Zero Fees + 500x Leverage: Understanding Avantis, the Largest Derivatives Exchange on Base

Source: Alea Research Daily Newsletter

Compiled by: Zhou, ChainCatcher

Synthetic derivatives, decentralized oracles, and composable liquidity protocols enable traders to access everything from Bitcoin and ETH to gold and FX using stablecoin collateral.

Since Avantis launched on the mainnet in February 2024, it has become the largest derivatives exchange on Base and the largest DEX in the RWA trading and market making field.

The protocol has processed over $18 billion in cumulative trading volume and executed over 2 million trades for over 38,500 traders. With $23 million in TVL across 25,000+ LPs and over 80 markets, Avantis is solidifying its position as a hub for perps.

This article will explore Universal Leverage, Avantis's architecture, and the launch of $AVNT.

About Avantis

Avantis is a perps DEX that allows users to trade cryptocurrencies, forex, commodities, and indices using stablecoin collateral. The protocol abstracts away individual order books and instead builds a “universal leverage layer” where any asset with a reliable price feed can be listed.

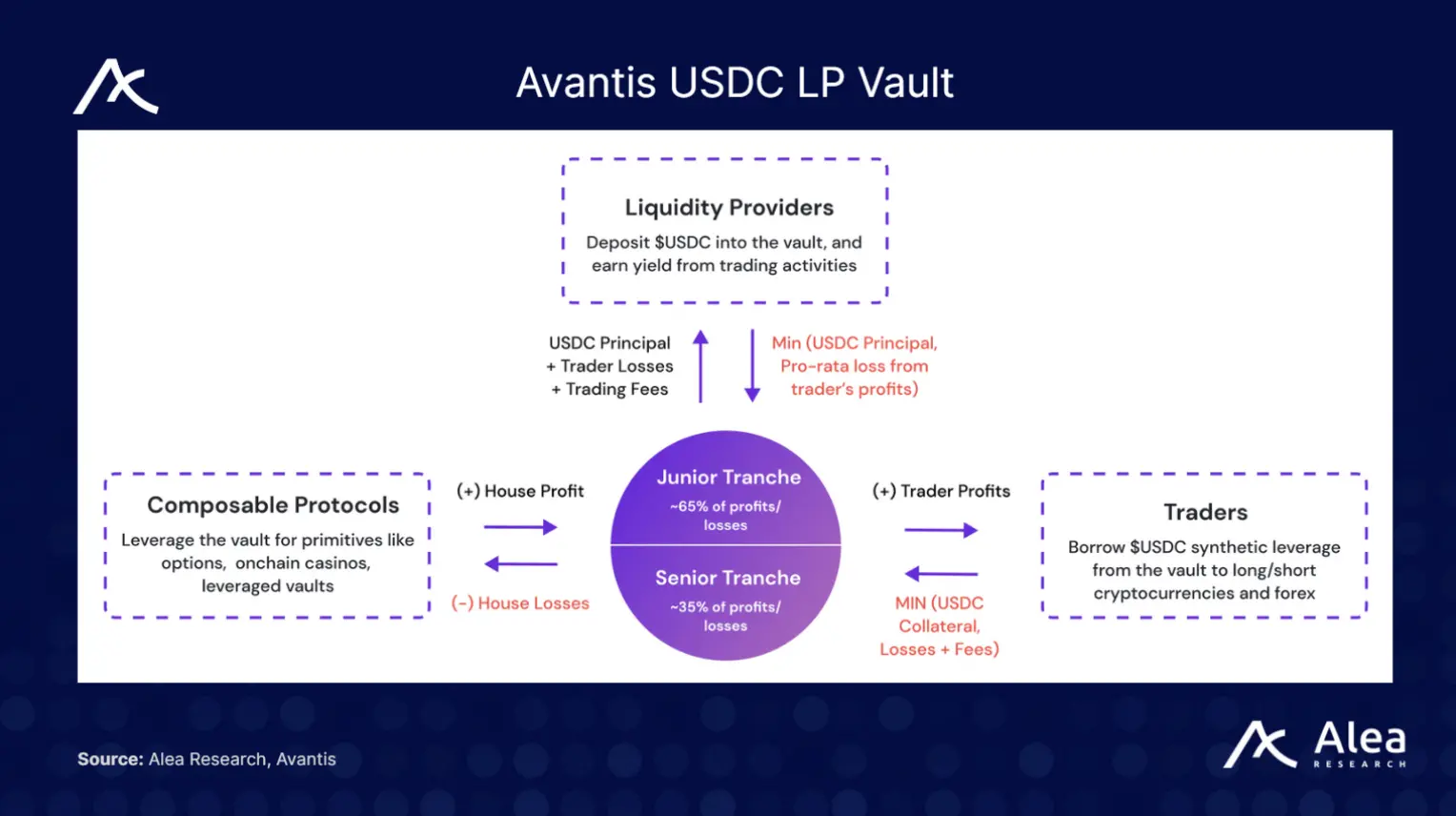

Synthetic leverage is achieved through a USDC-based liquidity vault that acts as the counterparty for all trades, enabling capital-efficient exposure to multiple markets. Traders can choose up to 500x leverage, allowing them to express directional views with minimal capital, while liquidity providers (LPs) earn a yield by providing USDC to support their positions.

Avantis distinguishes itself from other perpetual swap exchanges in that users can trade non-crypto markets like the Japanese Yen, gold, and US stock indices alongside BTC or ETH. The protocol's design also supports features like zero trading fees, loss rebates, and positive slippage, aligning incentives between traders and limited partners by returning a portion of fees or profits to users when they improve the protocol's risk profile.

Avantis Architecture

At its core, Avantis is a capital-efficient synthetic engine. Traders use the protocol's interface to open positions on supported assets. Instead of matching orders in an order book, Avantis pairs each trader with a USDC vault that takes the other side of the trade. This vault aggregates deposits from thousands of limited partners and acts as a single counterparty. This structure allows the protocol to offer deep liquidity across many markets without requiring separate liquidity pools for each pair, enabling Avantis to list over 80 markets, including 22 RWA assets.

