ZKSync in crisis: Developer Matter Labs accused of stealing core technology, under pressure from coin theft and shrinking ecosystem

Author: Nancy, PANews

The trust crisis caused by the airdrop distribution contract hack of the L2 project ZKsync has not yet subsided, and its developer Matter Labs has been involved in legal disputes and public opinion whirlpools for alleged intellectual property theft.

Matter Labs was sued by BANKEX for misappropriating technology and taking away the core development team

On March 19 this year, Igor Khmel, CEO of digital asset banking platform BANKEX, and his affiliated entities filed a lawsuit in the New York State Supreme Court, accusing former employees Alexandr Vlasov and Petr Korolev of misappropriating BANKEX's core technology while in office, privately establishing a competing company Matter Labs, and obtaining more than $450 million in venture capital.

According to LinkedIn, Vlasov is currently the head of research and development at Matter Labs, where he has been for 6 years and 8 months. During this period, he was mainly responsible for preparing for the release of Plasma on the Ethereum mainnet and developing a GPU-based zkSNARK prover for the next generation of Plasma protocols. Prior to this, Vlasov served as the chief research scientist at the BANKEX Foundation from March 2018 to January 2019, leading the implementation of Plasma and developing a complete set of tools including back-end systems and smart contracts to support the actual operation of Plasma. Another key figure, Korolev, is currently the founder of blockchain security company OXORIO. He served as co-founder and head of operations of Matter Labs from August 2018 to January 2020. Before joining Matter Labs, Korolev was the CEO and co-founder of the BANKEX Foundation, leading the establishment of the institution's research and development system. Among the four core projects he participated in and promoted during this period, Plasma research and development was listed as one of the priorities.

The lawsuit disclosed that as early as 2017, Ethereum co-founder Vitalik Buterin approached BANKEX and commissioned it to develop operating software related to "Plasma". At that time, Plasma was considered a key technology that could improve the scalability of Ethereum. Vlasov and Korolev, who were employees of BANKEX at the time, led the specific development of the project. BANKEX provided financial, human and community resource support for this. The relevant results were open sourced on the GitHub platform and appeared at many developer conferences, and were also publicly recognized by Vitalik.

However, according to the lawsuit, in February 2018, while still an employee of BANKEX, Vlasov created a new account called "Matter Labs" on GitHub and uploaded a code base that was almost identical to BANKEX's existing "Plasma Contract", without signing BANKEX and not following the original Apache/MIT license requirements. Vlasov then released the "Web3Swift Library" in his own name, which constituted an obvious conflict of competition and violation of intellectual property rights.

On August 13, 2018, Vlasov and Korolev suddenly announced their resignation without prior notice or arrangement of technical handover. Within a week, they publicly released the Matter Labs white paper on GitHub, detailing the Plasma expansion architecture, but deliberately avoiding the fact that its technology came from BANKEX. The white paper not only reused the code structure and algorithm design previously submitted by BANKEX, but also cited their achievements in the "ETHWaterloo Hackathon" and Vitalik's approval, but did not state that the achievements were obtained under the name of BANKEX. At the same time, the white paper also repackaged the Plasma technology demo, diagrams and algorithm details that BANKEX had previously disclosed on GitHub as the original achievements of Matter Labs.

What’s more serious is that after the two resigned, they quickly induced BANKEX’s key engineers to collectively “jump ship”. Matter Labs’ initial technical team was almost composed of former BANKEX core members, including Foundation COO Sergey Korolev (Korolev’s brother), Anton Nezlobin, Georgy Fesenko, Konstantin Panarin and other senior engineers. Even on the GitHub project page, the BANKEX official project was changed to prompt: “web3swift development has been frozen, welcome to use [matter-labs/web3swift]”, openly using BANKEX’s influence to divert users.

