Solana Price Depends On Existing SOL Holders, Here’s Why

Solana has struggled to recover after a recent price decline, with SOL remaining capped below the $130 resistance. The altcoin has shown attempts to stabilize, yet momentum remains fragile.

Unlike previous rallies driven by new inflows, the next move appears dependent on existing Solana holders rather than fresh market entrants.

Some Solana Holders Show Resilience

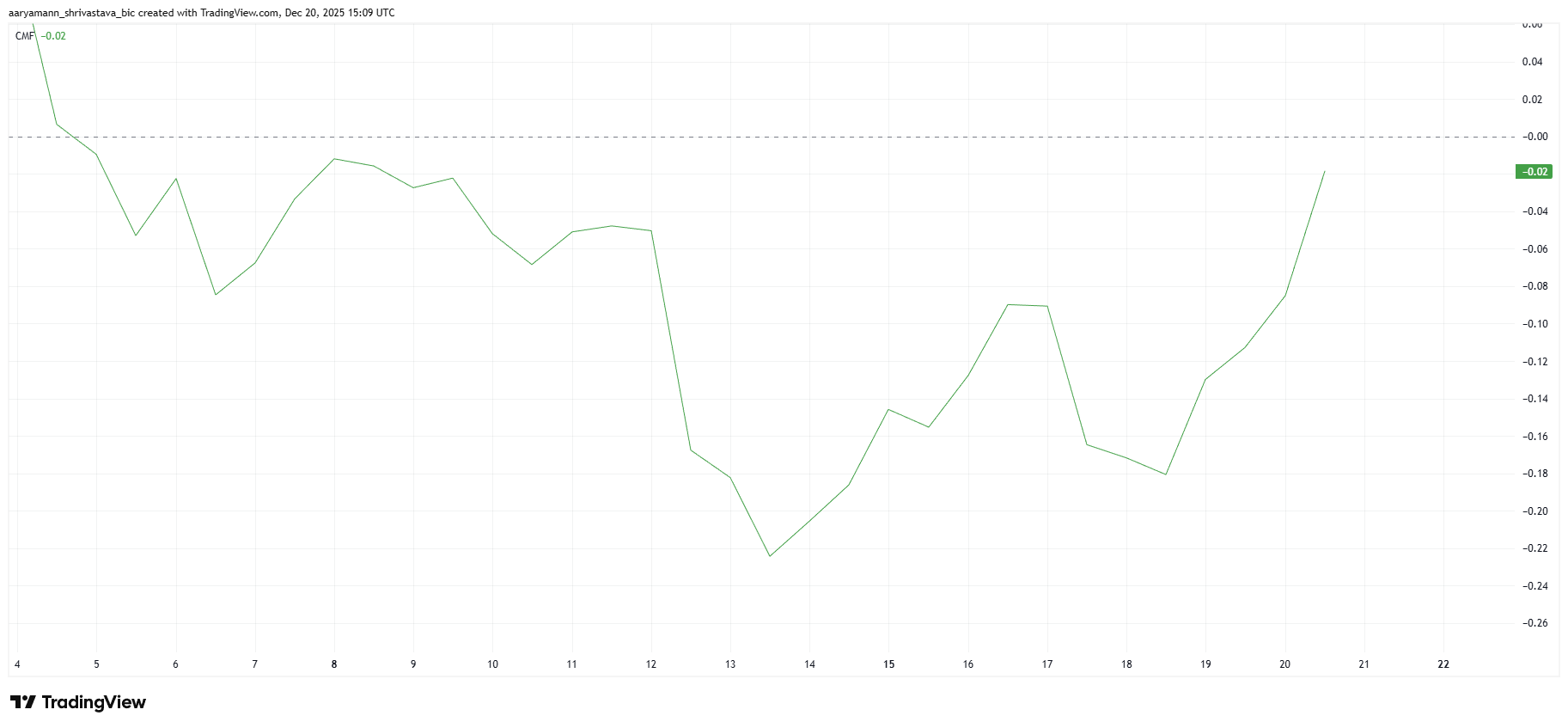

On-chain data shows early signs of stabilization. The Chaikin Money Flow has posted a sharp uptick over the past few days. Although the indicator remains below the zero line, the upward movement suggests that capital outflows are slowing.

