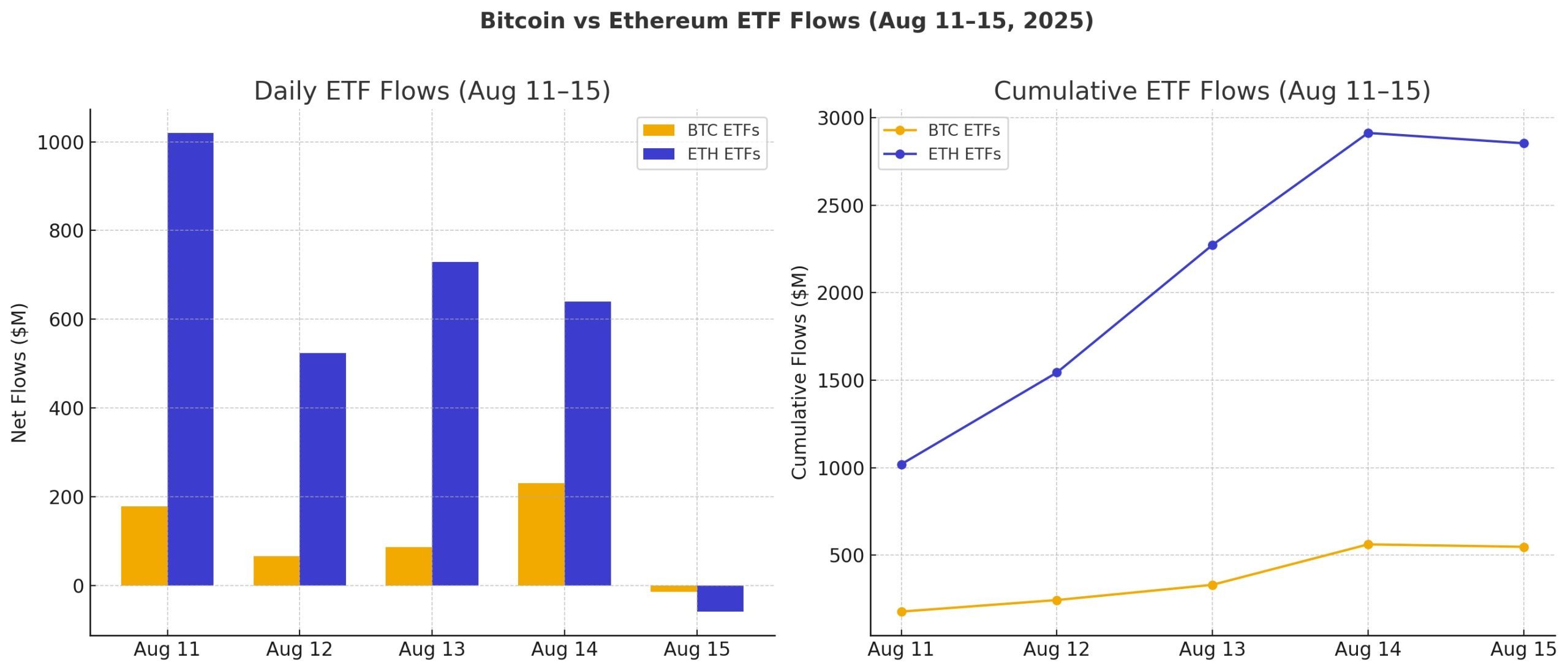

ETF Recap: Ether ETFs Deliver Blockbuster Week With $2.85 Billion as Bitcoin ETFs Trail Behind

Ether exchange-traded funds (ETFs) stole the spotlight last week with $2.85 billion in inflows, their strongest week on record. Bitcoin ETFs managed $548 million, extending their recovery but falling far short of ether’s dominance.

Crypto ETF Flows Diverge As Ether Shines and Bitcoin Lags

The week of Aug. 11–15 marked a turning point in the ETF race between bitcoin and ether. Investors poured billions into ether ETFs, dwarfing bitcoin’s steady but modest inflows, and signaling a shift in institutional sentiment.

Ether ETFs had an unprecedented week, locking in $2.85 billion in inflows. Blackrock’s ETHA led the charge with a stunning $2.32 billion, followed by Fidelity’s FETH at $361.23 million.

Grayscale’s Ether Mini Trust brought in $219.58 million, although its ETHE counterpart lost $71.57 million. Vaneck’s ETHV added $14.36 million, Franklin’s EZET brought in $8.48 million, Invesco’s QETH added $2.26 million, and 21shares’ CETH added $1.26 million.

On the other hand, bitcoin ETFs recorded a total $547.82 million inflow across the week. Blackrock’s IBIT carried the momentum with $887.82 million, while Grayscale’s Bitcoin Mini Trust picked up $32.97 million, along with Invesco’s BTCO adding $4.90 million.

Despite the net positive for the week, large redemptions were seen on Ark 21shares’ ARKB (-$183.92 million), Grayscale’s GBTC (-$95.96 million), Fidelity’s FBTC (-$73.78 million), Bitwise’s BITB (-$18.36 million), and Vaneck’s HODL (-$5.85 million).

The milestones were unmistakable: ether ETFs posted their largest single-day inflow ever on Aug. 11 ($1.02 billion), followed by their second-highest inflow on Aug. 13 ($729 million). By contrast, bitcoin ETFs never crossed the $500 million daily mark.

Trading volumes told the same story. Ether ETFs traded $14.1 billion across the week, while bitcoin ETFs saw $20.8 billion. Yet ether’s net assets jumped to $28.15 billion, now sitting at 5.3% of ethereum’s market cap.

The data makes one thing clear: institutional money is warming rapidly to ether ETFs, with bitcoin playing defense.

Ayrıca Şunları da Beğenebilirsiniz

Crypto Shows Mixed Reaction To Rate Cuts and Powell’s Speech

Vitalik Buterin Reveals Ethereum’s Long-Term Focus on Quantum Resistance