With the loss of core technology and team members, BANKEX quickly fell into trouble. In mid-2018, the company's valuation was as high as $530 million, with annual revenue of $6.5 million, but it shrank to $200 million by the end of the year. And because the core technology and team were drained and unable to obtain financing, BANKEX completely stopped operating in 2019. Khmel once sought emergency funding from the Ethereum Foundation from Vitalik, but received no response. In the fifth round of funding list announced by the Ethereum Foundation in February 2019, Matter Labs ranked first, and BANKEX was completely excluded.

The lawsuit also pointed out that Matter Labs CEO Alex Gluchowski, Placeholder partner and former director Chris Burniske, and investment institutions Dragonfly and Placeholder Capital were also suspected of knowing or participating in the misappropriation of technology and became one of the defendants.

In response to the allegations, Matter Labs said in a statement to Coindesk that the allegations are baseless. The core of the complaint is that Matter Labs built ZKsync based on the code developed by BANKEX, which is completely untrue. ZKsync is original technology and is not based on or derived from any code of BANKEX. "We are confident in the integrity of our work and look forward to clarifying this unfounded accusation in court after receiving a formal subpoena."

The reputation has been hit hard, and the ecological activity has shrunk significantly

In fact, this is not the first time that Matter Labs has been accused of plagiarism. As early as 2023, Polygon, also a ZK system, publicly criticized zkSync for copying its open source code without permission and using misleading language in its release. In response, zkSync said that only about 5% of the Boojum module code is based on Polygon's Plonky2 library, and the source is clearly marked on GitHub.

Not only that, in May last year, Matter Labs was jointly boycotted by the ZK ecological project party for submitting the "ZK trademark application". Although it eventually gave up the application, its founder Alex claimed that he opposed the concept of "intellectual property" and that everything he created was released to the public under a free open source license. This statement intensified the outside world's criticism of its "abuse of open source."

These controversies have caused a heavy blow to ZKsync's reputation. However, to make matters worse, ZKsync has recently fallen into a crisis of trust again due to theft. On April 15, the official team of ZKsync announced that the administrator account of its airdrop distribution contract had been compromised. The attacker minted about 111 million unclaimed ZK tokens from the airdrop contract by calling the sweepUnclaimed() function. This incident was limited to the airdrop distribution contract, and the attacker could not conduct further attacks through this method. According to Alex's further disclosure, this incident was caused by the leakage of an operator's key, but the project code was not leaked. Nearly a week later, ZKSync issued another statement saying that it is willing to provide a 10% bounty in exchange for the return of stolen funds within 72 hours. If the hacker completes the return within the deadline, it will publicly confirm that the incident has been resolved; if it fails to return on time, it will be upgraded to a criminal investigation and handed over to law enforcement agencies for handling.

