Delphi Digital's top ten predictions for 2025: DeAI will lead the DeFi revolution, and Solana will continue to outperform Ethereum

Original: Delphi Digital

Compiled by: Yuliya, PANews

In the field of cryptocurrency, 2025 is considered a critical year full of innovation and change. With the continuous development of technology and the changes in the market environment, many fields are expected to usher in huge breakthroughs and opportunities. From the continuation of Bitcoin's bull market to the rise of Solana, and then to the transformation of DeFi to DeAI, the crypto market in 2025 will show an unprecedented trend of diversification. This article will explore the top ten market trends predicted by Delphi Digital and reveal the possible future evolution direction of the cryptocurrency industry.

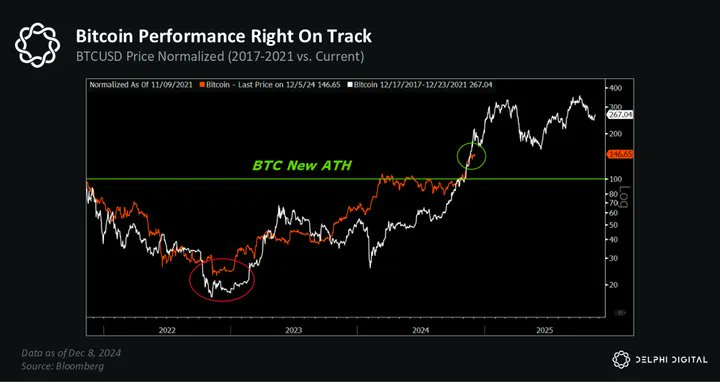

1. Bitcoin (BTC) still has room to rise

Delphi Digital's cycle model once predicted that Bitcoin would hit a new high in the fourth quarter of 2024. The current trend of Bitcoin is consistent with the prediction.

- Each new all-time high is accompanied by a monthly RSI exceeding 70, while previous bull markets usually ended after the RSI exceeded 90.

- According to the monthly price regression channel, Bitcoin remains within a 1-2 standard deviation range below the top of the marker.

- Increased institutional interest and a loosened regulatory environment are likely to be the main drivers of this bull run.

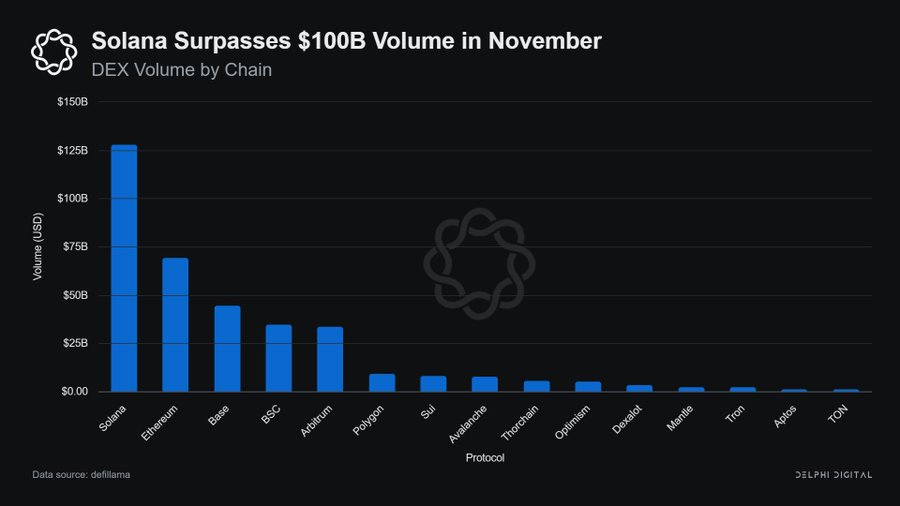

2. Solana is emerging

Solana will continue to outperform Ethereum primarily due to its superior user experience and better content ecosystem.

- With no token approval or wrapping required, Solana’s operation is simple and intuitive.

- The Solana Virtual Machine (SVM) is the fastest growing alternative virtual machine (alt-vm) ecosystem, and its network effect continues to increase. At the same time, Anza, Firedancer, and improved wallet infrastructure will further optimize the user experience.

- Solana co-founder Anatoly Yakovenko's vision is to increase bandwidth and reduce latency so that Solana can maintain its advantage even in the face of more competition.

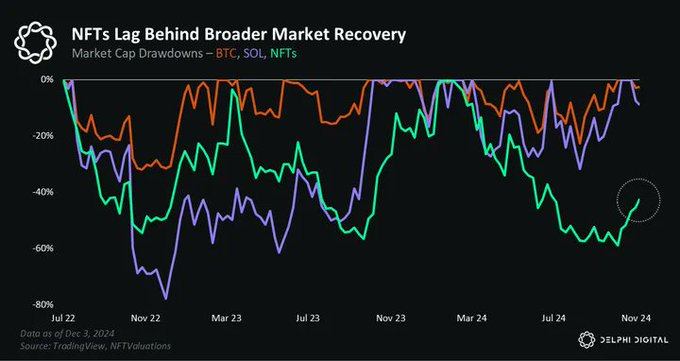

3. NFTs make a comeback

The NFT market will experience a strong recovery where sentiment is inconsistent with fundamentals.

- Although token transactions are more convenient, NFTs can achieve unique on-chain coding, and heterogeneous assets (such as artworks, wine, etc.) may be NFTized.

