BestChange Review: A Practical Tool for Finding Safe and Fair Crypto Exchange Rates

One of the biggest challenges for crypto users today isn’t choosing a coin—it’s figuring out where to exchange it safely. With regulations tightening, P2P markets shrinking, and scams increasing, users often struggle to identify reputable exchangers or competitive rates. BestChange offers a solution to this growing problem.

Established in 2007 and now operating internationally from the UAE, BestChange serves as a trusted aggregator of verified exchangers, giving users a cleaner, safer way to compare thousands of exchange offers before making a move.

All exchanger rates in one place

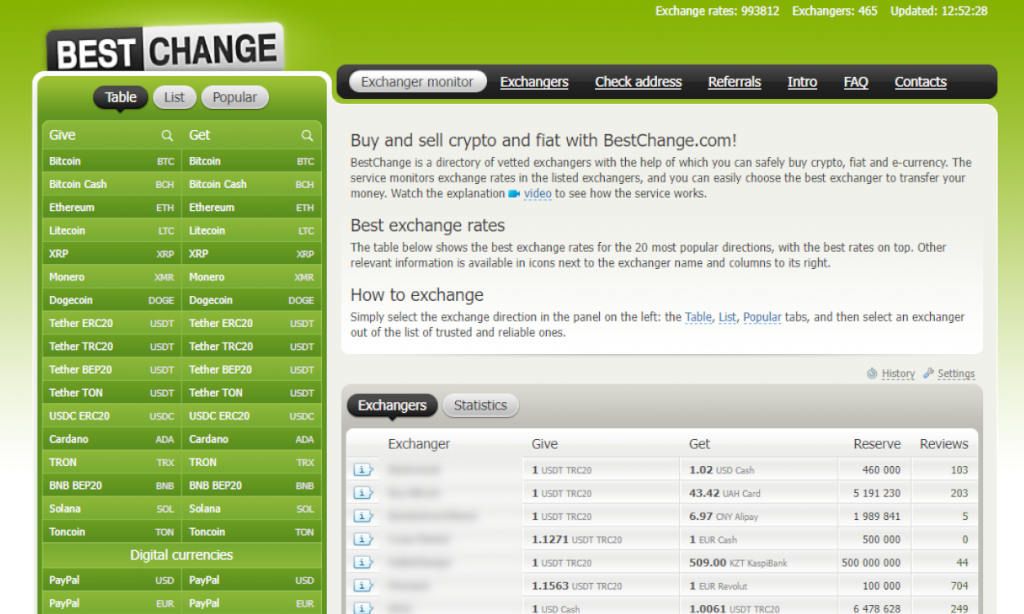

BestChange operates in a way that is different from centralized exchanges. It doesn’t process transactions, hold user funds, or act as a middleman. Instead, it functions as a comparison dashboard where users can instantly scan exchange offers from more than 440 approved exchangers.

Here’s how it works in practice:

- Choose the currency you want to give and receive.

- View a real-time list of exchange offers showing rates, fees, reserves, and limits.

- Check feedback from previous users.

- Go directly to the exchanger’s website to complete the transaction.

The data refreshes automatically every 15 seconds, which is especially useful for users dealing with fast-moving crypto prices.

What makes BestChange useful?

Clear information upfront

BestChange highlights rates, fees, minimums, maximums, and available reserves before you proceed—eliminating the guesswork that often leads to poor trading outcomes.

Verified and moderated exchangers

Each exchanger undergoes manual vetting, ongoing monitoring, and a public rating process supported by over a million user reviews. This gives users an added sense of security when comparing options.

Tools that help users save time

BestChange includes a range of supportive features, which provide both beginners and experienced users with a smoother experience:

- A currency converter that helps users estimate exchange amounts before choosing an exchanger

- Rate alerts (email or Telegram)

- Reserve alerts

- Double-exchange suggestions (useful when direct routes are unavailable or expensive)

- A detailed FAQ and 24/7 support team

Comparing rates the smart way

Before discovering BestChange, many users relied on scattered and unreliable methods to find exchangers. They move between random Google results, outdated forum threads, and unverified suggestions in Telegram or P2P groups, often searching for something like “how to convert crypto and transfer it to my bank account ” and hoping the sites they find are legitimate. With no central place to compare rates, reserves, or real client feedback, even experienced users risk wasting time or falling for misleading offers.

BestChange simplifies this entire process. Users select the currency they have and the currency they want to receive, instantly see a list of vetted exchangers with the best available rates, and review important details such as fees, limits, reserve amounts, verification requirements, and user ratings. From there, they choose a trusted exchanger and complete the transaction on its website.

If no exchanger has enough reserve or if the desired rate is not available yet, users can set a notification. BestChange monitors the market automatically and alerts them the moment conditions match their preferences.

Security and compliance practices

BestChange operates under Agretis Software Design LLC in Dubai and follows international AML/KYC guidelines. Even though the platform never holds user funds, it still prioritizes safety through:

- SSL encryption

- DDoS protection

- Multi-factor authentication

- Strict exchanger onboarding and moderation

- A built-in AML Analyzer for checking the risk score of crypto addresses

The aggregator model itself reduces exposure because all transactions happen directly between the user and the exchanger.

Why BestChange matters in 2025

As account freezes, increased KYC requirements, and exchange restrictions become more common, users need alternatives for:

- Buying crypto without high custodial fees

- Cashing out earnings

- Moving assets across payment systems

- Avoiding unsafe P2P deals

- Finding exchangers that still operate in certain regions

BestChange fills that gap by giving users a transparent, global, and non-custodial way to find legitimate exchange services.

Final thoughts

BestChange is not a trading app or a wallet—it’s a research and comparison tool designed to make crypto exchanges safer and more accessible. Whether someone is a beginner trying to buy their first crypto, a freelancer looking for fast withdrawals, or an arbitrage trader moving liquidity across markets, BestChange offers a structured way to shop around without getting blindsided by bad actors or hidden fees.

Its longevity, manual moderation process, and user-friendly interface make it a helpful resource in today’s increasingly fragmented crypto environment.

Ayrıca Şunları da Beğenebilirsiniz

What We Know (and Don’t) About Modern Code Reviews

X claims the right to share your private AI chats with everyone under new rules – no opt out