Cathie Wood’s Ark Sees Bitcoin Hitting $16T Market Cap by 2030

- Ark Invest’s “Big Ideas 2026” report projects Bitcoin will reach a $16 trillion market cap by 2030, driven by institutional adoption and ETF growth.

- The forecast assumes a 63% compound annual growth rate, with Bitcoin increasingly capturing the “digital gold” market as its volatility declines.

- Smart contract platforms are expected to reach a $6 trillion market cap by 2030, fueled by the rise of on-chain finance and tokenised real-world assets.

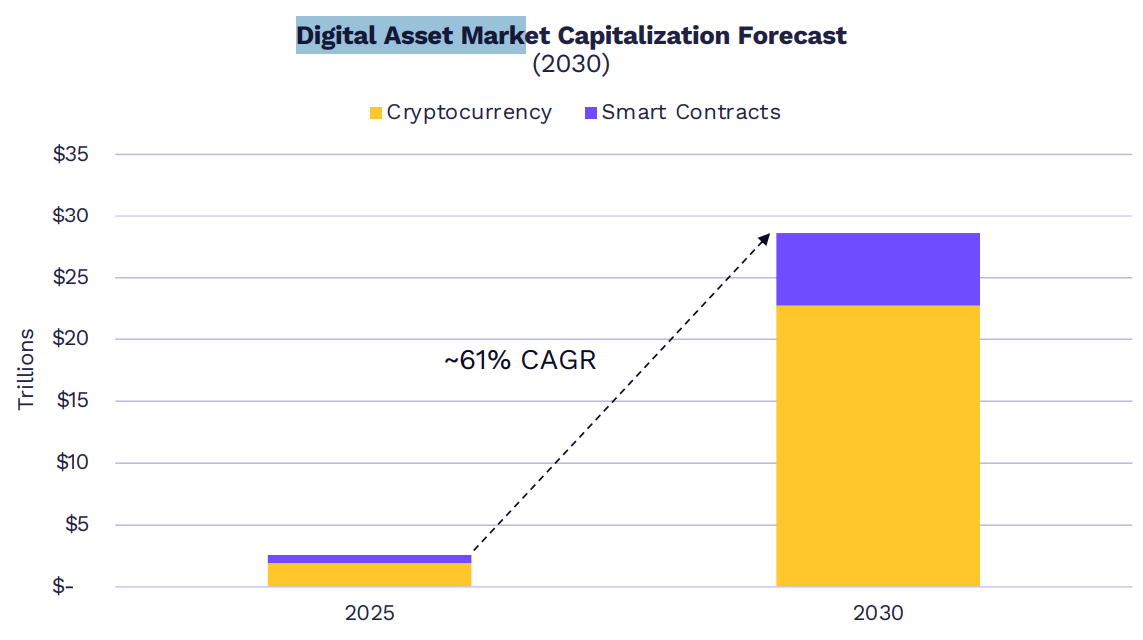

Ark Invest projects Bitcoin could reach a market capitalisation of about US$16 trillion (AU$24.48 trillion) by 2030, with the total crypto market growing to roughly US$28 trillion (AU$42.84 trillion) over the same period.

That means that at a US$16 trillion (AU$24.48 trillion) market cap, Bitcoin would trade around US$761,900 (AU$1.16 million) per coin, based on the fixed 21 million supply. So that implies about a 765% rise from prices near US$90,000 (AU$134K).

The forecast appears in Ark’s “Big Ideas 2026” report published Wednesday. The report argues bitcoin is becoming the leading asset in an institutional crypto allocation, supported by expanding ETF use, more corporate treasury holdings, and a decline in volatility compared with earlier cycles.

Based on ARK’s forecast, bitcoin is likely to dominate the market cap for cryptocurrencies, increasing at a compound annual growth rate (CAGR) of ~63% during the next five years, from nearly ~$2 trillion to ~$16 trillion by 2030.

Ark Invest

Ark Invest

Read more: Crypto Investment Products See Largest Weekly Inflows Since October 2025

Big Bitcoin Projections

The report projects bitcoin’s market cap could grow at about a 63% compound annual rate over the next five years, from nearly US$2 trillion (AU$3.06 trillion) to about US$16 trillion (AU$24.48 trillion) by 2030.

Source: Ark Invest.

Source: Ark Invest.

It also says the 2030 outlook has stayed largely unchanged despite two model updates: a 37% increase in the “digital gold” addressable market after gold’s market cap rose 64.5% in 2025, and a cut to expectations for Bitcoin as an emerging-market safe haven due to rapid stablecoin adoption in developing economies.

Outside Bitcoin, the report expects much of the remaining market value to come from smart contract platforms, forecasting smart contract networks to collectively reach about US$6 trillion (AU$9.18 trillion) in market cap by 2030.

According to the firm, that market cap would be achieved by on-chain finance, tokenised securities and decentralised applications (dApps), and generating annualised revenue of roughly US$192 billion (AU$293.76 billion) at an average take rate of 0.75%.

Two to three Layer 1 smart contract platforms should take the lion’s share of the market, but garner more market cap from their monetary premium (store-of-value and reserve asset characteristics) than discounted cash flows

Ark Invest

Ark Invest

Related: How Zero-Knowledge Proofs Are Turning Bitcoin into a Settlement Layer

The post Cathie Wood’s Ark Sees Bitcoin Hitting $16T Market Cap by 2030 appeared first on Crypto News Australia.

You May Also Like

Over 60% of crypto press releases linked to high-risk or scam projects: Report

Outlook remains cautious – TD Securities