- Some major wealth creation events (such as the Pudgy Penguins, Milady, and Azuki airdrops) may trigger other NFT projects to follow suit.

- NFT is more friendly to retail users and suitable for displaying culture and status.

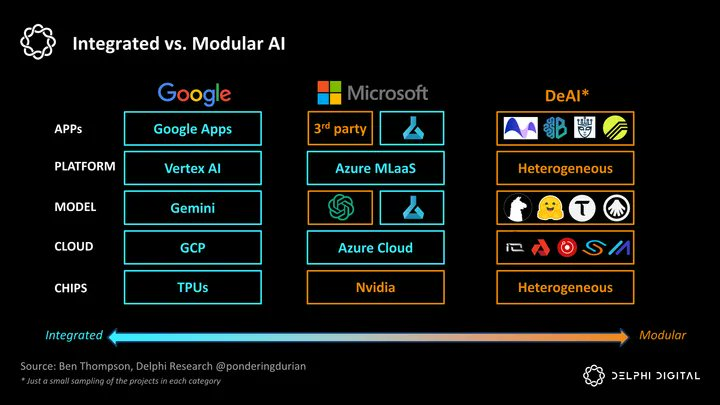

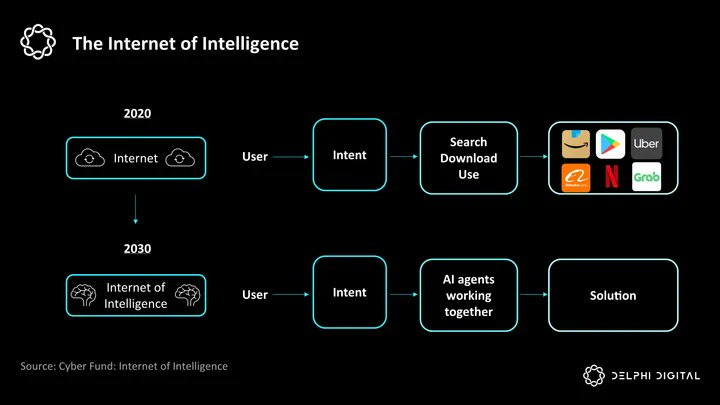

4. Evolution of decentralized finance (DeFi) to DeAI

DeAI will fundamentally change the way users interact with DeFi.

- The front-end interface will be replaced by intelligent agents, and users can complete transactions, currency exchanges, and profit searches through natural language processing.

- In the future, most capital allocation decisions will be made by agents. Griffain is a pioneer in this area, but DeAI projects such as HeyAnon are emerging rapidly.

5. AI Agents Become Top Crypto Venture Investors

The future of trading will be led by AI agents rather than human counterparties.

- As brokers can monitor markets 24/7 and process more data, trading will evolve into a competition for computing power and unique data sets.

- By 2025, at least three proxy frameworks will become unicorns with a market value of more than $10 billion.

6. High-throughput chains drive innovation

High-throughput blockchain will bring more experiments and opportunities in 2025.

- Major projects to watch include Hyperliquid, Sui, and Monad, but others like Berachain also have potential.

- MegaETH is expected to compete with the second-layer networks for market share rather than directly competing with the first-layer networks.

7. DePin is recovering

A large DePin project, if it becomes self-sustaining, could trigger a reassessment of the space as a whole and drive a “fundamentals” rally.

- DePin has disruptive potential in areas such as wireless services (Helium), network infrastructure (DoubleZero), mapping services (Hivemapper), healthcare, and power grid operations.

8. zkVM will usher in revolutionary development

- zkVM technology will enhance the interoperability between Rollups and enable seamless cross-chain interaction.

- zkVM will also expand the developer market, enabling developers to build zk applications using other languages such as Rust.

9. AI opens up new opportunities for GameFi

- AI development tools will increase the productivity of game developers.

- Projects like InWorldAI are developing AI-powered NPC services.

- Open source projects such as the Virtuals.io game framework and Eliza’s integration with Unreal Engine and Unity could be revolutionary breakthroughs in AI gaming.

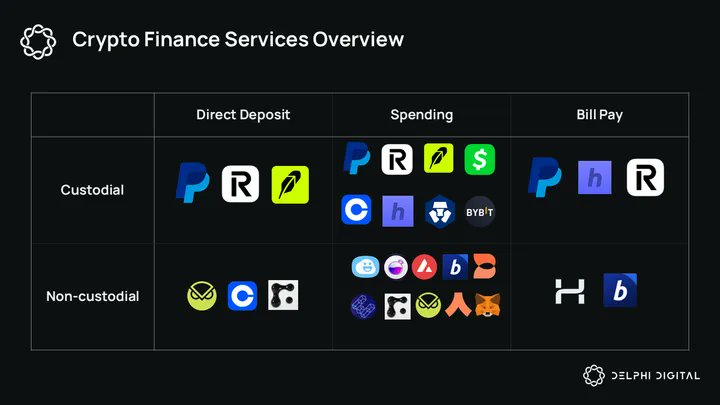

10. Consumer-grade DeFi is the next blue ocean

- By 2025, on-chain finance will fully serve crypto natives.

- zkTLS will allow sensitive Web2 data to be brought on-chain while maintaining privacy, enabling applications such as personalized proxies and credit scoring.

- Revenue-sharing stablecoins will continue to expand, with incentives better aligned between issuers and distributors.

You May Also Like

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council

BlackRock boosts AI and US equity exposure in $185 billion models