockchain networks also have a distributed architecture where game data is stored in a worldwide network of nodes, making them much less susceptible to centralised points of failure and attacks. This decentralised approach makes it exponentially more difficult to hijack systems or even shut off the game’s economy.

- Secure Transactions with Cryptography Whether a player buys an NFT or trades their in-game tokens for other items or tokens, the transactions are enforced by cryptographic algorithms, ensuring secure, verifiable, and irreversible transactions and eliminating the risks of double-spending or fraudulent trades.

- Smart Contract Automation Smart contracts automate the enforcement of game rules and players’ economic exchanges for the developer, eliminating the need for intermediaries or middlemen, and trust for the developer. For example, if a player completes a quest that promises a reward, the smart contract will execute and distribute what was promised.

- Anti-Cheating and Fair Gameplay The naturally transparent nature of blockchain makes it extremely simple for anyone to examine a specific instance of gameplay and verify the economic outcomes from that play. Furthermore, multi-player games that enforce smart contracts on things like loot sharing or win sharing can automate and measure trustlessness and avoid cheating, manipulations, and fraud by developers.

- Cross-Platform Security Many Web3 games feature asset interoperability across platforms. This interoperability is made viable by blockchain, which guarantees ownership is maintained whenever assets transition from one game or marketplace to another, thereby offering protection to players who rely on transfers for security against fraud. Key Security Dangers in Web3 Gaming Although blockchain provides sound first principles of security, the Web3 gaming ecosystem is susceptible to threats. Some of the most serious threats include:

Vitalik Buterin Challenges Ethereum’s Layer 2 Paradigm