Trump’s meme coin crypto marketing script, a presidential dinner he may not attend?

Author: Weilin, PANews

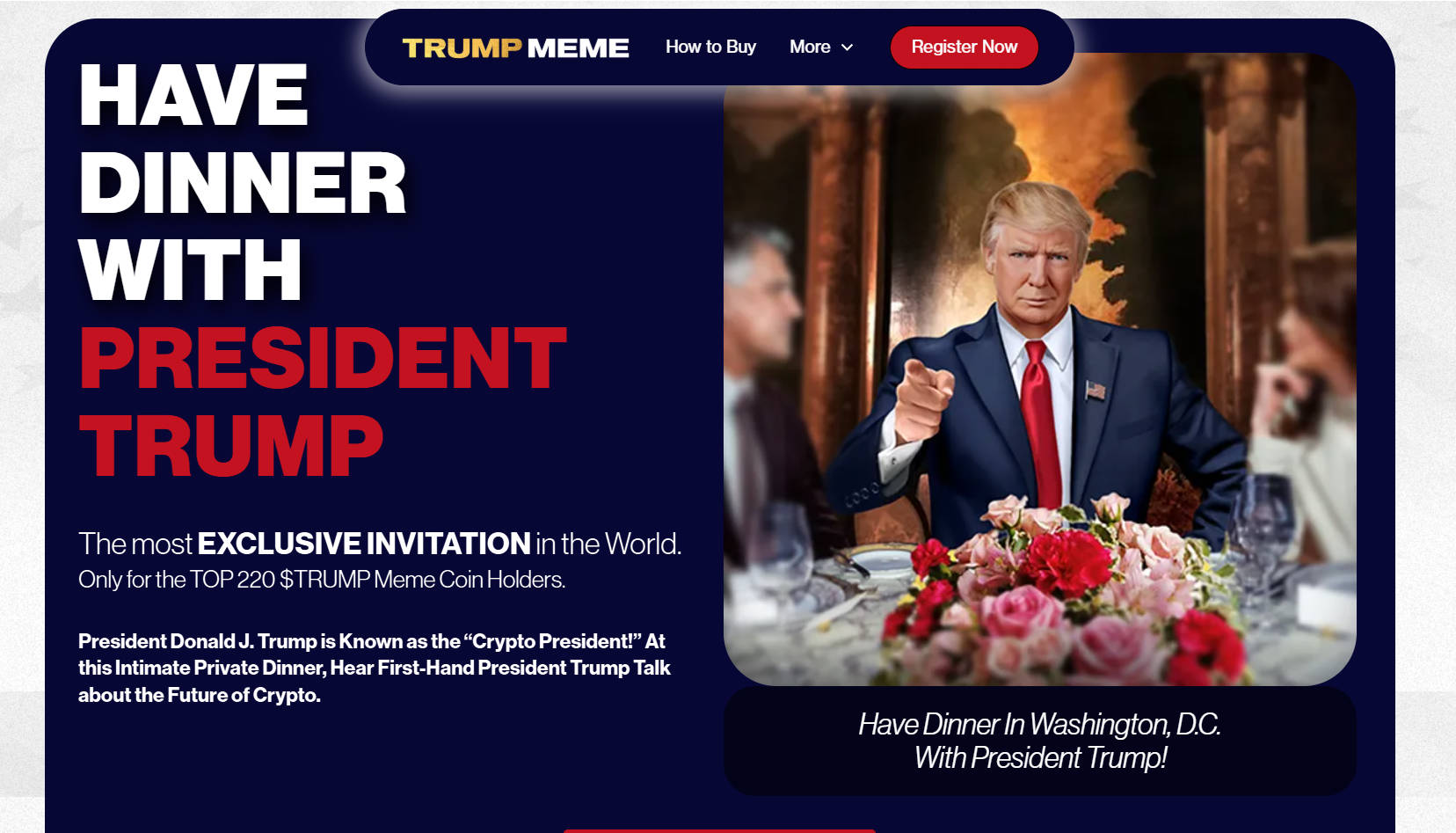

Trump, who issued the MEME coin, seems to understand the marketing "routines" of the crypto industry. On April 23, the meme coin project $TRUMP launched by US President Trump officially announced an "exclusive benefit": a "chance to have dinner with Trump" will be held for the first 220 token holders. According to the official website, this grand party is scheduled to be held at the Trump Golf Club in Washington on May 22 this year. The slogan is very contagious, calling the event "the most exclusive invitation in the world."

With the announcement of the news, the price of TRUMP coin has risen rapidly in the short term, but behind this rising phenomenon, $TRUMP has just experienced unlocking, and there is also a familiar "script" hidden in the recent period - unlocking, pumping, shipping, supplemented by a narrative of a "presidential dinner". Is this dinner a sincere return to crypto holders, or a marketing campaign planned to pump up the price?

