Solmate Launches First Bare-Metal Solana Validator in UAE at 0% Commission

Nasdaq-listed firm, Solmate Infrastructure (SLMT) announced on Nov. 6 that it has deployed the first-ever bare-metal Solana SOL $156.7 24h volatility: 4.0% Market cap: $86.61 B Vol. 24h: $5.68 B validator in the UAE, officially minting the country’s first Solana block at 0% commission.

The launch establishes Solmate as a major player in the Middle Eastern crypto ecosystem, with ambitions to become one of Solana’s top validators globally.

Solmate plans to expand its SOL inventory to improve validator capacity, enable faster transaction speeds and throughput for Solana-based DeFi protocols.

In the official press release, the team highlighted how this creates a self-reinforcing cycle, where higher validator performance attracts more staking, which increases treasury yield and further enhances infrastructure efficiency.

Acurast and Irys Partner to Power Decentralized Storage on Solana Mobile

Amid Solmate’s announcement, Acurast, a decentralized edge computing network, has unveiled a new partnership with Irys_xyz, that could see users of Solana mobile devices as functional nodes for decentralized cloud storage.

Following a $5.2 million fundraise, Acurast CEO Alessandro De Carli talked up the partnership on Wednesday, hinting that it could reshape how data and computers coexist.

This integration could unlock new retail use cases for Solana’s growing mobile ecosystem. Meanwhile, institutional demand for Solana has remained steady since going live on Oct. 28, defying market volatility.

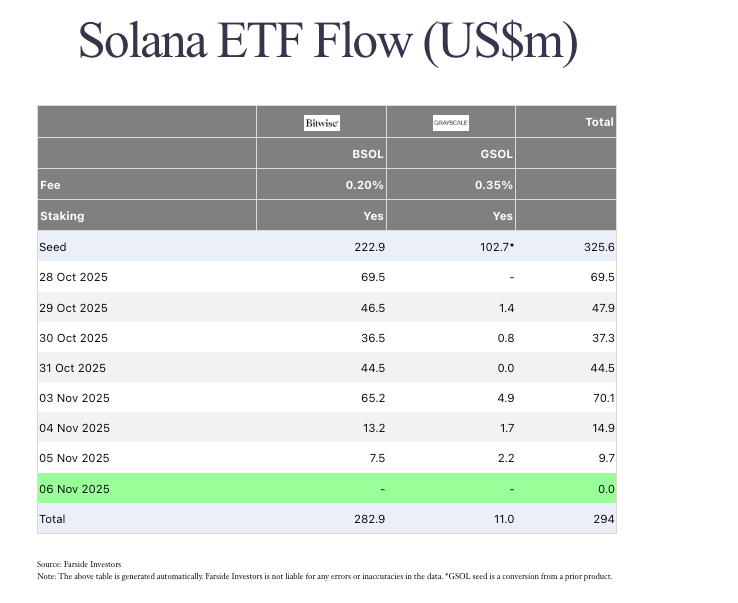

Solana ETFs hit $294 million in inflows | Oct. 28 to Nov. 6 | Source: FarsideInvestors

Data from FarsideInvestors indicates that the Bitwise Solana ETF (BSOL) and Grayscale Solana Trust (GSOL) have collectively attracted over $294 million in inflows. Both products have posted seven consecutive days of positive net flows, holding $282.9 million and $11 million in assets, respectively.

nextThe post Solmate Launches First Bare-Metal Solana Validator in UAE at 0% Commission appeared first on Coinspeaker.

You May Also Like

Kyrgyzstan’s finance ministry registers the USDKG stablecoin

Kyrgyzstan registeert USDKG stablecoin: Eerste stablecoin van een staat