PANews reported on November 6th that Wintermute published an article on its X platform stating: "Liquidity drives the cryptocurrency cycle, but inflows have now stalled. Since the beginning of 2024, the size of stablecoins, ETFs, and the digital asset treasury has increased from $180 billion to $560 billion, but the growth momentum has slowed. Funds are rotating internally rather than entering new markets, leading to a rapid fading of gains and a continued narrowing of market breadth. When any of these three inflow channels accelerates again, liquidity will flow back into the digital asset space. Until then, cryptocurrencies will remain in a self-funding phase."PANews reported on November 6th that Wintermute published an article on its X platform stating: "Liquidity drives the cryptocurrency cycle, but inflows have now stalled. Since the beginning of 2024, the size of stablecoins, ETFs, and the digital asset treasury has increased from $180 billion to $560 billion, but the growth momentum has slowed. Funds are rotating internally rather than entering new markets, leading to a rapid fading of gains and a continued narrowing of market breadth. When any of these three inflow channels accelerates again, liquidity will flow back into the digital asset space. Until then, cryptocurrencies will remain in a self-funding phase."

Wintermute: Liquidity drives cryptocurrency cycles, but inflows have now stopped.

PANews reported on November 6th that Wintermute published an article on its X platform stating: "Liquidity drives the cryptocurrency cycle, but inflows have now stalled. Since the beginning of 2024, the size of stablecoins, ETFs, and the digital asset treasury has increased from $180 billion to $560 billion, but the growth momentum has slowed. Funds are rotating internally rather than entering new markets, leading to a rapid fading of gains and a continued narrowing of market breadth. When any of these three inflow channels accelerates again, liquidity will flow back into the digital asset space. Until then, cryptocurrencies will remain in a self-funding phase."

Disclaimer: The articles reposted on this site are sourced from public platforms and are provided for informational purposes only. They do not necessarily reflect the views of MEXC. All rights remain with the original authors. If you believe any content infringes on third-party rights, please contact [email protected] for removal. MEXC makes no guarantees regarding the accuracy, completeness, or timeliness of the content and is not responsible for any actions taken based on the information provided. The content does not constitute financial, legal, or other professional advice, nor should it be considered a recommendation or endorsement by MEXC.

You May Also Like

Cashing In On University Patents Means Giving Up On Our Innovation Future

The post Cashing In On University Patents Means Giving Up On Our Innovation Future appeared on BitcoinEthereumNews.com. “It’s a raid on American innovation that would deliver pennies to the Treasury while kneecapping the very engine of our economic and medical progress,” writes Pipes. Getty Images Washington is addicted to taxing success. Now, Commerce Secretary Howard Lutnick is floating a plan to skim half the patent earnings from inventions developed at universities with federal funding. It’s being sold as a way to shore up programs like Social Security. In reality, it’s a raid on American innovation that would deliver pennies to the Treasury while kneecapping the very engine of our economic and medical progress. Yes, taxpayer dollars support early-stage research. But the real payoff comes later—in the jobs created, cures discovered, and industries launched when universities and private industry turn those discoveries into real products. By comparison, the sums at stake in patent licensing are trivial. Universities collectively earn only about $3.6 billion annually in patent income—less than the federal government spends on Social Security in a single day. Even confiscating half would barely register against a $6 trillion federal budget. And yet the damage from such a policy would be anything but trivial. The true return on taxpayer investment isn’t in licensing checks sent to Washington, but in the downstream economic activity that federally supported research unleashes. Thanks to the bipartisan Bayh-Dole Act of 1980, universities and private industry have powerful incentives to translate early-stage discoveries into real-world products. Before Bayh-Dole, the government hoarded patents from federally funded research, and fewer than 5% were ever licensed. Once universities could own and license their own inventions, innovation exploded. The result has been one of the best returns on investment in government history. Since 1996, university research has added nearly $2 trillion to U.S. industrial output, supported 6.5 million jobs, and launched more than 19,000 startups. Those companies pay…

Share

BitcoinEthereumNews2025/09/18 03:26

CME to launch Solana and XRP futures options on October 13, 2025

The post CME to launch Solana and XRP futures options on October 13, 2025 appeared on BitcoinEthereumNews.com. Key Takeaways CME Group will launch futures options for Solana (SOL) and XRP. The launch date is set for October 13, 2025. CME Group will launch futures options for Solana and XRP on October 13, 2025. The Chicago-based derivatives exchange will add the new crypto derivatives products to its existing digital asset offerings. The launch will provide institutional and retail traders with additional tools to hedge positions and speculate on price movements for both digital assets. The futures options will be based on CME’s existing Solana and XRP futures contracts. Trading will be conducted through CME Globex, the exchange’s electronic trading platform. Source: https://cryptobriefing.com/cme-solana-xrp-futures-options-launch-2025/

