Cryptocurrency War: After the FBI raided the founder of Polymarket, competitor Kalshi bought KOLs to influence public opinion?

Author: Pirate Wires

Compiled by: Felix, PANews

On November 13, local time, the Federal Bureau of Investigation (FBI) raided the New York residence of Polymarket CEO Shayne Coplan and seized his mobile phones and electronic devices. The FBI investigation focused on whether the Polymarket platform operated as an unlicensed commodity exchange.

But after this incident, it seems that it is not just a question of compliance, but even involves commercial competition. According to the US media Pirate Wires, Kalshi funded KOLs to imply that its competitor Polymarket and CEO Shayne Coplan were engaged in illegal activities. The following is the details of the content.

After Polymarket CEO Shayne Coplan’s SoHo home was raided at 6 a.m. on Nov. 13, Polymarket competitor Kalshi paid influencers on social media to spread news of the raid and promote claims that Shayne and Polymarket were engaged in illegal activity, according to people familiar with the matter and screenshots received.

Other screenshots provided by the sources appear to show that after the raid, influencers who posted negative content about Shayne and Polymarket discussed the fact that they had paid to work with Kalshi. One source said that just days after the raid, a third party associated with Kalshi offered him $3,500 to write an "offensive article" about Polymarket.

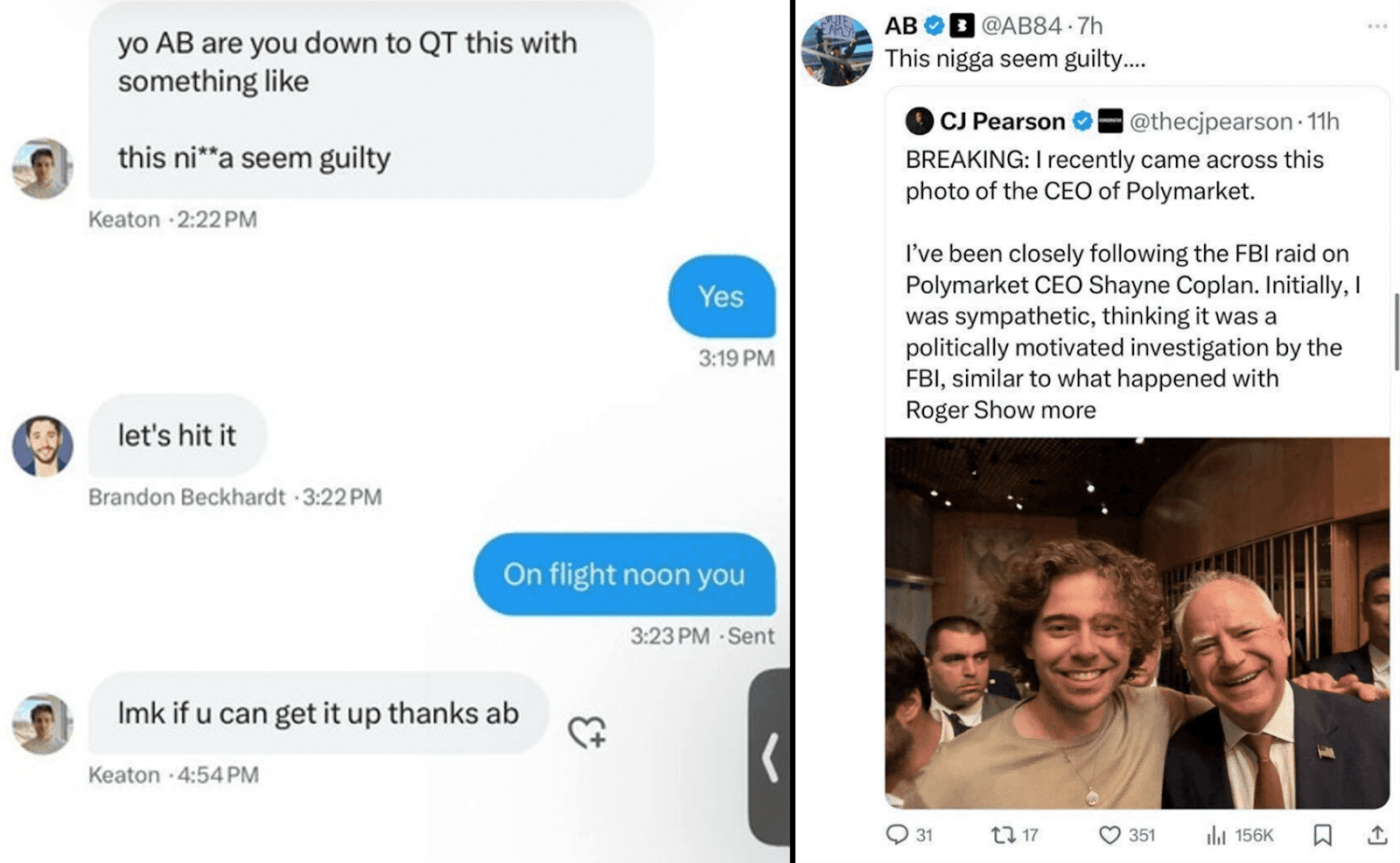

In a chat screenshot (see below), Kalshi's employees asked former NFL wide receiver Antonio Brown, who has 2.2 million followers, to release specific information about the raid.

Keaton Inglis, a member of Kalshi's growth team, asked Antonio Brown in the screenshot: "Hey Antonio Brown, are you going to comment on this with something like 'this nigga seems guilty'?" He seemed to be referring to a post by CJ Pearson that implied Shayne was corrupt ( archive link ). Keaton Inglis' colleague Brendan Beckhardt, Kalshi's chief of staff, added: "Let's do it."

On November 15, Antonio Brown quoted CJ Pearson's tweet ( archive link ) and wrote "This nigga seems guilty..."

That same day, a third-party company associated with Kalshi offered Gateway Pundit reporter Elijah Schaffer (772,000 followers) $3,500 to write a “hot article” promoting the idea that Polymarket and Shayne were involved in criminal activity. Schaffer told Pirate Wires in a phone call that he turned down the offer.

Other screenshots show that in the days after the FBI raided Shayne’s apartment, several influencers pushed anti-Polymarket rhetoric and discussed their paid partnership with Kalshi.

