Trading time: Trump's approval rating hits 80-year low after 100 days in office, Bitcoin's whale selling pressure of $94,000 to $99,000 becomes the focus of the breakthrough

1. Market observation

Keywords: BONK, ETH, BTC

Trump will enter the first 100 days of his second term on April 29, but his approval rating continues to decline to 39%, the lowest 100-day approval rating of any president in the past 80 years. Polls show that 72% of Americans believe that his economic policies may trigger a short-term recession, 53% of respondents believe that the national economic situation has deteriorated, and 41% feel that their personal financial situation is under pressure. The Trump administration's protectionist policies and tariff measures have exacerbated market volatility. The S&P 500 index has fallen by about 8% since his inauguration, the worst 100-day performance since 1974; the US dollar index has plummeted by 9% during the same period, the weakest start since the Nixon era, and funds have accelerated to gold and non-US assets. At the same time, the Federal Reserve is caught in a policy dilemma due to the coexistence of inflationary pressure and economic recession risks, and the room for interest rate cuts is limited. In addition, Trump's remarks on the intervention of the central bank's independence have further weakened market confidence. Wall Street strategists generally recommend reducing holdings of US stocks and US dollar assets on rallies. Bank of America emphasizes that global capital allocation is shifting from "American exceptionalism" to diversified layout, and gold and emerging markets have become the preferred safe havens.

Bitcoin recently broke through the key resistance level of $95,000, running steadily above the 21-week moving average, and also stood firm at the 23.6% Fibonacci retracement level of $87,045, providing a clear stop-loss reference for bulls. Although Bitcoin only recorded a 43.4% increase after the halving in April 2024, which is significantly weaker than the historical cycle performance, the strengthening of gold and the diversification trend of US dollar assets still give it long-term allocation value. Crypto analyst Willy Woo believes that the acceleration of on-chain capital inflows lays the foundation for breaking through historical highs, and the medium-term target points to the range of $103,000 to $108,000. Citibank predicts that if the stablecoin market size grows to $1.6 trillion according to the baseline scenario, the price of Bitcoin may reach $285,000 in 2030, and even $475,000 in an optimistic scenario. Even under conservative assumptions, the price may double to more than $190,000. However, analyst Ali warned that Bitcoin faces selling pressure of 1.76 million BTC from 2.61 million wallet addresses in the range of $94,125-99,150, and it is still necessary to be vigilant about fluctuations during periods of weak market liquidity.

