Millions of people are flocking to PumpFun to become streamers?

Author: hitesh.eth

Compiled by AididiaoJP, Foresight News

I was browsing through Pumpfun's streams yesterday and it was really interesting to see the incredible income some of the creators are making. Compared to what you can earn on other platforms like Kick, Twitch, or even YouTube, the returns on Pumpfun are way higher.

What’s interesting is the payment structure. Traditional platforms are optimized for platform advertising and take a significant cut before creators receive any revenue. Content discovery is algorithmic and uneven.

On Pump, the rewards loop is closer to the action itself: attention turns into transactions, transactions immediately turn into creator fees, and viewers have a financial stake in the continued growth of their content. It’s a tighter flywheel, with fewer layers between creators and their rewards.

Converting attention into expenses

So, in terms of compensation, on Pump, if you livestream, you have the potential to earn more than on other platforms. The dashboard shows some very interesting streamers and very interesting streams. One very popular one is "Streamer Coin." This person consistently donates his creator fees to all small creators, and he also has this token. Every creator, whenever they start a livestream, also has a token associated with them. The market capitalization of "Streamer Coin" has reached around 22 million.

Tokens transform viewers into co-owners of attention. When viewers hold your tokens, they become more than just spectators: they become promoters, callers, and retention loops. If you set up fee sharing, sweepstakes, or livestreaming tasks, you're essentially running a real-time, on-chain loyalty program without a middleman. Price becomes a public scoreboard for attention.

Then I saw another token called "Bagwork." They had a very viral clip where a well-known online personality named Radley slapped a live streamer titled "Bagwork." The clip went viral on social media, so he gained attention.

This is the new model: capture a moment the internet can't ignore, then channel that attention into on-chain assets tied to your livestream. Viral clip → surge in new wallets → transaction volume → creator fees → more content. This cycle rewards those who can repeatedly create moments.

Streamers are trying to get attention and do different things. I even saw a creator giving out food to people in Los Angeles. There's a token called "Feed the People" (FTP). They've been donating everything they earn through these streams. They're donating food, donating to shelters, and so on. They're trying to promote a noble cause.

Cause-driven livestreams transform empathy into measurable action. When viewers see the transparent on-chain flow of funds toward meals or shelter, trust builds rapidly. That trust becomes community, which becomes endurance, which generates compounding fees for creators and sustained results for the cause.

From Twitch to Pumpdotfun

There are about 7.3 million people streaming on Twitch every month, but on Twitch, I think 90% of them don't make any money. Even some of the top streamers don't make any significant fees compared to what new streamers on Pump can make. For example, the guy behind "bagwork" has made $150,000 in two days, which is amazing.

Why most Twitch streamers struggle: Monetization relies on subscriptions, bits (tip points), advertising, and brand partnerships. Content discovery favors established talent, compensation is paid late, and the platform takes a significant cut. For smaller creators, average monthly income is often small or unstable, stifling motivation. Pump disrupts discovery and monetization: small creators can rise quickly in a moment of explosive growth, and rewards are instant because they are on-chain.

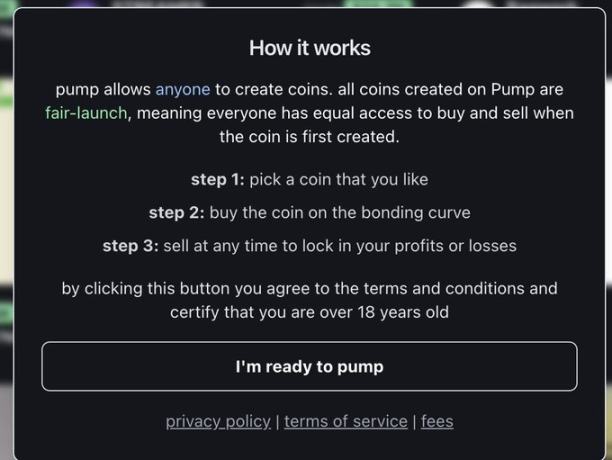

Pump provides a platform where you can live stream and you can expect to make more money. It is a crypto-native platform that is decentralized to some extent, relatively more decentralized, you could say, compared to purely centralized platforms like Kick, Twitch, etc.