This shift is critical for Solana’s recovery outlook. Declining outflows often precede a transition toward inflows. Once buying pressure outweighs selling, SOL price can respond quickly. Sustained improvement in CMF would signal returning confidence among current holders.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Solana CMF. Source: TradingView

Solana CMF. Source: TradingView

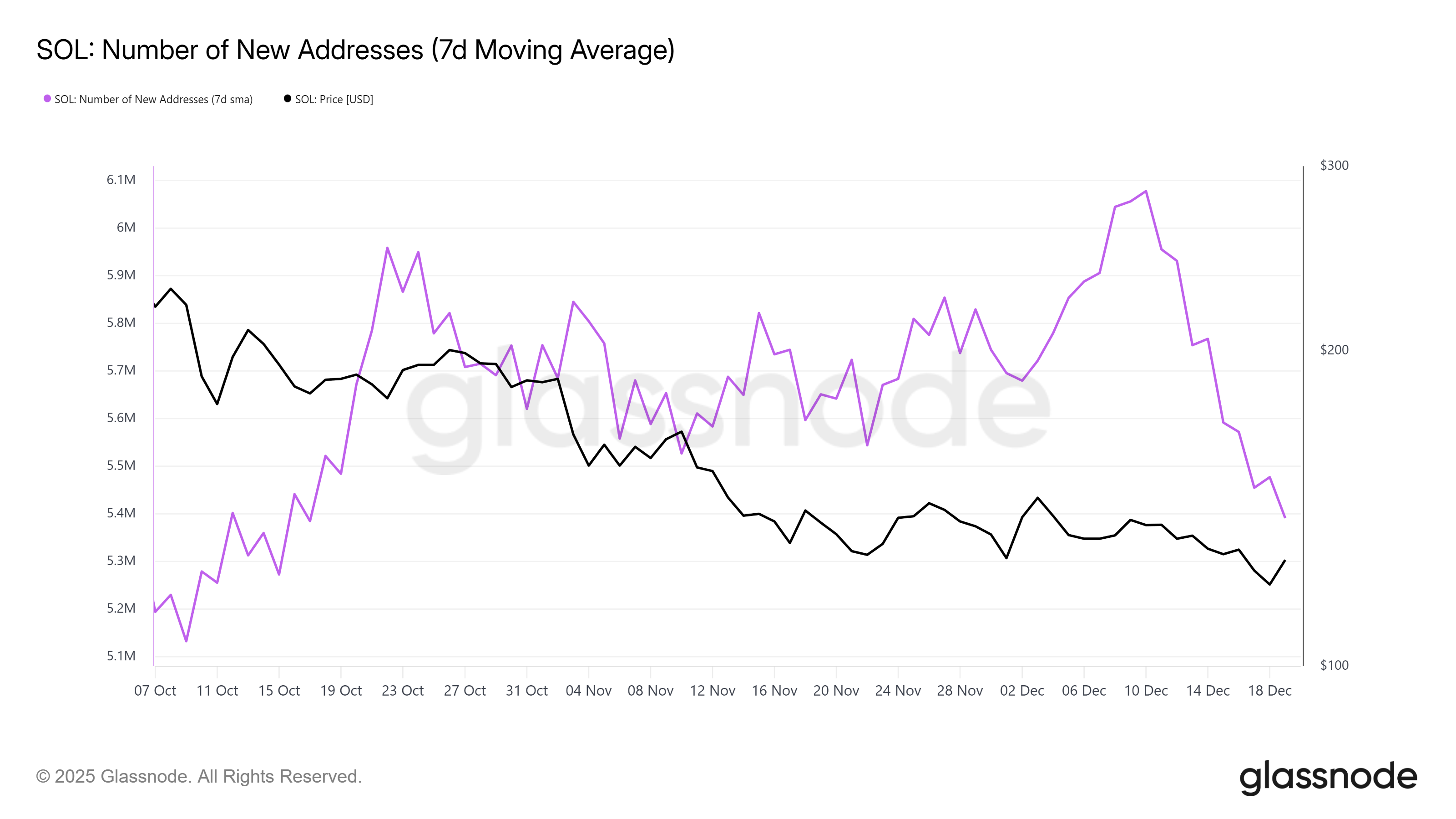

Macro indicators present a more cautious picture. The number of new Solana addresses has dropped sharply in recent sessions. New addresses declined from 6.077 million to 5.390 million, an 11.3% decrease over ten days.

Falling network participation suggests weaker speculative interest. New investors appear hesitant, citing limited short-term incentives. This lack of fresh demand places greater importance on existing holders to support price stability and any recovery attempt.

