BlackRock Bitcoin ETF Operations or Profit-Taking? $136M Transfer Raises Questions

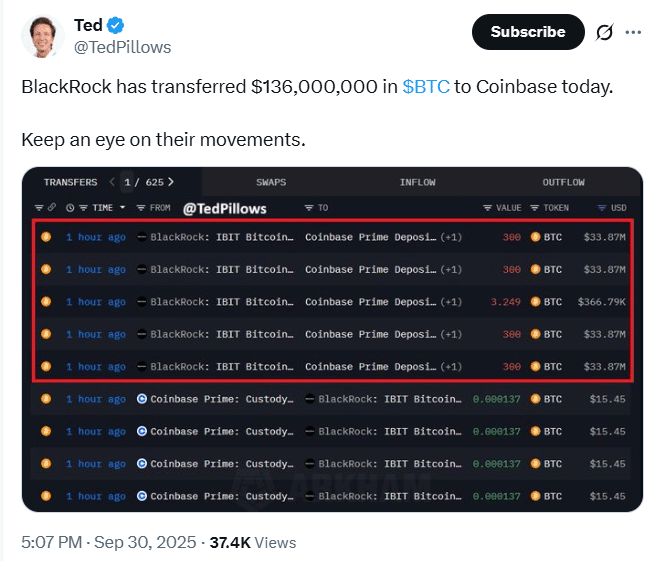

According to market trackers, BlackRock Bitcoin made waves this week after $136 million worth of BTC was transferred to Coinbase. The shift caught traders on edge, with speculation swirling around whether it signals a looming sell-off or a simple custodial adjustment.

Big money doesn’t creep, and when the world’s largest asset manager makes a splash, the ripples are felt across the crypto pond.

Whale Moves Raise Eyebrows

When funds of this size reach exchange wallets, the market takes notice. Analysts often read such transfers as a sign that liquidity might be tapped. This can involve rebalancing portfolios, harvesting profits, or reallocating funds for operational reasons.

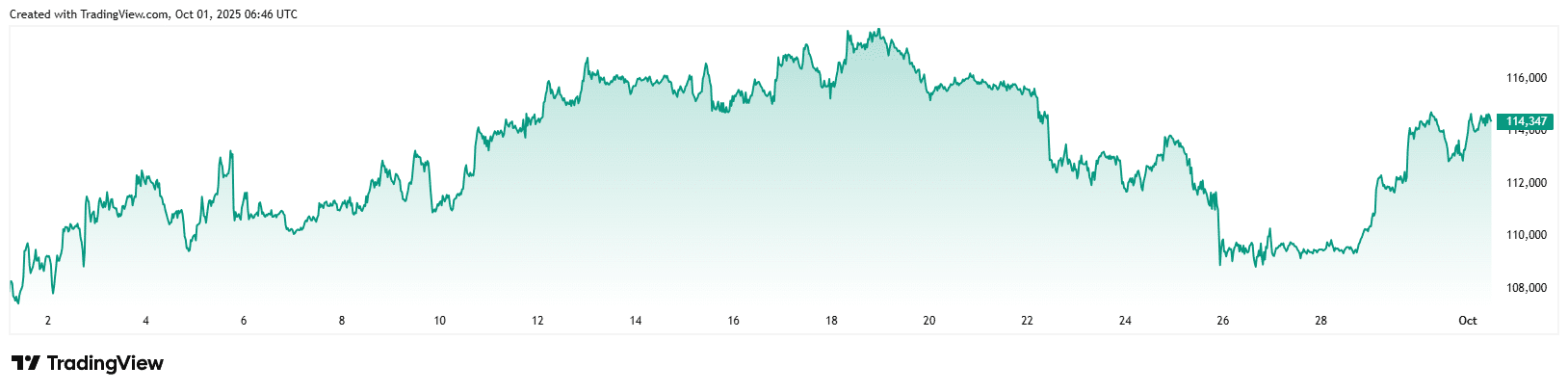

Still, the timing matters. Bitcoin has been hovering near $114,000, and a $136M swing is not the sort of detail traders brush under the rug.

In a recent note shared online, one strategist explained that “institutional flows often set the tone for retail traders,” adding that BlackRock Bitcoin transfers highlight the growing visibility of traditional finance in the crypto space. The tug-of-war between ETF inflows and spot market pressures only deepens the intrigue.

Also Read: BlackRock Bitcoin ETF Nears Top Spot With $76B AUM as IBIT Set to Break Records

Sources: X (Formerly Twitter)

Sources: X (Formerly Twitter)

Could It Be About ETFs?

Another school of thought suggests that this transfer could be tied to ETF operations, where custodial wallets and exchange balances often require adjustments. With BlackRock’s spot Bitcoin ETF consistently ranking among the top products by daily inflows, internal fund movements are not unusual. Yet the sheer size of this transaction still sparks chatter.

Mobility at this level has generally coincided with important trading sessions, pushing volatility even higher. Traders are watching to see whether Bitcoin can hold its near-term support around $111,000 or whether profit-taking pressures will pull it lower.

