MicroStrategy’s stock price is bearish, and its Bitcoin holdings exceed US$32.6 billion. Can the leverage game continue?

Author: Nancy, PANews

MicroStrategy is undoubtedly one of the big winners in this bull market, with its main business of business intelligence (BI) performing mediocrely, but its sideline business of investing in Bitcoin is booming. Thanks to the strong momentum of Bitcoin, MicroStrategy has achieved huge profits and driven its stock price soaring after boldly betting on Bitcoin. This winning strategy is also attracting more and more imitators who are trying to replicate its successful experience.

However, while MicroStrategy has achieved capital appreciation with the help of Bitcoin's strong returns, the high premium of its stock price has also caused market concerns, and Citron, a well-known short-selling institution, has publicly stated its short position. Can MicroStrategy's leverage game continue?

Bitcoin holdings valued at more than $32.6 billion, share price surges 497% this year

Since adopting a Bitcoin investment strategy in 2020, MicroStrategy has become a well-deserved whale, and the value of its Bitcoin reserves now exceeds the cash and securities held by companies such as IBM and Nike.

According to data from BitcoinTreasuries.com, as of November 22, MicroStrategy purchased more than 331,000 bitcoins at an average price of about $49,874, accounting for nearly 1.6% of the total bitcoin supply, with a current value of more than $32.69 billion. If calculated based on the current bitcoin price of about $99,000, MicroStrategy has realized a floating profit of about $16.2 billion in the past four years.

Despite the huge returns, MicroStrategy has not stopped its pace of increasing its investment in Bitcoin, and the reason behind its unlimited money printing is that it purchases Bitcoin through the issuance of stocks and convertible bonds. According to MicroStrategy's latest announcement, the company has completed the issuance of $3 billion in zero-interest convertible senior bonds. The bonds will mature in 2029, and the conversion price is 55% higher than the market price, which is approximately $672 per share. The net proceeds from this issuance are approximately $2.97 billion. MicroStrategy plans to use most of the funds to purchase more Bitcoin and for other company operations. Not only that, MicroStrategy still has $15.3 billion of the $21 billion in previous equity financing that it has obtained to purchase Bitcoin, and plans to raise $42 billion to invest in Bitcoin in the next three years.

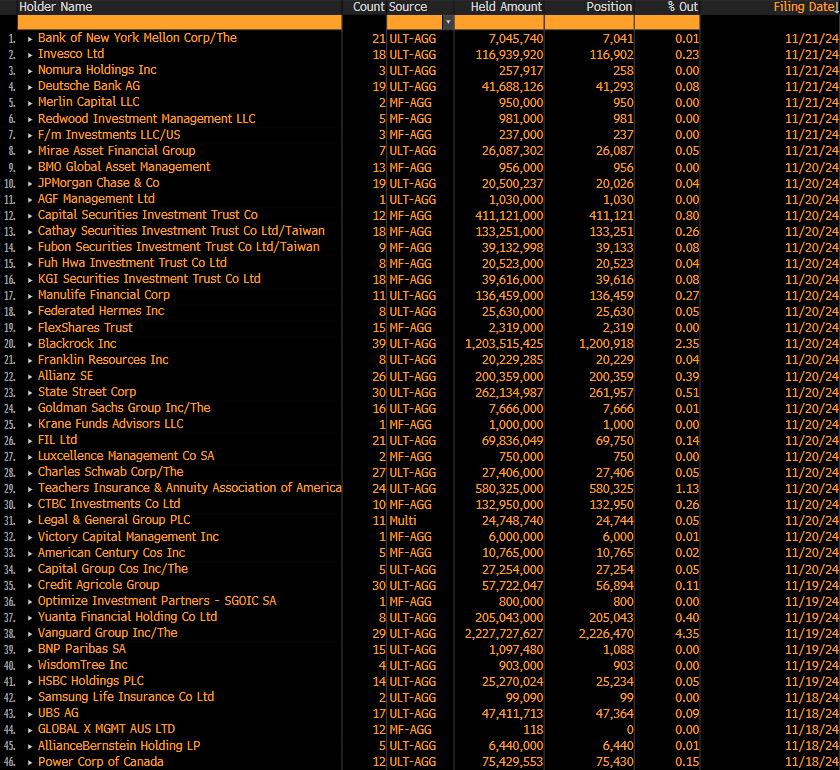

Among them, according to the latest data shared by @thepfund, since November 18, the list of MicroStrategy's major bondholders (who have the right to choose to convert bonds into stocks) shows that Vanguard Group ranks first and BlackRock ranks second. Many well-known financial institutions and investment companies such as Goldman Sachs, JPMorgan Chase and Deutsche Bank also appear on the list.

The strengthening of Bitcoin's yield has boosted the market's optimistic sentiment towards MicroStrategy's prospects. Data shows that MicroStrategy's market value has reached $80.506 billion, nearly 2.5 times the premium of its Bitcoin holdings, and it once ranked among the top 100 US listed companies by market value. And from the perspective of stock price performance, MSTR's price has climbed to $397.28, about 14 times the stock price when the company first purchased Bitcoin, and has risen 497.8% this year alone, far exceeding the increase in Bitcoin during the same period. Of course, MSTR's trading is also very active. Data from the Top 100 most active US stocks tracked by Tradingview shows that MSTR's trading volume yesterday (US time) reached $39.9 billion, second only to Nvidia's $58.8 billion.