Relative decentralization is important because it reduces platform risk. If your rewards rely on smart contracts and liquidity pools, you're less vulnerable to arbitrary policy changes, hidden bans, or delayed withdrawals. The trade-off is volatility and personal responsibility, but many creators prefer this to opaque rules.

Why People Livestream: Emotion, Identity, and Ownership

Here you already have a crypto community, a niche community, that can buy your token, sell your token, generate trading volume for you, and you can set fees on every trade completed on your token, thereby making money. It's very simple and straightforward. However, you also need to "graduate" your token, which has requirements. At the current Solana price, that's around $20,000 (85 Sol).

Graduation is essentially a threshold of credibility. Demonstrating sustained attention, holder growth, and a transparent token distribution allows you to achieve deeper liquidity and better value discovery. In practice, this means: a stable schedule, a clear storyline, regular catalysts, a fair launch mechanism, and active community management. When your livestream becomes a story that people want to trade, the token will have successfully launched.

When I think about livestreaming, I think about why people actually do it. Why do they go to these platforms, turn on their cameras, and show off whatever they're doing? Many people do very unique and quirky things. The first reason is probably hope. They might want to make some money because they see so many success stories everywhere. While they chase the money and aim for a quick buck, I'm not sure many people are able to play the long game. They'll try it for a few days or weeks, and when the money doesn't roll in, they might quit.

Emotionally, livestreaming offers recognition, identity, and a listening room. For some, it's therapy, for others, a performance, a way to transform solitude into a ritual. Financially, it offers optionality: even small payments feel meaningful because they're tied to your own IP (intellectual property) and your own schedule. People livestream to be seen, to matter, to publicly practice a craft and see if the market agrees.

But many people continue to livestream, regardless of how much money they make. Sometimes for a few, the money isn't that important, but they truly enjoy the process of livestreaming. They truly enjoy talking to whatever community they have. It could be 10 people, it could be 100 people, they enjoy talking to people, they enjoy sharing their emotions. This is great practice for those who don't have emotional support in their lives, if they don't have family or friends who they can share emotions and whatever's going on in their lives.

This is the parasocial relationship engine. You build micro-communities where inside jokes, rituals, and shared progress make people feel safe. Creators gain accountability and purpose, and viewers gain companionship and meaning. On Pump, these bonds are priced in real time, which can amplify both joy and stress, so you need boundaries and clear rules.

Even if they're looking for someone to share something they're truly good at, let's say they work at a corporate job but really enjoy singing and it brings them relief. If singing puts them in a flow state, they can choose to sing. They can start a live stream and connect with their audience. If they're good at singing, they can build an audience, potentially earn money and gain recognition that way. The possibilities are enormous. This is great for those seeking a break from their busy, stressful lives, a space where they can truly be themselves.

Flow coupled with ownership is why this will scale. When your side hustle becomes a token-backed ritual performed with fans who own a portion of your upside potential, the feedback loop is tangible: practice → audience growth → price action → more practice.

Pump is interesting because it could potentially give long-time streamers who have been streaming on Twitch, Kick, or even YouTube for a while but haven't been able to generate significant revenue from their efforts a chance to capitalize on their long-term efforts.

Think of it as retroactive funding. Your accumulated work becomes instant credibility. On day one of Pump, you're not a new creator; you're a proven IP with a profile, a backstory, and fans ready to convert.

This is similar to what we've seen with NFTs and the potential they bring. What NFTs have done for some great artists, streamers might see the same kind of reaction from Pump streams. It can do the same thing. In 2021-2022, in those 12 months, a lot of artists who weren't even making $100, who couldn't even sell their art in real life, made $10,000 to $100,000 selling their digital art through NFTs. I think a similar trend will happen here. The artist category is limited. There aren't that many artists jumping into NFTs.

OpenSea unlocks primary markets and secondary royalties for visual artists. Pump unlocks real-time royalties for streamers: transaction fees, token-gated benefits, on-chain sponsorships, and community-owned milestones. Same energy, but with a real-time market and ongoing content, rather than static art.