The recent unlocking of $TRUMP has brought selling pressure. Is Trump’s team using the cryptocurrency strategy to “push up and sell”?

Whether it is the previously launched "Trump headshot" NFT series, Bitcoin-themed customized sports shoes, or the encryption project WLFI in which family members participated, the Trump team seems to be more familiar with the psychology of cryptocurrency users. The $TRUMP meme coin continues this strategy and throws out a "dinner invitation" at a critical moment.

The promotional page for the Trump dinner reads: It is "the most exclusive invitation in the world. Limited to the first 220 $TRUMP Meme coin holders. President Donald J. Trump is known as the 'Crypto President'! At this private dinner, you will have the opportunity to hear President Trump talk about his views on the future of cryptocurrency." What has aroused market enthusiasm even more is the additional benefits for the top 25 big holders: exclusive receptions and VIP itineraries.

In order to be eligible to participate, users must register and accept Leaderboard ranking based on "time-weighted holdings".

The dinner rumor first appeared on April 20, when the 4% unlocking period of TRUMP tokens was approaching, which caused investors to worry about increased selling pressure. However, driven by the news, market sentiment quickly reversed and the tokens stopped falling and rebounded.

On April 23, after the news of the dinner was officially announced, the price of TRUMP tokens rose significantly, from $9.35 to $16.7 at noon on April 24. At noon on April 25, its price fell back to around $12.06, an increase of 60.46% in 7 days.

Previously, the first vesting and unlocking of TRUMP tokens took effect on April 18, releasing 40 million tokens worth approximately US$309 million, a 90% drop from the token's highest point.

The operation of "favorable conditions and unlocking period" is very common in the currency circle. PANews recently sorted out the on-chain data and found that TRUMP's major holders have frequently changed hands in the past three months. Compared with the data on January 20, 86.9% of the top 1,000 major holders chose to liquidate tokens, totaling 48 million tokens, accounting for 24% of the total circulation. On April 18, 4% of TRUMP tokens were unlocked. But on April 20, news came out that Trump planned to hold a dinner for TRUMP token holders. Subsequently, TRUMP stopped falling and began to rebound. The dinner event happened to become a "new story."

What followed was more frequent on-chain activities, showing the FOMO sentiment of coin holders. On April 24, according to Lookonchain monitoring, a long-term $TRUMP liquidity provider withdrew liquidity from two wallets about 2 hours ago, and withdrew a total of 211,977 $TRUMP and 18,376 $SOL, both equivalent to approximately US$2.76 million. At that time, both wallets were among the top 220 $TRUMP holding addresses, and were expected to receive an invitation to Trump's dinner. The address initially purchased 332,000 $TRUMP at $2.41 on the first day of listing, and its market value once exceeded US$24 million.

On the same day, according to Arkham monitoring, a HTX cold wallet had registered for Trump's dinner event. This wallet held $14.6 million worth of TRUMP tokens, making it the wallet with the largest number of TRUMP tokens among all wallets registered for the dinner. It is worth mentioning that Justin Sun, a member of the HTX Global Advisory Committee, is an advisor to the Trump family project WLFI.

On April 25, the official clarification was that the participation threshold caused misunderstanding. The official TrumpMeme X account said that you do not need to hold more than $300,000 in $TRUMP tokens to participate. Participation qualifications are based on time-weighted holdings registered and on Leaderboard, not block browser rankings. Initial unlocking and daily unlocking tokens will still be locked for an additional 90 days to ensure fairness of the competition.