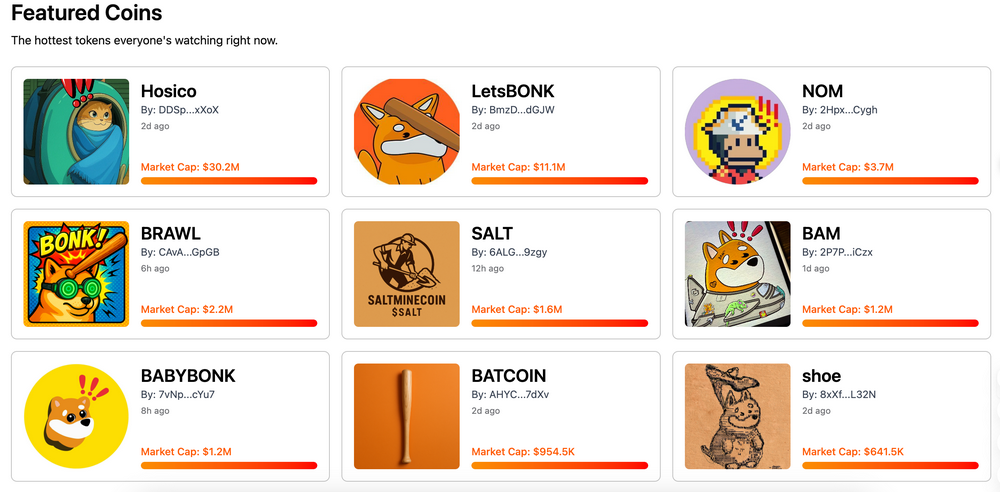

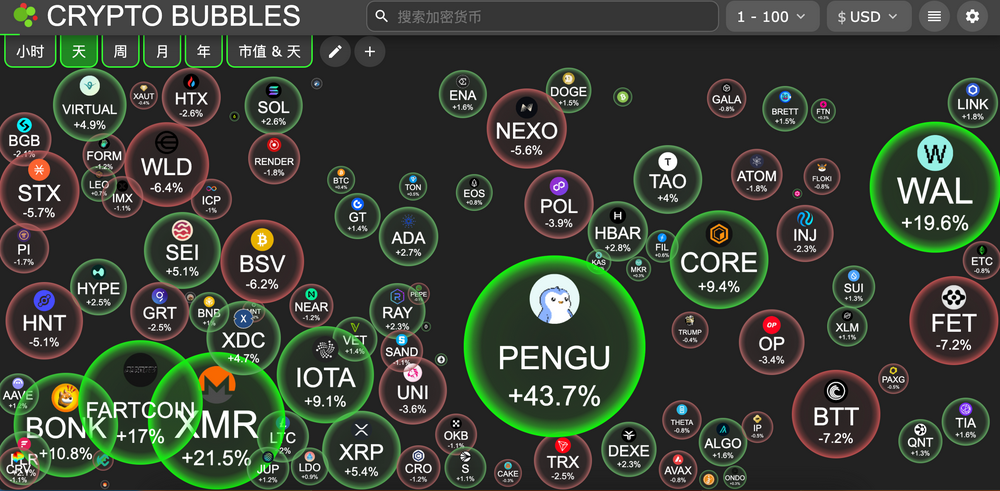

Sui's ecological popularity continues unabated. Its token SUI will unlock 74 million (accounting for 2.28% of the circulation) on May 1, worth about $267 million. Its ecological projects DeepBook, MemeFi, and Walrus have also seen significant increases recently, and Binance Alpha will also launch its ecological project Haedal Protocol on April 29. At present, SOL is still hovering around $150. The ecological project PENGU has risen rapidly in the past week, more than doubling. The new MEME token HOUSE has recently briefly exceeded the market value of $78 million and has now fallen back to around $67 million. In addition, the leading Meme project BONK announced yesterday the launch of the Meme coin issuance platform Letsbonk.Fun jointly developed with Raydium. Currently, many million-dollar projects have emerged, including Hosico, LetsBONK, and NOM.

2. Key data (as of 12:00 HKT on April 28)

(Data sources: Coinglass, Upbit, Coingecko, SoSoValue, Tomars, GMGN, Letsbonk.Fun)

-

Bitcoin: $94,179.39 (+0.5% YTD), daily spot volume $17.72 billion

-

Ethereum: $1,794.82 (-46.15% YTD), with daily spot volume of $9.749 billion

-

Fear of corruption index: 54 (neutral)

