OnRe Introduces Points Program Rewarding ONyc Participation Across DeFi

Hamilton, Bermuda, September 11th, 2025, Chainwire

OnRe, an onchain asset manager delivering institutional-grade yield to DeFi, has announced the launch of OnRe Points, a rewards program designed to encourage participation in the ONyc ecosystem. The program differs from conventional liquidity mining by rewarding capital efficiency based on how ONyc is utilized across decentralized finance (DeFi) protocols. The initiative is intended to support ONyc’s role as a premier collateral asset within the Solana ecosystem.

Rewarding Capital Efficiency

OnRe Points mark a shift from passive token farming to active ecosystem building. By rewarding ONyc’s deployment across DeFi protocols, the program creates a direct link between user activity and ecosystem growth.

Multi-Tiered Rewards for DeFi Strategies

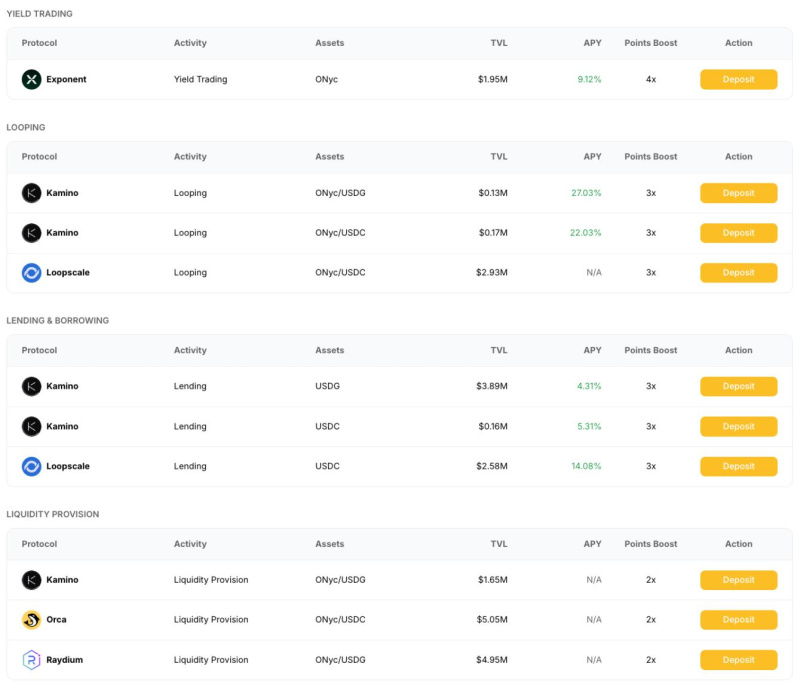

Points accrue daily with strategic multipliers that reward DeFi participation:

- Base Holding (1x): 1 point per ONyc per day for asset holders, providing baseline rewards while accessing real-world yield from reinsurance performance.

- Liquidity Provision (2x): Double rewards for providing ONyc liquidity on leading Solana DEXs including Kamino, Orca, and Raydium. LPs support deeper markets and tighter spreads, earning both multipliers and trading fees.

- Lending and Borrowing (3x): Triple rewards for supplying ONyc as collateral to lending protocols like Kamino and Loopscale. Advanced users deploying looping strategies receive multipliers that scale with leverage, rewarding capital efficiency through recursive deposits that boost yields while maintaining exposure to ONyc.

- Yield Trading (4x): Maximum rewards for providing liquidity and holding YT-ONyc on Exponent. YT (Yield Tokens) give LPs the ability to speculate on the future yield of the underlying asset.

Bonus campaigns will add extra rewards tied to social engagement, partnership launches, and community participation, giving users more ways to earn while driving deeper utility for ONyc.

Bonus campaigns will add extra rewards tied to social engagement, partnership launches, and community participation, giving users more ways to earn while driving deeper utility for ONyc.

Designed for the Future of DeFi

The program’s transparent structure allows users to optimize strategies while contributing to ONyc’s growth. OnRe Points are structured to allocate rewards based on the level of contribution to ecosystem liquidity and utility, with participants receiving recognition in proportion to their activity.

Immediate Availability

OnRe Points are now available across all supported strategies. Participants can track their ONyc positions, accrued points, and related onchain activity in real time through the OnRe application. Participants can monitor their progress and adjust strategies as new opportunities emerge: https://app.onre.finance/.

The program underscores OnRe’s commitment to building sustainable DeFi infrastructure where genuine utility drives long-term value creation, ensuring early adopters capture maximum benefit from ONyc’s expanding ecosystem.

About OnRe

OnRe is a leading onchain asset manager using yield-bearing assets to underwrite reinsurance, bringing stable, institutional-grade returns to DeFi. By connecting the $750B global reinsurance market with blockchain technology, OnRe provides investors access to structured products designed to deliver consistent yield across market cycles, opening a market that has historically been out of reach. Its flagship product, ONyc, is a multi-collateral, yielding dollar asset backed by reinsurance premiums, a $1.2T market the team has underwritten for more than a decade. Liquid, scalable, and fully composable, ONyc delivers resilient, uncorrelated returns and is positioned to become the preferred collateral asset across all of DeFi.

Contact

Head of Operations

Sarah George

OnRe

[email protected]

You May Also Like

The Federal Reserve cut interest rates by 25 basis points, and Powell said this was a risk management cut

SEC clears framework for fast-tracked crypto ETF listings