- FedWatch data suggests possible Fed rate cut in December.

- Unchanged rates probability slightly higher at 51.1%.

- Market reactions include major crypto liquidations.

BlockBeats News reports on CME’s “FedWatch” data indicating a 48.9% chance of a 25 basis point Fed rate cut in December, with 51.1% probability of rates staying unchanged.

Crypto markets closely watch potential Fed moves, impacting asset volatility. $7.9 billion in liquidations reflect market reactions to macroeconomic signals.

FedWatch Predicts Small Fed Rate Cut in December

The CME’s FedWatch tool captures current market expectations regarding the U.S. Federal Reserve’s interest rate stance. As of mid-November, there is a nearly even split between expectations for a cut and for no change, hinting at market uncertainty.

Such monetary policy speculations often precede notable shifts in financial markets, including cryptocurrencies. Leading digital assets like Bitcoin and Ethereum could witness significant price reactions depending on any Fed announcement.

Market reactions remain cautious amid this uncertainty. The crypto community is focused on potential ripple effects across asset prices, highlighted by the recent major liquidation events tied to speculative positioning.

Bitcoin and Ethereum: Coping with Potential Policy Shifts

Did you know? In similar past cycles, crypto markets have experienced sharp volatility surges ahead of FOMC meetings, reflecting trader positioning in anticipation of outcomes.

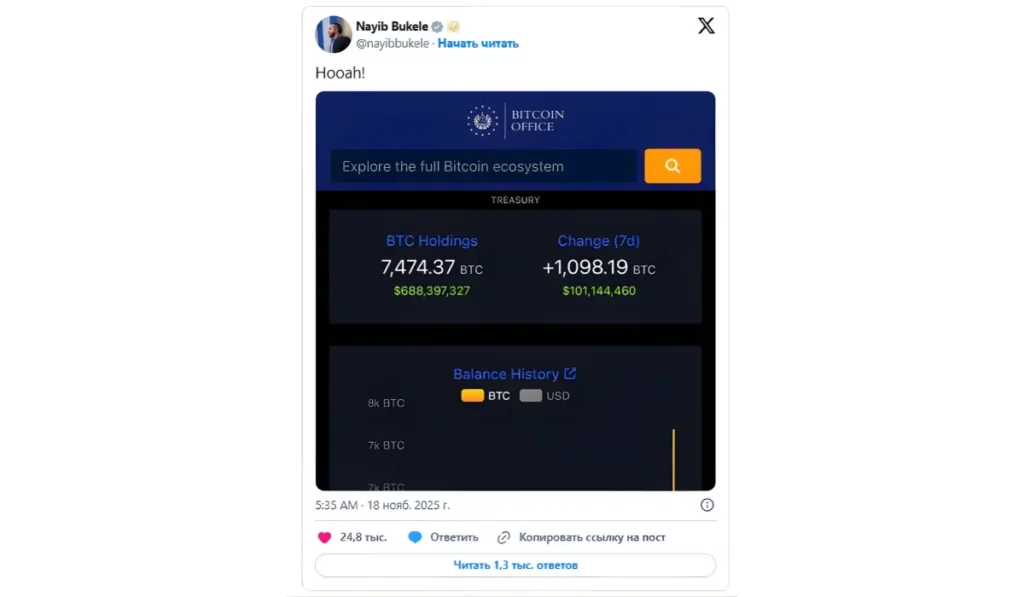

Bitcoin (BTC) currently trades at $91,457.44, with a market cap of $1.82 trillion and a dominance of 58.32%, according to CoinMarketCap as of November 19, 2025. Over the past 24 hours, BTC saw a trading volume of $86.42 billion, marking a decrease of 19.55%, with its price rising by 1.97%. However, a seven-day decline of 11.31% continues to reflect broader market nervousness.

Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 04:48 UTC on November 19, 2025. Source: CoinMarketCapAnalytical insights indicate the potential for financial market upheaval if the Federal Reserve shifts its rate policy. Cryptocurrencies, being highly sensitive to macroeconomic cues, are expected to react sharply based on these rate decisions, influencing both their valuation and volatility trends.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/fedwatch-december-2025-rate-cut/