-

Average GAS: BTC 1 sat/vB, ETH 0.4 Gwei

-

Market share: BTC 63.3%, ETH 7.3%

-

Upbit 24-hour trading volume ranking: XRP, DEEP, TRUMP, JST, WAL

-

24-hour BTC long-short ratio: 1.0153

-

Sector gains and losses: NFT sector rose 7.2%, PayFI sector rose 5.78%

-

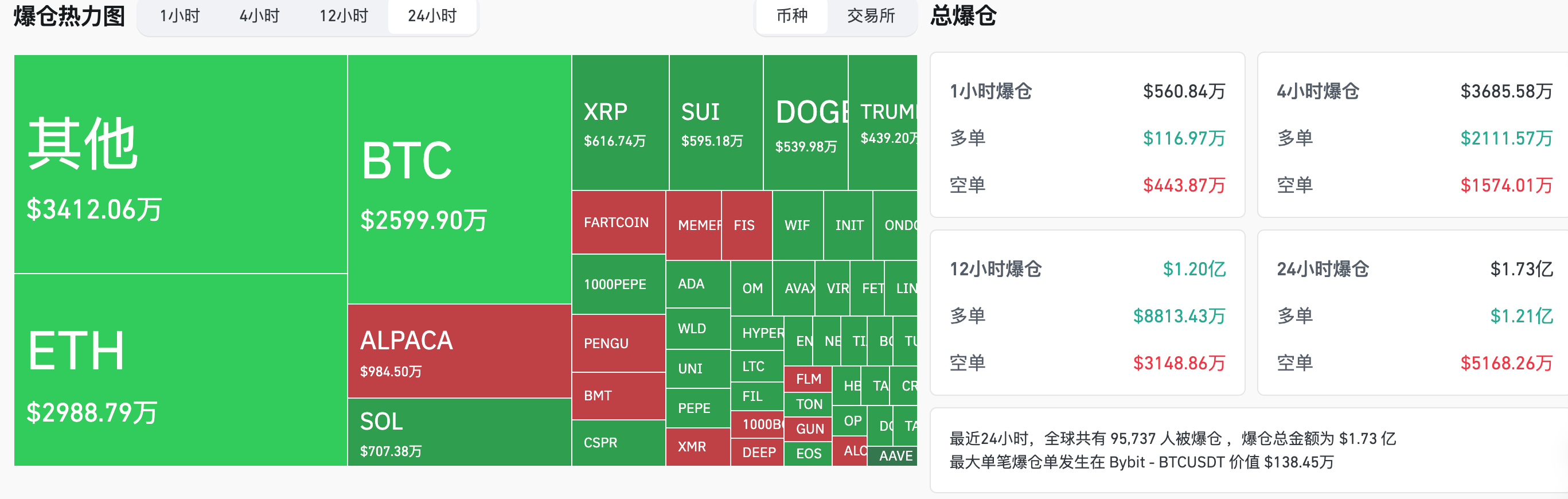

24-hour liquidation data: A total of 95,737 people were liquidated worldwide, with a total liquidation amount of US$173 million, including BTC liquidation of US$25.99 million, ETH liquidation of US$29.88 million, and ALPACA liquidation of US$9.84 million

-

BTC medium- and long-term trend channel: upper channel line ($90,816.14), lower channel line ($89,017.80)

-

ETH medium and long-term trend channel: upper channel line ($1733.27), lower channel line ($1698.95)

*Note: When the price is higher than the upper and lower edges, it is a medium- to long-term bullish trend; otherwise, it is a bearish trend. When the price passes through the cost range repeatedly within the range or in the short term, it is a bottoming or topping state.

3. ETF flows (April 21 to April 25)

-

Bitcoin ETF: $3.06 billion (second highest inflow in history)

-

Ethereum ETF: $157 million (ended 8 weeks of net outflows)

4. Today’s Outlook

-

Arizona's two bitcoin reserve laws to receive third reading on Monday, with a possible final vote

-

MANTRA plans to destroy 150 million OM tokens from the team token allocation on April 29. These tokens will be released from the pledge period today.

-

Binance Alpha to List Haedal Protocol (HAEDAL) on April 29

-

Frax Finance will undergo North Star upgrade on April 29, Frax Share will be renamed Frax and used as gas token

-

Ouyi will delist five spot trading pairs including KISHU and MAX on April 29

The biggest increases in the top 500 by market value today : CSPR up 63.43%, UNP up 52.19%, PENGU up 44.23%, XMR up 22.61%, and FWOG up 18.87%.

5. Hot News

-

Preview of this week | Trump's second son Eric Trump attends TOKEN 2049 Dubai; Arizona's two Bitcoin reserve bills may be voted on

-

Data: SUI, OMNI, OP and other tokens will usher in large amounts of unlocking, of which SUI unlocking value is about 267 million US dollars

-

This week's macro outlook: Super data week is coming, non-agricultural and PCE will follow

-

Grayscale GBTC's implied annual revenue exceeds $268 million, surpassing the sum of all other Bitcoin ETFs

-

A whale holding 1.32 million SOL deposited 35,000 SOL into Binance, worth about $5.07 million

-

Ethereum Foundation researcher proposes to increase Ethereum gas limit 100 times in 4 years

-

ALPACA fell more than 50% in the early hours of this morning and is now trading at $0.1763

-

Binance Alpha to List Haedal Protocol (HAEDAL) on April 29

-

Report: 45.4% of South Korean investors are optimistic that BTC will outperform gold in the next 6 months

-

Binance TRUMP spot trading volume increased by 202% month-on-month in 9 days, and the price of the currency increased by 94.6% in 9 days

-

A whale that had staked for more than 2 years unstaked 17,481 SOL and transferred most of them to Kraken

-

BONK launches Meme coin issuance platform Letsbonk.Fun

-

Market News: IMF says El Salvador has stopped using public funds to invest in Bitcoin

-

Analysis: Bitcoin has only risen 43.4% since its fourth halving, far lower than the market performance after the previous three halvings

-

Analysis: BTC could rise to $285,000 by 2030 if Citigroup predicts a surge in stablecoin supply

-

Crypto Advocates Call on Swiss National Bank to Add Bitcoin to Reserve Assets

You May Also Like

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council

BlackRock boosts AI and US equity exposure in $185 billion models