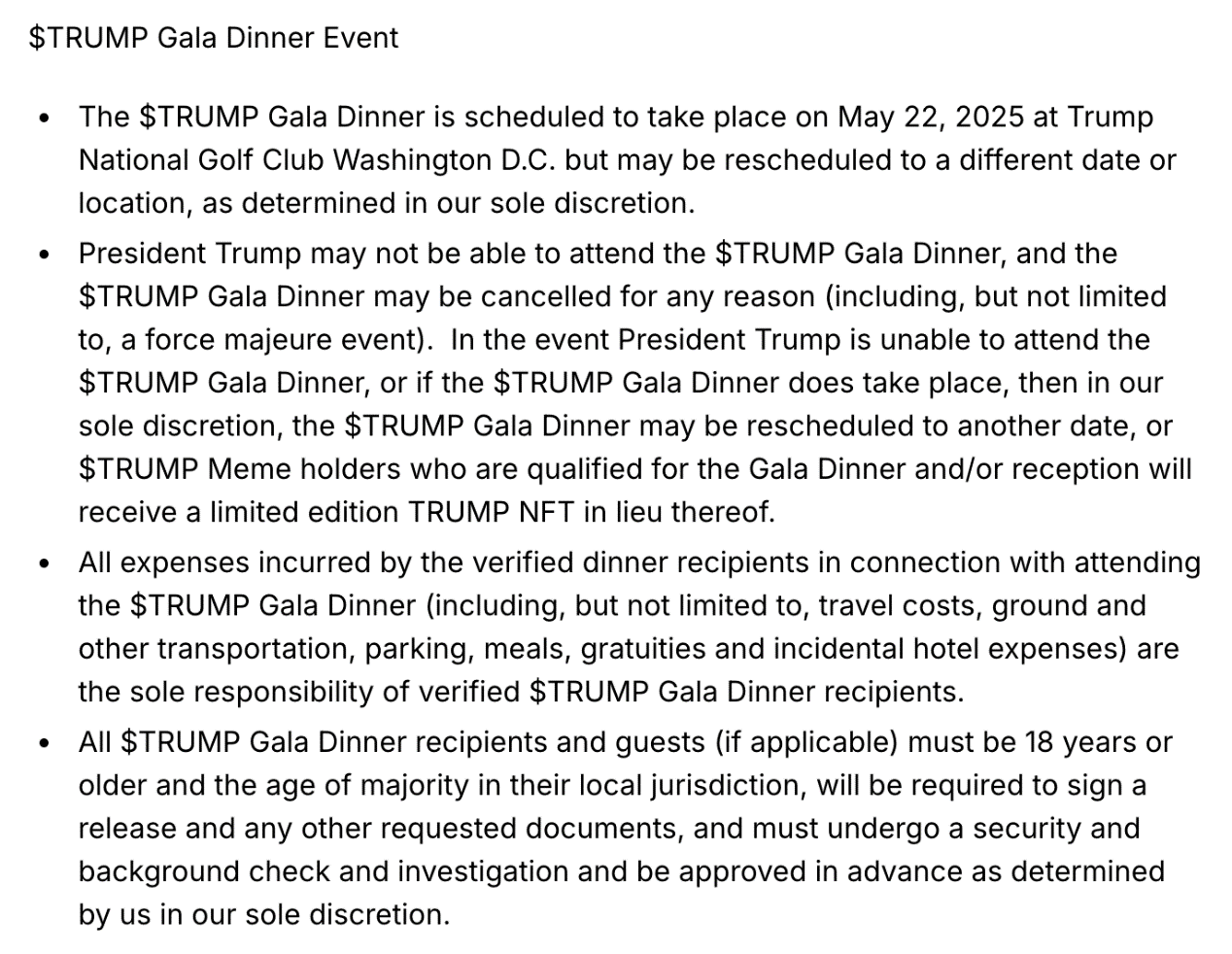

The dinner details show that Trump may not attend, and the dinner plan has been "dumped" many times before

It is worth noting that the official terms and conditions of the Trump Meme coin $TRUMP show that the organizers of the $TRUMP dinner reserve the right to change the time and location. President Trump may be absent. If the dinner is cancelled or he fails to attend, eligible $TRUMP holders will receive a limited edition NFT as a replacement. All participants must be over 18 years old and pass security and background checks, and the relevant travel and accommodation expenses must be borne by themselves.

