World Still Not Off the Hook: Thai SEC Raids Iris Scanning Hub Over WLD Token Breach

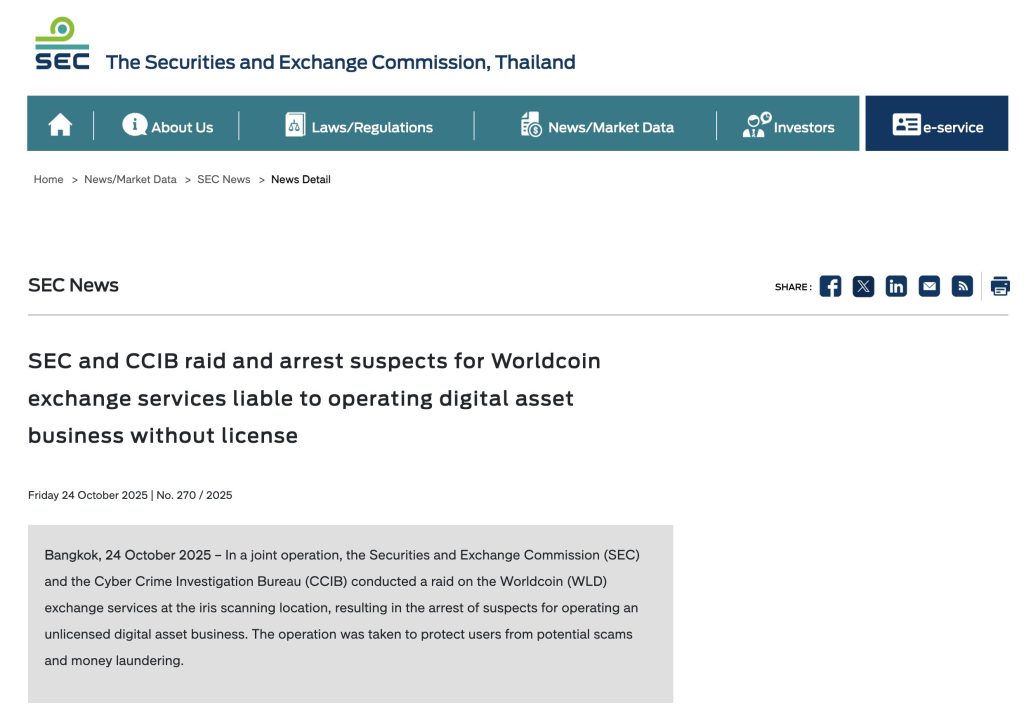

Thailand’s Securities and Exchange Commission (SEC) and the Cyber Crime Investigation Bureau (CCIB) have raided a Worldcoin-linked iris scanning center in Bangkok, arresting suspects accused of running an unlicensed digital asset exchange.

The joint operation, announced Friday, is part of Thailand’s growing crackdown on unregulated crypto services amid global scrutiny of Worldcoin’s controversial biometric identity system.

Has Worldcoin Crossed the Line in Thailand’s Crypto Crackdown?

Source: Thailand SEC

Source: Thailand SEC

According to the SEC’s statement, investigators discovered that the iris scanning hub was providing “WLD exchange services” without the required authorization under the Emergency Decree on Digital Asset Businesses B.E. 2561 (2018).

The operators were allegedly facilitating token exchanges linked to Worldcoin’s native cryptocurrency, WLD, in violation of licensing laws.

The SEC said the arrests were made under Section 26 of the decree, which prohibits the operation of digital asset businesses without a license, with penalties prescribed under Section 66.

The law enforcement officials said the move was intended to protect users from potential scams and prevent money laundering through unregulated crypto exchanges.

At the joint press briefing, SEC Deputy Secretary-General Jomkwan Kongsakul said the operation marks a broader effort to tighten oversight of unlicensed digital asset activity.

“This collaboration will enhance the effectiveness of law enforcement in prosecuting and suppressing unlicensed digital asset businesses, while protecting users from a lack of legal protection and mitigating risks of scams and money laundering,” she stated.

The raid followed weeks of surveillance by the SEC’s monitoring unit, which has been tracking several unlicensed operators across Thailand.

The agency had previously issued public warnings against exchanging WLD tokens with unlicensed providers and urged the public to verify operator licenses through the official SEC website and its Check First application.

Officials reiterated that users dealing with unauthorized operators are not covered by legal protection and face high risks of fraud and data misuse.

Worldcoin Faces Mounting Global Scrutiny as Thailand Joins Enforcement Wave

Worldcoin, now rebranded as World Network, was launched in 2023 by OpenAI CEO Sam Altman and Alex Blania as a biometric identity verification project that rewards users with WLD tokens for verifying their “humanness” through iris scans.

The verification process, carried out using a chrome sphere device known as the Orb, captures iris images to generate a unique digital ID, or World ID.

The platform operates over 1,100 Orb devices globally, including more than 100 locations across Thailand.

Users receive WLD tokens after completing verification, which they can exchange through the World App.

According to the World website, it only issues WLD tokens to users who complete verification in regions where such activity is legally permitted.

The project notes that eligibility for token distribution depends on several factors, including location and age restrictions.

However, some local sites have reportedly gone further, providing token exchange services without the necessary licenses, an activity now under investigation.

Thailand’s enforcement action places it among a growing list of countries confronting Worldcoin’s practices.

Regulators in Spain, Portugal, Brazil, and Kenya have suspended or restricted the project’s operations, citing violations of data protection laws and concerns about the handling of sensitive biometric information.

In Kenya, a High Court ruling in May ordered the deletion of all biometric data collected from citizens, describing Worldcoin’s consent practices as “invalid” due to monetary inducements.

European regulators have also intervened. Portugal’s data protection commission followed with a 90-day ban, while Germany imposed corrective measures to bring the project in line with EU privacy regulations under the General Data Protection Regulation (GDPR).

In Brazil, authorities banned the exchange of biometric data for crypto rewards in early 2024, ruling that such incentives compromise users’ ability to give free and informed consent.

Also, France, Portugal, Spain, Hong Kong, and South Korea have all launched investigations into the project’s data practices.

Worldcoin Rolls Out New Security and ID Tools—But Can It Regain Confidence?

Worldcoin’s parent company, Tools for Humanity, has responded by developing a new Secure Multi-Party Computation (SMPC) system in 2024 that splits and encrypts iris data across multiple storage points.

In October 2024, the project also unveiled a redesigned version of its Orb device that integrates 5G connectivity and enhanced AI processing powered by NVIDIA’s Jetson chipset.

It also features 30% fewer parts and a removable SD card for inspection, a change intended to improve transparency and address privacy concerns.

To reduce reliance on biometric verification, World Network introduced a non-biometric option that allows users to verify identity using passports with NFC, confirming details like nationality and age without sharing personal data.

The company claims the system eliminates the risk of decryption from a single source and says old iris codes are being deleted as part of a privacy upgrade.

Despite growing regulatory resistance, Worldcoin’s global presence continues to expand. The project recently launched its World ID service in the United States and the Philippines; currently, it has now surpassed 100 million verifications across 160 countries.

The World App now counts more than 37 million users, with over 1,000 Orb devices active worldwide.

Still, Worldcoin’s token has struggled to maintain market confidence amid ongoing legal challenges. WLD, which once traded as high as $11.74 in March 2024, currently hovers around $0.88, down over 90% from its peak.

You May Also Like

UK FCA Plans to Waive Some Rules for Crypto Companies: FT

Singapore’s central bank flags ‘stretched valuations’ in tech and AI stocks