Solana New Addresses. Source: Glassnode

Solana New Addresses. Source: Glassnode

SOL Price Recovery Is Possible

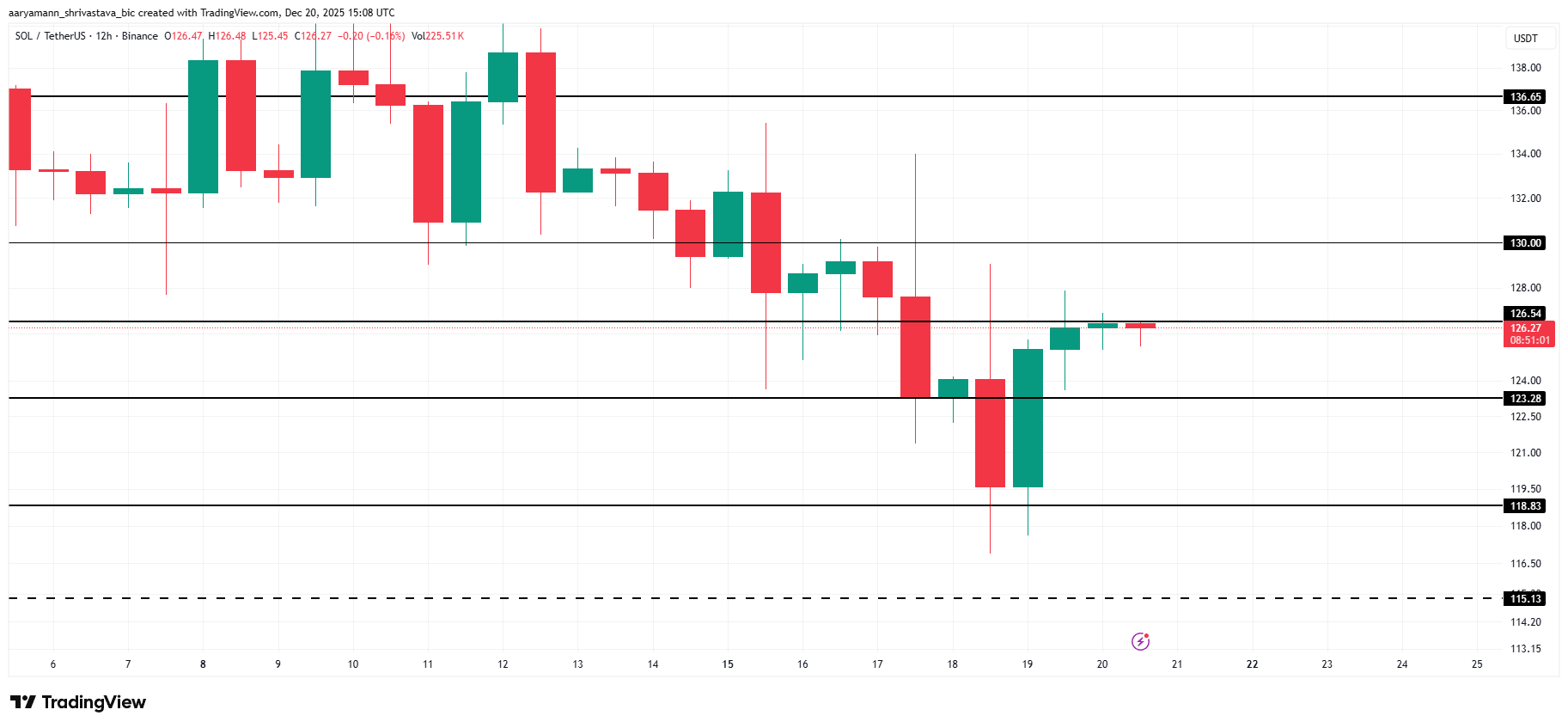

Solana trades near $126 at the time of writing, remaining below the $130 resistance level. Price action shows consolidation rather than a breakout. The immediate goal for SOL is reclaiming $130, which would mark a shift in short-term momentum.

Declining outflows improve the probability of a rebound. If current holders maintain accumulation and inflows emerge, buying pressure could lift SOL toward $130. A sustained move above this level would require consistent support rather than brief speculative spikes.

Solana Price Analysis. Source: TradingView

Solana Price Analysis. Source: TradingView

Downside risks persist if sentiment deteriorates. Renewed selling could push Solana below the $123 support. A breakdown at that level may expose $118 as the next downside target. Losing this support would invalidate the bullish outlook and reinforce short-term weakness.

Ayrıca Şunları da Beğenebilirsiniz

Elon Musk’s net worth hits record $749B after legal win restores massive Tesla compensation