One of the screenshots shows a representative from Clown World (which has 2.8 million followers) discussing a paid partnership with Kalshi. On November 14, the day after the raid, the account posted ( archive link ): "SBF lookalike raided by FBI for illegal betting scheme." He was referring to Shayne. Clown World has posted other content related to Kalshi several times since the election ( archive link ).

Another screenshot shows Miami-based influencer Arynne Wexler, who has over 67,000 followers, discussing her “deal” with Kalshi in late October. On November 14, Arynne Wexler posted a video about the raid ( archive link ), noting that trading on Polymarket is illegal in the United States and that “Kalshi has a license to operate in the United States,” and encouraged her followers to “check the platforms you use to make sure they are legal in the United States.” Like Clown World, Arynne Wexler also posted other content related to Kalshi before the election ( archive link ).

If true, the allegations would reveal a brutal behind-the-scenes battle between the two companies for dominance of the U.S. prediction market, with Kalshi paying large social media accounts to incite a covert PR campaign in his name without clearly disclosing the obvious inherent conflict of interest.

According to Bloomberg, the raid on Shayne's apartment was related to an investigation by the U.S. Department of Justice. In a 2022 settlement with the CFTC, Polymarket was banned from accepting trades from U.S. users, and the company paid a $1.4 million fine for launching trades without first obtaining approval from the agency to become a designated contract market (DCM). Polymarket currently geo-blocks U.S. visitors who try to create accounts; it is unclear whether the DOJ's investigation involves users circumventing geo-blocking.

After receiving approval from the CFTC to become a DCM in 2020, Kalshi launched its platform in 2021 and offered a variety of non-political campaign contracts. In 2023, the CFTC rejected Kalshi’s application to allow users to trade congressional control contracts. The company sued the agency over the decision, and in September 2024, a district court ruled in favor of Kalshi. Last October, a circuit court denied the CFTC’s emergency stay of the ruling, effectively allowing Kalshi to offer campaign contracts on congressional control and other political topics.

Polymarket CEO Shayne Coplan declined to comment for this story. Kalshi CEO Tarek Mansour, Keaton Inglis, Antonio Brown, Arynne Wexler and Clown World did not respond to requests for comment.

Related reading: From the FBI raid on Polymarket’s founder to the death of Peanut, PolitiFi-like MEME coins are hotly speculated

You May Also Like

Michael Saylor’s Strategy follows Metaplanet, adding 6,269 BTC worth $729 million

Payward Revenue Hits $2.2 Billion as Kraken Exchange Reports Strong 2025 Growth