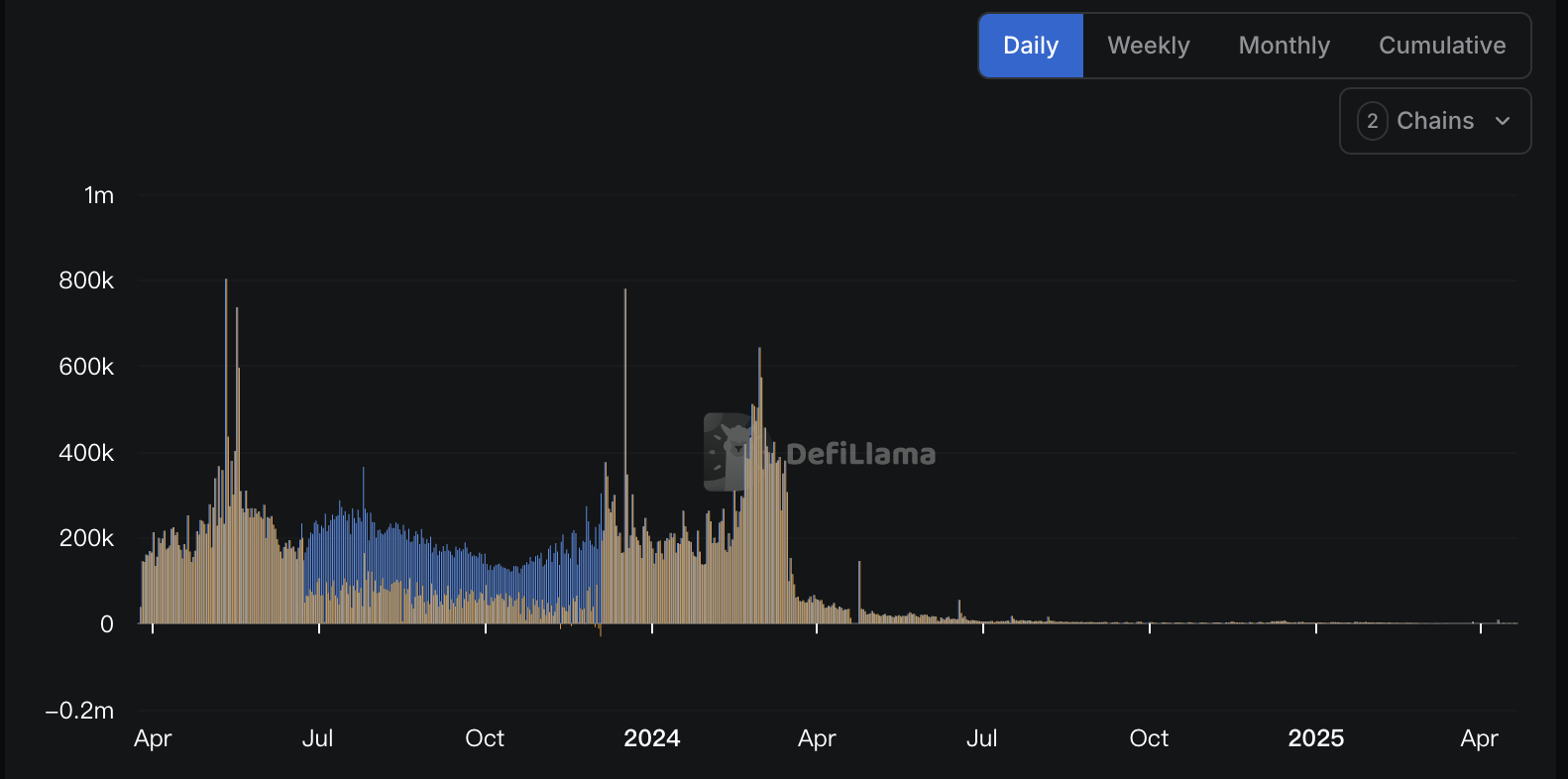

Today, the ZK star project, which was once highly anticipated, is also facing market challenges. From the data, the ecological activity of zkSync has declined significantly. DeFiLlama data shows that ZKsync's daily income and daily expenses have dropped sharply from hundreds of thousands of dollars before, and have been below $10,000 for a long time since June last year, and have even been zero for many consecutive days recently.

