What is the Most Promising AI coin in 2025? DeepSnitch AI Nears $200k as BTC Steadies

Bitcoin is rising again as titans like MicroStrategy continue accumulating tokens in September. Now trading around $112,000, Bitcoin is overturning its recent decline, and its positive momentum is being bolstered by growing ETF inflows.

Following this upswing, investors are turning to the market with one question: What is the most promising AI coin in 2025? Bittensor and Near Protocol are in the spotlight, but smaller tokens like DeepSnitch AI presale coin may offer better returns.

DeepSnitch leverages artificial intelligence to empower retail traders with quality investing insights, allowing them to keep up with whale activity. Here’s why investors say DeepSnitch might become one of the best-performing AI coins.

BTC stabilizes as corporate accumulation continues

Bitcoin bulls are jubilant over the recent acquisition by MicroStrategy. Shortly after missing out on the S&P 500, MicroStrategy confirmed its bullishness in Bitcoin with another $217 million purchase.

This new acquisition of 1,955 BTC tokens takes the company’s total holdings to 638,460 tokens. Additionally, the new token purchase also helped MicroStrategy cement its place as the largest corporate holder of Bitcoin, with around $42 billion in assets.

Many investors had wondered whether MicroStrategy would change its Bitcoin accumulation strategy, which involves monthly purchases. Their concerns came after the S&P 500 omitted MicroStrategy from its index, a situation that many had pinned on negative sentiments around cryptocurrencies.

However, the company has remained undaunted, continuing to acquire BTC tokens monthly. In July, MSTR acquired 31,466 BTC tokens shortly after acquiring 17,000 tokens in June.

In light of MSTR’s commitment to its Bitcoin portfolio, many investors now have speculations about a possible rally. These investors point to MSTR’s accumulation strategy as whale positioning for a future rally.

These sentiments have been strengthened by Bitcoin’s recent price gains, which saw the token rise by 3.51% over the past week. Still, despite trading at $112,579, BTC is down by 3.67% over the past month. But if investor predictions are accurate, then BTC might be preparing for a mega rally in the final quarter of 2025.

DeepSnitch to give small traders an edge this altseason

Crypto success often depends on being the first to react, something whales have always used to their advantage. DeepSnitch levels the playing field by putting retail traders on equal footing. Its AI agents continuously analyze market conditions, wallet movements, and contract risks, giving users instant access to insights that once required entire research teams.

DeepSnitch also shields you from threats. From rug pulls to pump-and-dump schemes, the platform’s surveillance tools are designed to spot manipulation early and keep your portfolio secure.

One area that makes DeepSnitch a standout project is its incorporation of artificial intelligence. Already, AI tokens have become one of the most popular assets in the crypto market. Additionally, many coin investors believe that AI tokens will outperform other assets in 2025.

Moreover, DeepSnitch offers the potential to make asymmetrical upside gains without breaking the bank.

Now in its presale, one DSNT token is trading at $0.01634, giving early investors a chance to secure high-growth potential at a bargain price. Additionally, presale buyers will enjoy staking privileges alongside exclusive priority access to network features.

With retail adoption rising, DeepSnitch has all the right ingredients for a breakout.

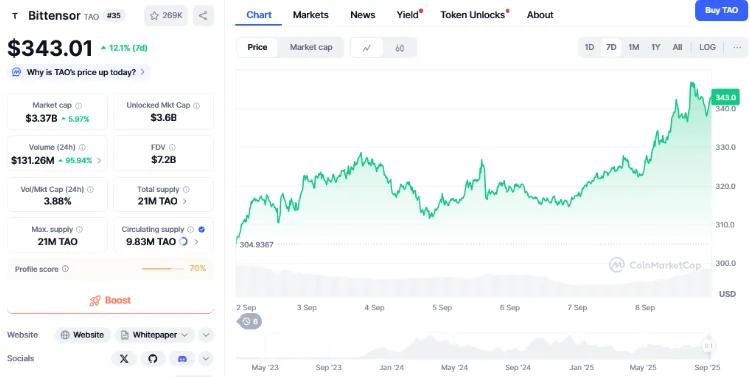

Will the halving event make Bittensor one of the top AI tokens?

Bittensor AI is set to undergo its first-ever halving event in December. As the event draws nearer, investors are fixated on the token, watching its performance to see if a mega rally could be close by.

The event will cut daily TAO emissions by half, taking the 7,200 TAO to 3,600 TAO. Additionally, it will reduce selling pressure on TAO, a factor that could stimulate Bittensor’s price growth. Historically, assets like Bitcoin have benefited from halving events as their reduced supply boosted demand and increased the token’s price momentum.

If a similar thing happens, investors asking what the most promising AI coin is in 2025 could turn to Bittensor. Already, the token is trading at $343.01 following its 12.1% increase over the past week. However, excitement around its halving event could push the token towards the $450 region.

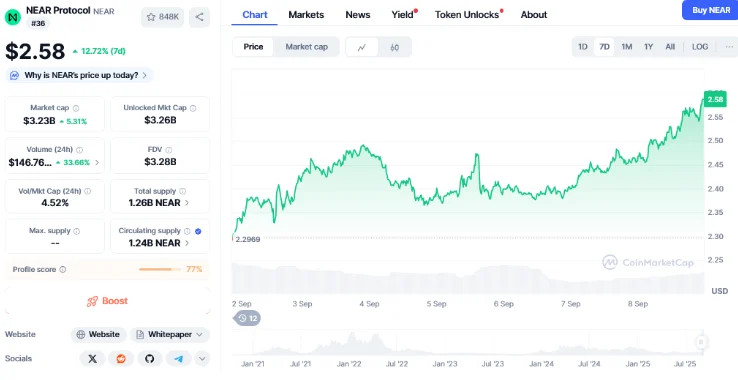

Near Protocol could soar on the back of Fed rate cuts

Near Protocol is in the news again after its recent 7-day increase. Like many AI tokens, Near Protocol endured a bearish performance in August as market volatility soared. However, its price movement in early September could indicate a positive turnaround. Now trading at $2.56, NEAR is up by 9.27% over the past week.

Additionally, Near Protocol could get a much-needed boost if the Federal Reserve cuts interest rates in September. That would pump fresh capital into the coin market, increasing demand for top AI tokens like Near Protocol. This could spur a sharp price boost for the token.

Conclusion

One question currently dominates many crypto communities: What is the most promising AI coin in 2025? Interestingly, many investors have pointed to DeepSnitch, a newcomer that melds meme coin-like hype with practical real-world utility.

Interest in DeepSnitch continues rising, taking its presale revenue to $192,000. With a price increase scheduled soon, now might be the best time to join DeepSnitch’s ecosystem.

Visit the website to buy into the DeepSnitch AI presale now.

Frequently asked questions

Can DeepSnitch outshine top AI tokens?

Many investors believe DeepSnitch could become one of the top AI coins, citing its rapid presale growth and real-world utility.

Is DeepSnitch’s presale live?

DeepSnitch’s presale has kicked off, raising over $192,000 in record time. Joining its presale now can help investors capitalize on its next price increase.

Is DeepSnitch a trading platform?

No. DeepSnitch helps investors to compress market data and whale activity into actionable insights.

This article is not intended as financial advice. Educational purposes only.

You May Also Like

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt

United States Building Permits Change dipped from previous -2.8% to -3.7% in August