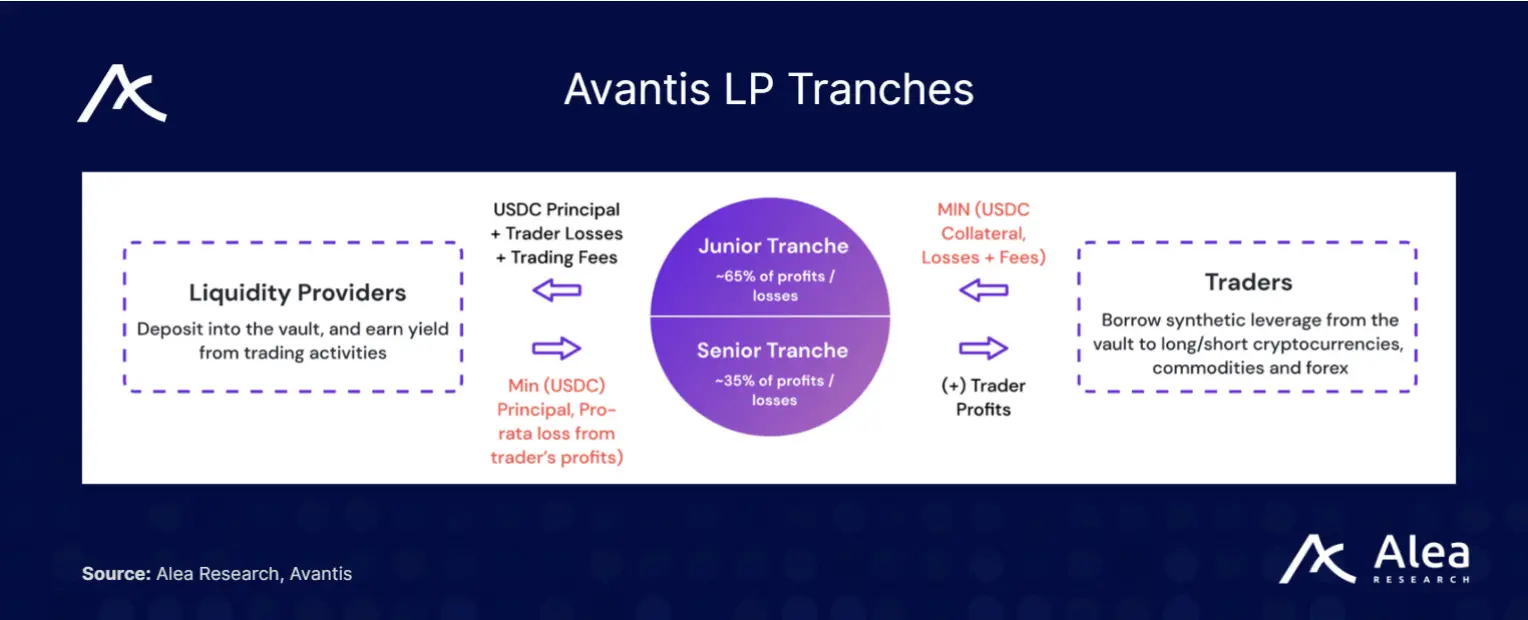

Avantis introduces risk tranches and time-lock parameters so that LPs can choose their preferred exposure. LPs can passively deposit in the senior tranche or take more risk in the junior tranche, which has higher return potential but also absorbs a greater share of losses.

Additionally, LPs can choose a time lock (e.g., 30 or 90 days) to control the duration of their capital commitment, with longer locks incurring more fees. This design mimics the centralized liquidity model of Uniswap v3 while applying it to the risk management of perps exchanges.

Trader <> LP Alignment

Avantis' innovative mechanism further aligns the interests of traders and LPs.