What's Next: Migration, Playbooks, and the Future

On Pump, I think there are probably millions of people thinking about joining. They can sign up to become streamers, and some of them could become millionaires in the next 12 months. If you're someone who wants to make money in this space, this is a great opportunity. Even if you've been streaming on different platforms and you love talking about something you know, you're good at something, and you want to share it with people, then start streaming. There's no need to be shy about it. You just need to open up, express yourself, and have that icebreaker moment. If something's holding you back, give it a try.

The trigger for migration will be simple: once a few mid-tier creators publish transparent, on-chain earnings that far exceed their old income, the public will take notice. Creators follow incentives, audiences follow creators, and liquidity follows both.

If you're serious about making money, if money is important to you, even if it's not all about the money, but it's about sharing that thing that you've always had in your mind, that you've always wanted to do, that you've wanted to pursue, but you had obligations and responsibilities that prevented you from pursuing that passion, then now is the time. Pursue your passion in the right way so that you can maximize your capital, better capitalize on your passion, make more money, enjoy the process, and get a better return.

Treat live streaming like a startup: a simple roadmap, token utility, weekly catalysts, and clean wallet management. Put guardrails in place for your community so speculation doesn’t overshadow your craft.

I believe there will be a huge wave of interest on Pump in the near future. Many streamers will join, and as word spreads that they can make more money by switching to Pump, the flywheel will begin to turn. Meanwhile, on Pump, not only will streamers profit, but traders will too. You can speculate on the growth of streamers by buying tokens, selling them, and flipping them for a profit.

Traders will build playbooks around “attention signals”: sudden spikes in concurrent viewers, Discord join rates, Twitter mentions, watch time retention, clip virality, and on-chain holder growth. The best strategies will be narrative plus numbers, not just numbers.

It's all about memecoins. It's all memes, but these memes are doing something great. On the streamer side, streamers are getting paid for their efforts. They're trying to get attention for whatever they do. They're gamifying attention. They're putting in the effort, and the more effort they put in, the better their chances of getting attention.

On the trading side, you need to be incredibly focused. You need to be invested, scanning on-chain wallets, trying to find the right alpha (information advantage). It's not easy, and you have to put in the effort. It's a highly invested game for both parties. On the livestreaming side, you need to put in more effort to earn more, and on the trading side, you need to put in more effort to earn money.

Tools to watch: KOLscan and Stalkchain for KOL wallet tracking and narrative mapping, DEX dashboards for inflow/outflow, Holderscan for checking holder concentration, new wallet velocity, LP (liquidity provider) depth and lockup, and whale entry and exit timing. X (for clipping virality and sentiment). A simple rule of thumb: rising attention plus improved holder distribution plus deepening liquidity is a stronger bet than attention alone.

Attention has always been money; the Pump simply makes it liquid. Those who can reliably build and track attention will capture the most value here: creators through consistent programming and authentic storytelling, and traders through the disciplined interpretation of social and on-chain signals.

You May Also Like

Crypto execs met with US lawmakers to discuss Bitcoin reserve, market structure bills

Lawmakers in the US House of Representatives and Senate met with cryptocurrency industry leaders in three separate roundtable events this week. Members of the US Congress met with key figures in the cryptocurrency industry to discuss issues and potential laws related to the establishment of a strategic Bitcoin reserve and a market structure.On Tuesday, a group of lawmakers that included Alaska Representative Nick Begich and Ohio Senator Bernie Moreno met with Strategy co-founder Michael Saylor and others in a roundtable event regarding the BITCOIN Act, a bill to establish a strategic Bitcoin (BTC) reserve. The discussion was hosted by the advocacy organization Digital Chamber and its affiliates, the Digital Power Network and Bitcoin Treasury Council.“Legislators and the executives at yesterday’s roundtable agree, there is a need [for] a Strategic Bitcoin Reserve law to ensure its longevity for America’s financial future,” Hailey Miller, director of government affairs and public policy at Digital Power Network, told Cointelegraph. “Most attendees are looking for next steps, which may mean including the SBR within the broader policy frameworks already advancing.“Read more

Ethereum Price Prediction: ETH Targets $10,000 In 2026 But Layer Brett Could Reach $1 From $0.0058