However, whatever the outcome from the events, Bitcoin activities by BlackRock will still remain a further bellwether for wider institutional sentiment.

Market Sentiment and Speculation

Markets are never short on theories. Some argue the deposit may prepare Coinbase Prime for institutional trading desks. Others whisper that it’s about hedging exposure as macro headwinds linger. Meanwhile, long-term holders take comfort in the bigger picture: institutions like BlackRock remain deeply invested in digital assets.

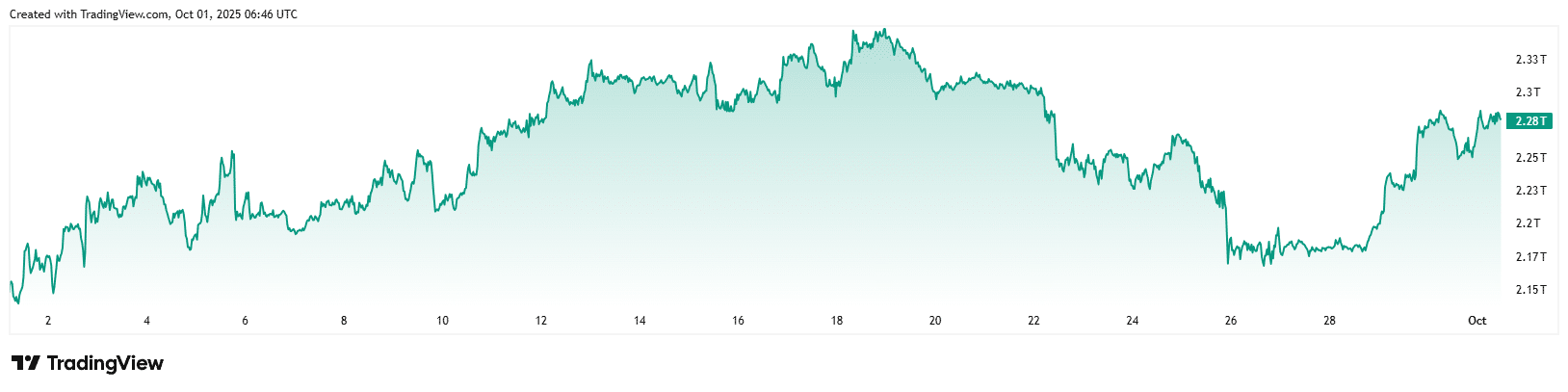

Source: Tradingview

Source: Tradingview

Charts show Bitcoin’s 30-day average volume climbing steadily, with open interest on futures nearing $ 40 billion. When institutions shuffle funds, they don’t just move money; they often move narratives. The phrase “follow the whales” has never felt more fitting.

Source: Tradingview

Source: Tradingview

Conclusion

Based on the latest research, BlackRock Bitcoin transfers remind us that institutions remain central to the crypto growth story. Whether this $136M move turns into a headline-grabbing sell or simply a reshuffling of custodial decks, the message is clear: Wall Street continues to treat Bitcoin as a serious asset.

For crypto readers, that’s both a warning and a vote of confidence. The tide may shift with each whale splash, but the current is undeniably flowing toward deeper institutional adoption.

For more expert reviews and insights into the world of cryptocurrencies, visit our dedicated platform featuring the latest news and forecasts.

Summary

BlackRock rattled the crypto scene by moving $136 million in Bitcoin to Coinbase. The sudden shift sparked a wave of speculation: Is it a sign of profit-taking, ETF housekeeping, or just routine fund management?

Whatever the reason, the move reminds traders how closely Wall Street’s footsteps are watched in crypto. The message is simple: when BlackRock Bitcoin makes a move, the market listens.

Glossary of Key Terms

ETF (Exchange-Traded Fund): An investment fund traded on stock exchanges that tracks assets like Bitcoin.

Liquidity: How easily an asset can be bought or sold without moving the price.

Whale: A large holder whose trades can influence market movements.

Coinbase Prime: Coinbase’s platform for big players like hedge funds and institutions.

FAQs about BlackRock Bitcoin

Q1. Why did BlackRock transfer Bitcoin to Coinbase?

The exact reason isn’t apparent. It could be tied to ETF adjustments, portfolio rebalancing, or simply moving funds for liquidity purposes.

Q2. Does this mean BlackRock is selling Bitcoin?

Not necessarily. Transfers to exchanges don’t always end in sales. Sometimes they’re just internal or operational moves.

Q3. How much Bitcoin was moved?

Approximately $136 million worth of BTC was transferred in the transaction.

Q4. Could this affect Bitcoin’s price?

Yes, big transfers can stir short-term volatility. But broader trends and market sentiment still play a bigger role.

Read More: BlackRock Bitcoin ETF Operations or Profit-Taking? $136M Transfer Raises Questions">BlackRock Bitcoin ETF Operations or Profit-Taking? $136M Transfer Raises Questions

You May Also Like

Bitcoin (BTC) Dips and Rallies Post-Fed Rate Cut: What's Next for Prices?

How to earn from cloud mining: IeByte’s upgraded auto-cloud mining platform unlocks genuine passive earnings