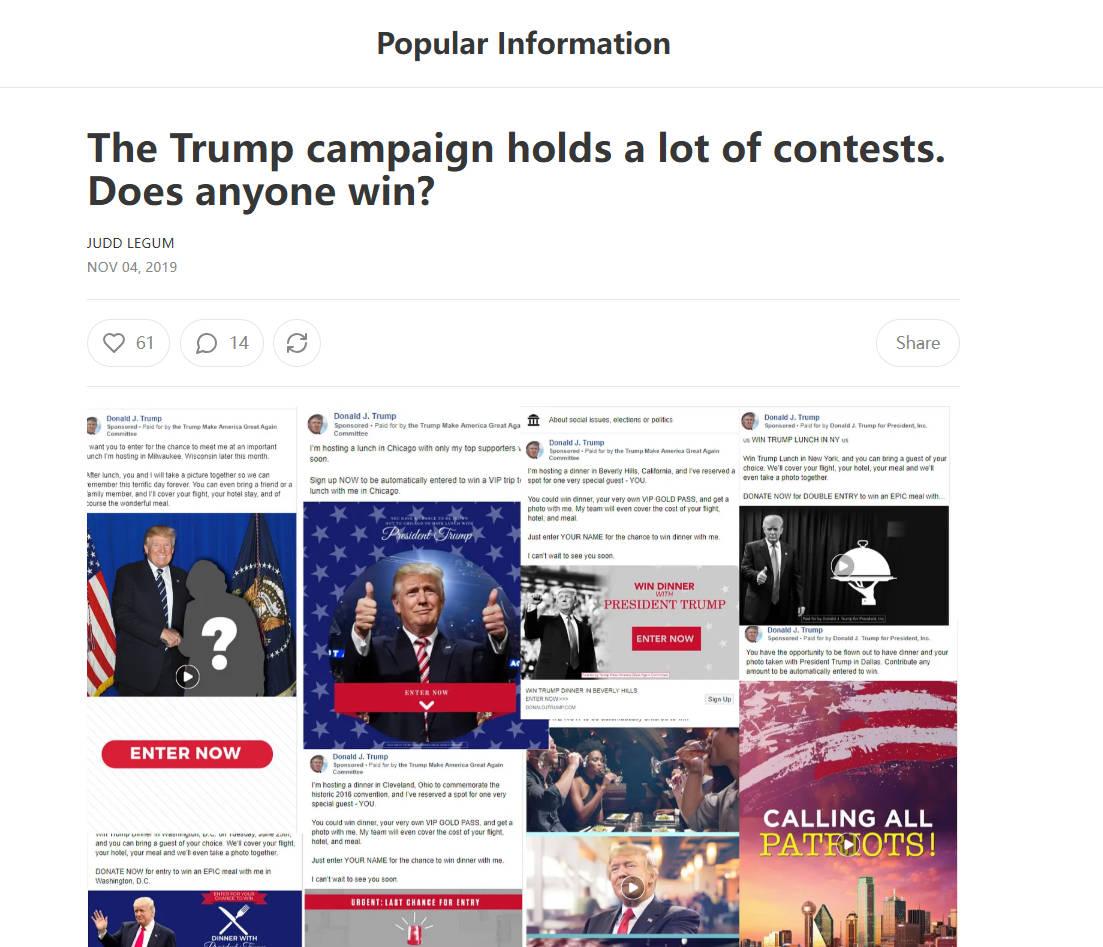

A post on the X platform from 2019 was also brought up with the news, showing that dinners are a common strategy of Trump, but he has missed at least 15 similar promises.

In November 2019, a series of contests offering Trump campaign donors a chance to have breakfast, lunch or dinner with him were denounced as "fraud." According to reports from The Guardian and other media, Popular Information, a news organization led by journalist Judd Legum, checked at least 15 contests held by the Trump campaign since 2018 that offered the opportunity to have breakfast, lunch or dinner with the president. The website stated: "Supporters were lured to donate to the Trump campaign with promises of free travel, accommodation and the opportunity to have a 'great' meal with Trump across the country." However, Popular Information's investigation "found no evidence that anyone actually won these prizes."

The second post from Popular Information stated that the prize for breakfast with Trump in New York promoted by the Trump campaign in hundreds of Facebook ads was fraudulent. The article pointed out that although a woman named Joanna Kamis was invited to a breakfast event in New York, Trump did not have any meal with her and only took a photo with her afterwards.

Dining with political candidates is a traditional way to raise awareness and funds. In 2012, former US President Barack Obama's re-election campaign promoted "Dinner with Barack."

In response to the report, Trump's campaign denied the accusation of operating a scam. Erin Perrine, chief deputy communications director of the Trump campaign, said: "Every contest has a winner. Any report to the contrary is wrong." As so-called evidence, Erin Perrine sent a link to an article in The Washington Post in October 2017, showing that donor Chris Chavez and his father Tracy Chavez met with Trump at a rally in Phoenix, Arizona. But after verification, Chavez participated in another contest that did not involve a dinner.

Despite this, Trump has fulfilled his promise, but before he took office as US President. As early as the evening of May 8, 2024, local time, before taking office in January 2025, Trump held an NFT dinner at the Mar-a-Lago Resort in Palm Beach, Florida. Buyers of at least 47 Trump "MugShot Edition" NFTs were invited to attend. At that time, Hong Kong actor Stephen Fung, who is keen on NFTs, also appeared on the scene.

Trump's MEME dinner also became a handle for the Democrats to attack. On April 24, regarding "Trump will have dinner with the first 220 holders of TRUMP tokens", Chris Murphy, a Democratic senator from Connecticut, said: "This not only reflects Trump's nature, but the TRUMP coin scam may be the most blatantly corrupt presidential behavior in history." Obviously, his political opponents are not optimistic about this publicity and event.

It can be seen that the "Trump Dinner" successfully attracted the attention of the crypto market with its high-profile celebrity effect, and also made the TRUMP coin achieve a short-term price rebound during the unlocking period. However, whether the dinner will be fulfilled, whether the president will attend, and whether the participants will really benefit are still unknown. Looking back at the past record of "dinner together" being cancelled, coupled with the adjustment of the dinner rules, investors and users may need to be more aware of the risks involved.

How long the narrative of the “encrypted president” can last remains to be further tested.

You May Also Like

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council

BlackRock boosts AI and US equity exposure in $185 billion models