Tesla Inc. (TSLA) Stock: Musk’s $1 Trillion Payday Comes with Sky-High Strings Attached

TLDR

- Tesla’s board unveiled a pay package that could give Elon Musk up to $1 trillion if the company reaches an $8.5 trillion market value over the next decade

- Musk would receive 423.7 million additional Tesla shares through 12 tranches tied to performance milestones including 20 million annual vehicle deliveries

- The package requires Musk to stay at Tesla for 7.5 years minimum to access any stock and 10 years for the full amount

- Early targets include reaching $2 trillion market value, 1 million robotaxis in service, and 1 million humanoid AI robots

- Tesla’s latest quarterly profits dropped from $1.39 billion to $409 million while revenues declined and missed Wall Street expectations

Tesla’s board of directors has proposed what could become the largest executive compensation package in corporate history. The electric vehicle maker unveiled a pay structure Friday that could award CEO Elon Musk up to 423.7 million additional shares over the next decade.

The potential payout reaches nearly $1 trillion if Tesla achieves the plan’s most ambitious targets. At Friday’s closing price, those shares would be worth $148.7 billion today.

The compensation plan centers on Tesla reaching an $8.5 trillion market valuation. That figure represents eight times the company’s current worth and double any company’s previous peak value.

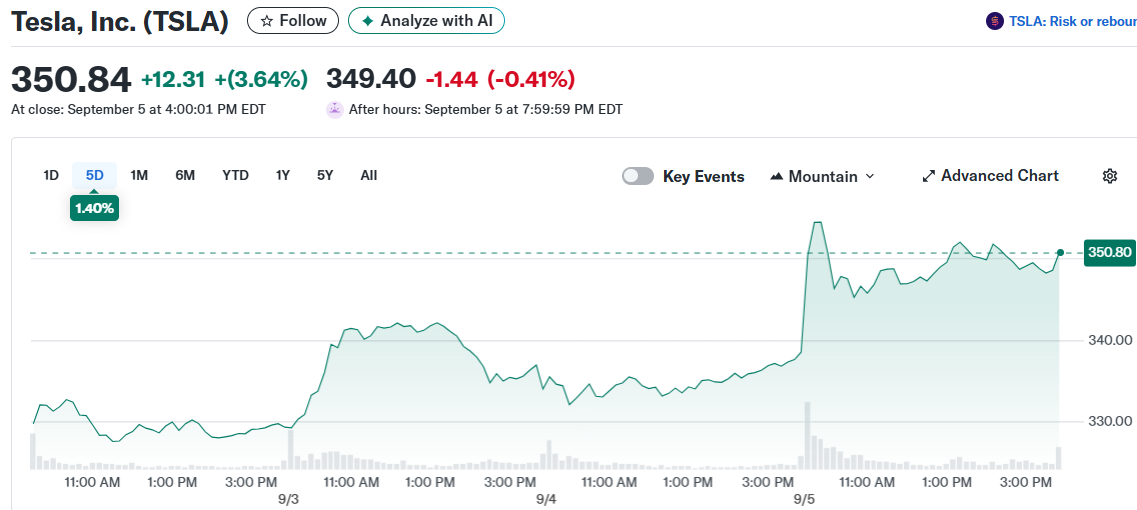

Tesla, Inc. (TSLA)

Tesla, Inc. (TSLA)

The board structured the package around 12 share tranches. Each tranche unlocks only when Tesla hits specific performance milestones.

Early targets include reaching a $2 trillion market value and delivering 20 million vehicles annually. Tesla delivered fewer than 2 million vehicles in 2024.

The plan also requires Tesla to deploy 1 million self-driving robotaxis and sell 1 million humanoid AI robots. These goals reflect Musk’s vision of Tesla expanding beyond traditional automaking into robotics and artificial intelligence.

Musk Must Commit Long-Term to Tesla

The pay package includes strict retention requirements. Musk must remain at Tesla for at least 7.5 years to access any stock compensation. The full 10-year commitment is necessary to collect the entire prize.

The board’s filing reveals concerns about losing Musk to other ventures. During negotiations, Musk raised the possibility of pursuing other interests if he didn’t receive assurances about his Tesla role.

Musk divides his attention between multiple companies including SpaceX, Starlink, and artificial intelligence firm xAI. He also purchased Twitter for $44 billion in 2022 and recently served in Donald Trump’s administration.

Earlier this year, Tesla’s board reportedly searched for a potential successor to Musk. Both board chair Robyn Denholm and Musk denied these reports.

Control and Voting Power Drive Package Design

Musk has repeatedly emphasized his need for greater control over Tesla. He posted on X in January 2024 that he requires at least 25% voting control of the company.

Tesla supporters believe artificial intelligence and robotics represent the company’s future growth areas. They argue these technologies could justify the ambitious $8.5 trillion valuation target.

Critics point to Musk’s history of missed promises regarding autonomous vehicles. Tesla has been promising full self-driving capabilities since 2014 without delivering on those commitments.

Gordon Johnson, a Tesla analyst and critic, called Musk “a master manipulator” who keeps the stock price elevated through ambitious promises. Despite past disappointments, Tesla investors have consistently approved Musk’s compensation packages.

The latest package requires shareholder approval at Tesla’s annual meeting. Investors previously reinstated a $44.9 billion pay deal in 2024 after a Delaware judge initially rejected it.

Tesla’s recent financial performance adds complexity to the compensation debate. The company’s quarterly profits fell from $1.39 billion to $409 million, while revenues declined and missed Wall Street expectations.

Tesla continues expanding globally despite financial headwinds. The company recently opened its second showroom in India at Delhi’s Aerocity, following its first Indian location in July.

The post Tesla Inc. (TSLA) Stock: Musk’s $1 Trillion Payday Comes with Sky-High Strings Attached appeared first on CoinCentral.

You May Also Like

XRP Enters ‘Washout Zone,’ Then Targets $30, Crypto Analyst Says

Republicans are 'very concerned about Texas' turning blue: GOP senator