USDH on Hyperliquid: Native Markets dominates Polymarket shares (94%) two days before the validators’ vote

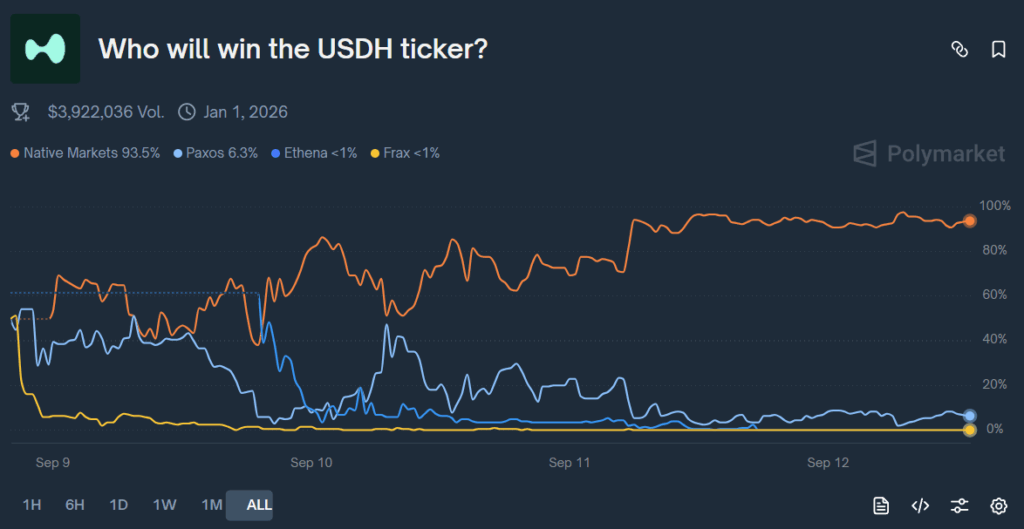

Two days before the validators’ voting window, Native Markets emerges as the favorite for the issuance of the stablecoin USDH on the Hyperliquid ecosystem. According to the odds recorded on Polymarket, the implied probability of Native Markets exceeds 94% on a total pool of over $3 million. In this context, the signal — reconfirmed by outlets like Bitcoin News is decisive for the token structure and future integration into the ecosystem.

According to the data collected by our predictive markets monitoring team (Polymarket snapshot from 09/12/2025, 14:00 UTC) and on-chain analysis, the price concentration on Native Markets has significantly increased in the 48 hours following Ethena’s withdrawal. Industry analysts note that this dynamic may result from either an actual operational realignment between projects and validators or speculative positioning in low-depth markets.

Polymarket: updated numbers and context

Prediction markets, which synthesize expectations in real-time, paint a picture clearly skewed in favor of Native Markets, while the other candidates register significant volumes but much lower probabilities.

Native Markets in clear lead on Polymarket as a potential issuer of the stablecoin USDH on Hyperliquid.

Native Markets in clear lead on Polymarket as a potential issuer of the stablecoin USDH on Hyperliquid.

Method: on Polymarket the “probability” corresponds to the normalized yes/no contract price (0–100), while the staked volume indicates the money traded. In fact, it may happen that some projects show large volumes but low probabilities if the price reflects skepticism about the outcome. The odds also vary with liquidity and market activity.

Hyperliquid stablecoin: what is USDH and why does it matter who issues it

USDH is the native stablecoin proposed for the Hyperliquid ecosystem. The choice of minter will directly impact stability, fund privacy, reserve transparency, DeFi integrations, and the distribution of any yields. In other words, it will define the risk profile of the entire stack, as highlighted by industry analyses.

Native Markets in Advantage: Key Factors

Despite not yet having a public track record in stablecoin management, Native Markets is ahead due to a well-established operational alignment with the Hyperliquid ecosystem and a proposal considered particularly pragmatic in terms of integrations and governance. In this context, the initial orientations emerging from the community have helped to strengthen consensus in the predictive market, consolidating the perception of high reliability of the project.

The contenders: models and trade-offs

The proposals in the competition present different approaches on backing, controls, and returns. For example, Paxos focuses on a fiat-backed model with strong compliance and custody, while Agora emphasizes governance mechanisms and alignment with validators. Bastion concentrates on security and collateral management, Native Markets prioritizes native integrations and operational focus, Ethena had proposed a scheme with hedging and variable yield, Sky (formerly MakerDAO) capitalizes on the experience gained with DAI, and Frax proposes a hybrid design oriented towards scalability and monetary policy tools.

Validator Vote: Timings and What to Expect

The validators’ vote is scheduled for September 14, 2025 from 10:00 to 11:00 UTC. During this window, the validators will express their preferences: the outcome could confirm the current sentiment or, on the contrary, overturn it. It should be noted that, in the hours leading up to the vote, an increase in the volatility of shares on Polymarket is plausible.

Implications for Hyperliquid

The choice of the minter will affect several critical aspects:

- Trust: quality of reserves and independent audits;

- Liquidity: depth on DEX/CEX and in the main trading pairs;

- Adoption: ease of use for lending, perps, and payments;

- Regulatory risk: exposure to jurisdictions and compliance requirements;

- Sustainability of yield: potential profit sharing towards the ecosystem.

If Native Markets proves to be successful, a rapid and fully integrated implementation into the network is expected. Alternatively, the focus will shift to the guarantees and mechanisms proposed by other participants.

How to Read the Discrepancies Between Volumes and Probabilities

The apparent discrepancy, for example in the case of Paxos which, despite boasting over $540k in volume, shows an implied probability of about 3%, is typical of the market structure. The contract price on Polymarket expresses the expected probability, while the volume indicates the intensity of participation, even when low prices keep the probability compressed.

Quick FAQ

Who is leading in the bets?

Native Markets leads with an implied probability around 94% according to Polymarket (snapshot from 09/12/2025, 14:00 UTC).

When is the voting?

The validators’ vote is scheduled for September 14, 2025 from 10:00 to 11:00 UTC.

Do the odds guarantee the outcome?

No. The quotes are market forecasts and can change rapidly; the final outcome will depend on the on-chain vote of the validators.

You May Also Like

GCC and India to sign terms for start of free trade talks

PEPE Holders Looking For The Next 100x Crypto Set Their Sights On Layer Brett Presale