Share

BitcoinEthereumNews2025/09/18 01:07

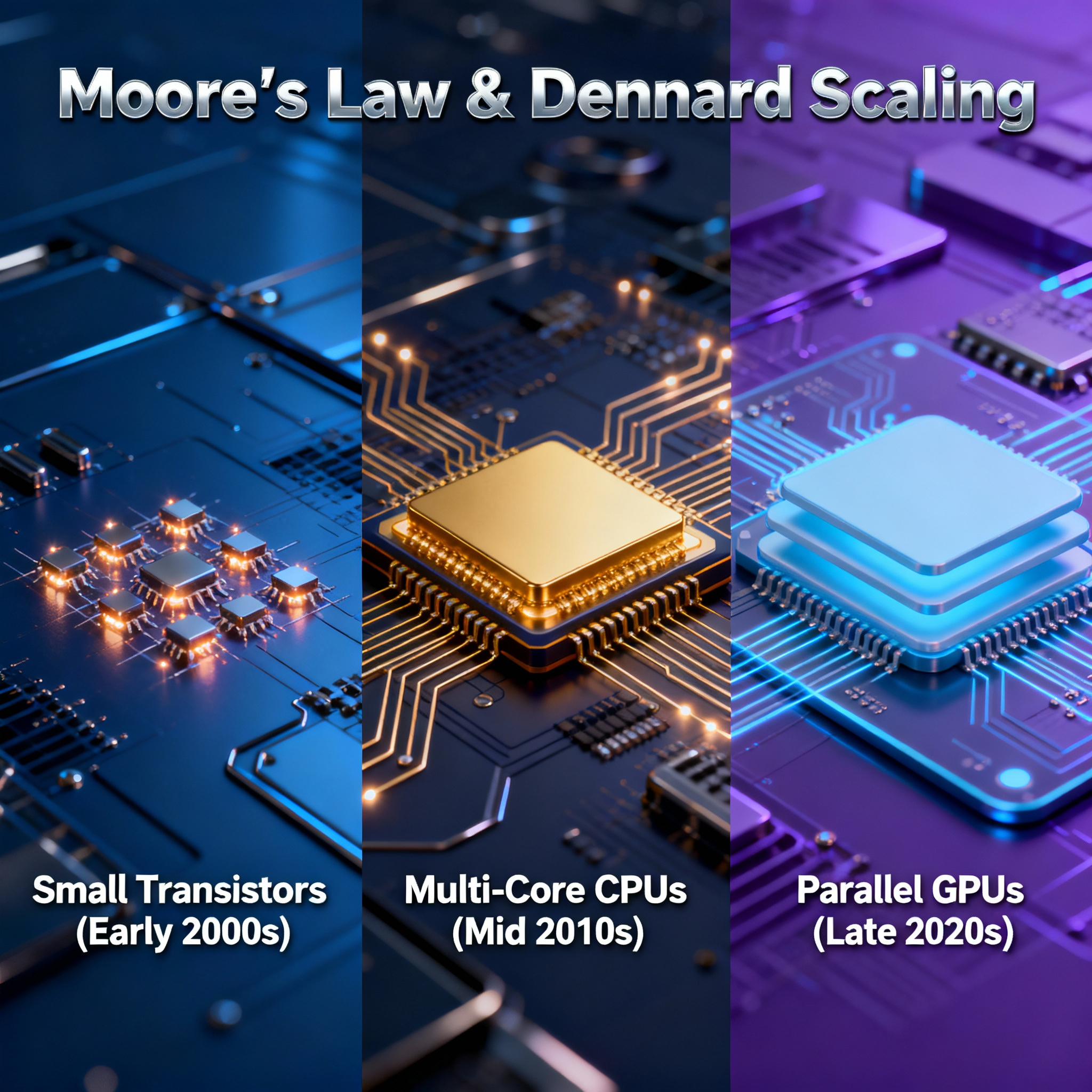

Why Machine Learning Loves GPUs: Moore’s Law, Dennard Scaling, and the Rise of CUDA & HIP

Moore’s Law and Dennard Scaling drove explosive growth in computing power. But in the early 2000s, things hit a wall when transistors became so tiny. Multi-Core Processors let chip work on multiple tasks at once. This led to the rise of GPUs, which are built to handle thousands of tasks in parallel.

Share

Hackernoon2025/11/06 14:11