MicroStrategy shareholders also gained significant value-added effects. According to MicroStrategy founder Michael Saylor's disclosure on social platforms a few days ago, MSTR's financial operations achieved a 41.8% Bitcoin return, providing its shareholders with a net income of approximately 79,130 BTC. This is equivalent to approximately 246 BTC per day, and there are no costs, energy consumption or capital expenditures typically associated with Bitcoin mining. According to the third-quarter 13F filing tracked by Fintel, MSTR's institutional holders have increased to 1,040, totaling 102 million shares (currently worth $40.52 billion), and shareholders include Capital International, Vanguard Group, Citadel, Jane Street, Morgan Stanley, Susquehanna International Group and BlackRock.

In this regard, CoinDesk analyst James Van Straten once pointed out that MicroStrategy's shareholders are a unique group. Usually, the dilution of shareholders' equity is considered a bad thing, but MicroStrategy's shareholders seem to be very happy that their equity is diluted because these shareholders know that MicroStrategy is buying Bitcoin. This strategy is equivalent to increasing the value of its shares, which means that shareholder value also increases accordingly.

High stock price premium sparks controversy, sustainability of leverage strategy becomes focus

Faced with the high premium of MicroStrategy's stock, the market began to have different opinions on the leverage strategy behind it.

Optimists believe that MicroStrategy has successfully combined the rising potential of Bitcoin with the performance of the company's stock through leveraged layout, creating huge value growth space, especially against the backdrop of strong Bitcoin price increases. For example, Mechanism Capital partner Andrew Kang posted on the X platform that MicroStrategy was pushed up by Bitcoin, and the premium rate continued to hit new highs. Traditional finance could not understand it, and there was a certain degree of insensitivity to MicroStrategy's model; BTIG analyst Andrew Harte praised MicroStrategy's plan, believing that the company's management has done an excellent job in using volatility to raise additional legal capital to buy Bitcoin, and significantly raised MicroStrategy's target price from $290 to $570.

"According to recent statistics, MicroStrategy's average cost of Bitcoin is $49,874, which means that it is now close to a 100% floating profit, which is a super thick safety cushion. MicroStrategy borrows OTC leverage and has no liquidation mechanism at all. Angry creditors can only convert their bonds into MSTR stocks at a specified time, and then angrily smash them into the market. Even if MSTR is smashed to zero, it still does not need to be forced to sell these Bitcoins, because the earliest debt that MicroStrategy needs to repay is due in February 2027. Not only that, because of MicroStrategy's convertible bonds, creditors generally make a profit, so its interest rate is quite low." Nothing Research partner 0xTodd said in a post.

In the view of Yang Mindao, founder of dForce, MicroStrategy is not just a triple arbitrage of stocks, bonds and coins. The key is to turn the stock MSTR into the real Bitcoin in traditional finance, which can be described as a masterpiece of "borrowing the false to cultivate the true". As for when the flywheel stops turning and when the music stops, the key lies in how long the high premium of stocks and single-share net coins can be maintained. If the market trend breaks expectations, the supply of Bitcoin derivatives increases, and the stock/coin premium of MicroStrategy is reduced to less than 1.2, this kind of financing will be difficult to sustain. He also pointed out that MicroStrategy now has a 300% premium on Bitcoin. Secondary market participants, if they do not understand the variables, are at extremely high risk. The growing volume means that the premium will only shrink rather than expand; the ability to continue financing is one of the variables that turn the premium from virtual to real.

However, bears believe that MicroStrategy's current stock price premium far exceeds the value of Bitcoin itself, and the downside risk of the stock price may narrow or even amplify rapidly as market sentiment fluctuates.

For example, Citron believes that as Bitcoin investment becomes easier than ever (currently you can buy ETFs, COINs, HOODs, etc.), MSTR's trading volume has completely decoupled from Bitcoin's fundamentals. Although Citron is still bullish on Bitcoin, it has hedged by opening a short position in MSTR. Even Michael Saylor must know that MSTR is now overheated.

Steno Research also pointed out in a recent report that "the fading effect of MicroStrategy's recent stock split further reinforces the belief that its premium is unlikely to continue. The company's premium relative to its Bitcoin reserves recently soared to nearly 300%, indicating that the company's valuation "is very different from a direct calculation of its assets and business fundamentals." As regulators become more and more favorable to Bitcoin and cryptocurrencies, investors may choose to hold Bitcoin directly rather than MicroStrategy stock.

BitMEX Research believes that MicroStrategy's price performance and growth model is a "Ponzi scheme" and is not reasonable. The stock price has a huge premium over the value of the Bitcoin it holds, partly because some financial regulators prohibit people from buying Bitcoin ETFs, but investors are so eager for Bitcoin exposure that they buy MSTR regardless of the premium, and MSTR also has a "income strategy".

You May Also Like

Botanix launches stBTC to deliver Bitcoin-native yield

Unprecedented Surge: Gold Price Hits Astounding New Record High