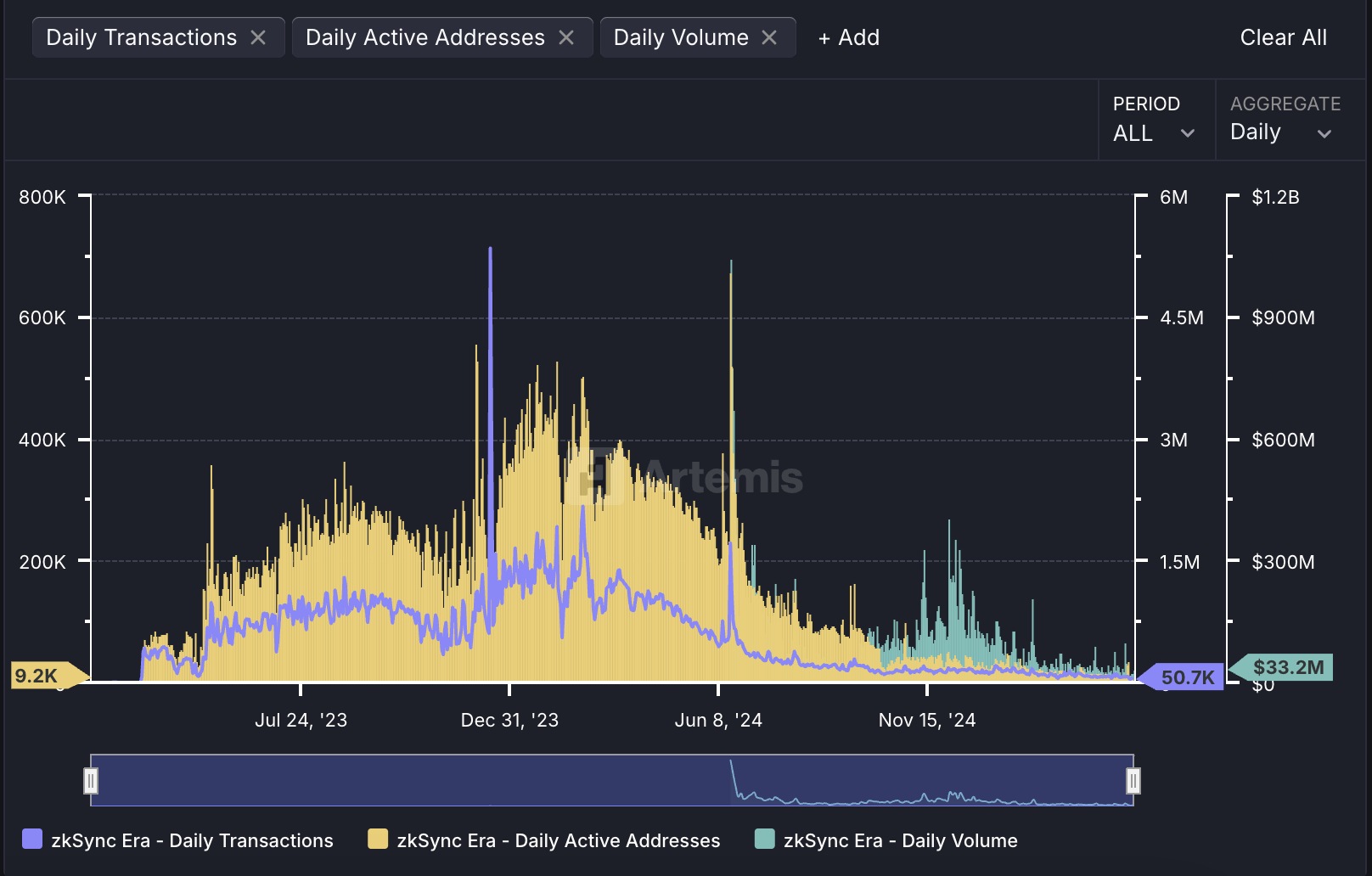

At the same time, Artemis data also shows that as of April 21, ZKsync's daily active addresses dropped from a peak of 445,000 to only 9,200, a drop of more than 97%. During the same period, its daily transaction volume also dropped from a historical high of 5.2 million to 50,700, and its transaction volume dropped from a peak of over US$770 million to today's US$3.32 million, a drop of more than 95%.

From accusations of technological infringement to theft of airdrop distribution contracts, to the rapid shrinkage of the ecosystem, zkSync is now struggling amid a crisis of trust and market incentive competition.

Related reading: zkSync developers launched a trademark battle over "ZK" and were jointly boycotted by multiple crypto leaders

You May Also Like

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council

BlackRock boosts AI and US equity exposure in $185 billion models