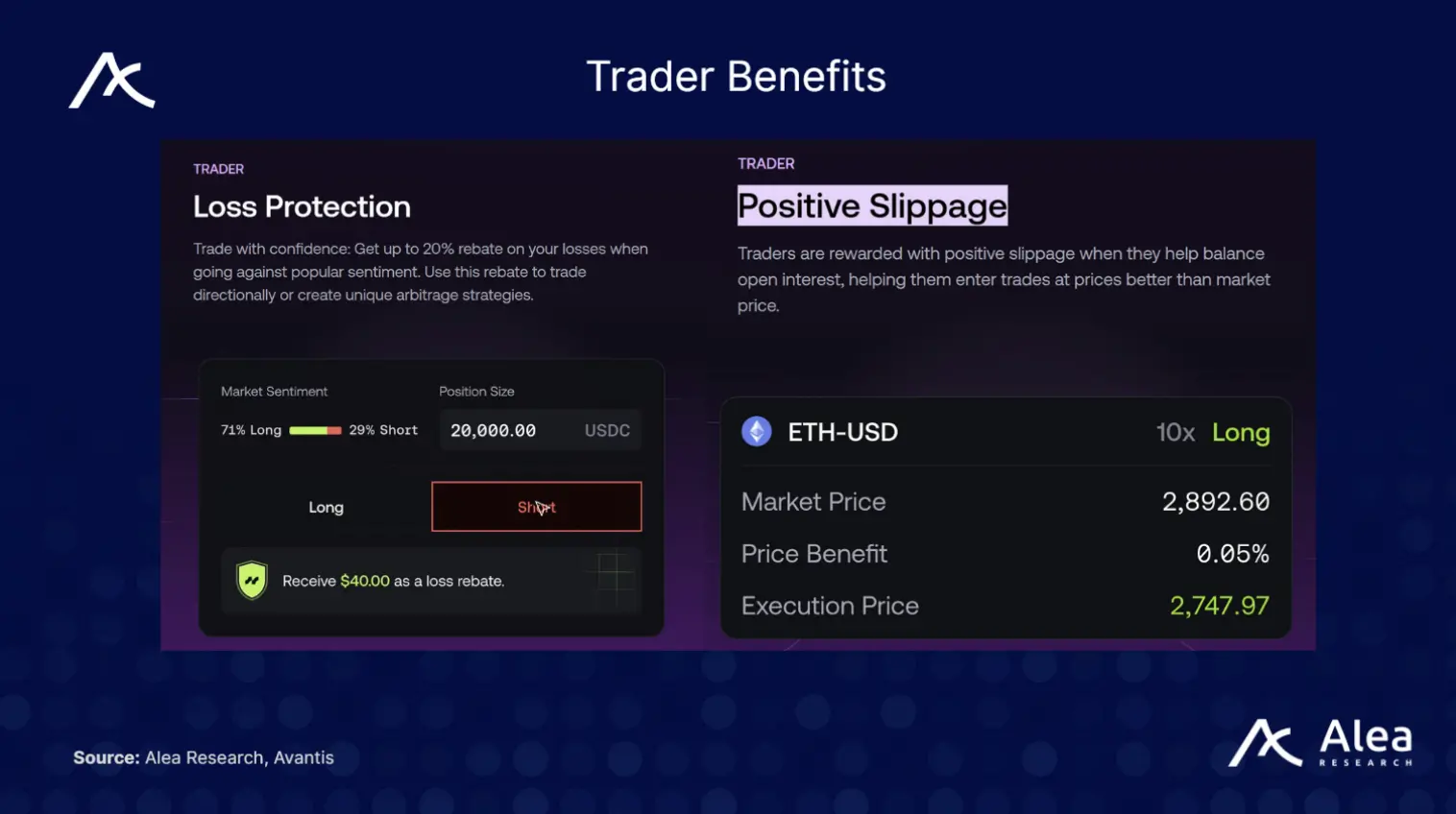

Loss Rebates: Traders who take the opposite side of open interest (helping balance the platform’s long/short skew) can receive up to 20% loss rebates. This encourages traders to arbitrage open interest and stabilize LP exposure.

Positive Slippage: When a trader's order reduces the vault's risk (e.g., closing out a heavily long position), Avantis offers an entry price above the Mark Price. This "better-than-market" execution rewards traders for helping to balance flows.

Zero Trading Fees: Avantis pioneered a product where traders pay no fees to open, close, or borrow positions. Instead, they pay only a portion of their profits when closing a winning trade. Available for $BTC, $SOL, and $ETH, with leverage up to 250x, this tool is popular with scalpers and high-frequency traders.

Advanced Risk Management: LPs can act as passive lenders or active market makers by selecting risk tranches and time locks. Each tranche has its own share of fees and potential losses, enabling LPs to control risk and return.

$AVNT: Token Issuance and Token Economics

To facilitate its next phase of growth, Avantis has launched $AVNT, a utility and governance token.

$AVNT has multiple functions:

Security and Staking: Holders can stake $AVNT in the Avantis Security Module to support the USDC vault during periods of extreme market volatility. Stakers receive $AVNT rewards and discounted trading fees.

Community Rewards: 50.1% of the total 1 billion token supply is reserved for traders, liquidity providers, referrers, and builders who contribute to Avantis. Airdrops (12.5% of the supply) will reward protocol activity starting in February 2024, while on-chain incentives (28.6%) will fund future XP seasons and community contributions. Builder and ecosystem grants (9%) will support the creation of new front-ends and trading tools, such as AI agents and Telegram bots.

Governance: Token holders will be able to propose and vote on protocol decisions, ranging from asset listings and fee structures to buyback programs and cross-chain deployments.

The remaining 49.9% of the supply is distributed as follows:

- Team (13.3%)

- Investors (26.61%)

- Avantis Foundation (4%)

- Liquidity reserve (6%)

You May Also Like

Top Altcoins To Hold Before 2026 For Maximum ROI – One Is Under $1!

UBS CEO Targets Direct Crypto Access With “Fast Follower” Tokenization Strategy