When on-chain naked running becomes the norm, how does Aleo use privacy infrastructure to reconstruct Web3 sovereignty?

Author: Frank, PANews

On February 23, Binance founder CZ caused a stir with a common test on the BSC chain. When he tried to buy MEME coins, the on-chain data was tracked in real time, and the community misjudged it as an official action, causing tens of thousands of users to follow suit. In response, CZ reluctantly clarified: "This is just a personal test."

Behind this blunder, the "privacy paradox" caused by the transparency of blockchain was exposed: on-chain behavior is like streaking, sandwich attackers snipe transactions, hackers target phishing, and MEME players track smart money and get harvested. Howard Wu, founder of Aleo, commented pointedly: "CZ's first experience with AMM is a typical example of why I created Aleo. I just want my account to be visible to me, and I don't know why the whole world needs to see it." The transparent traceability of blockchain was once a revolutionary advantage, but it has evolved into a fatal weakness in complex scenarios such as DeFi and GameFi: privacy leaks become attack portals, and transparent ledgers become a hotbed for evil.

According to a report by Certik, the losses from phishing attacks due to the exposure of on-chain behaviors will reach $1 billion in 2024. When transparency changes from a cornerstone of trust to a shackle on development, does blockchain need a privacy revolution? Aleo's answer is: reconstruct the privacy boundary with zero-knowledge proofs, allowing users to regain data sovereignty.

Building a bridge in the deep waters of cryptography

While other privacy projects are wavering between "complete anonymity" and "regulatory compliance", Aleo has chosen a more basic breakthrough path: using ZKP technology to achieve "selective transparency" - users can hide sensitive data while proving authenticity to specific parties. This vision is based on three major technical pillars

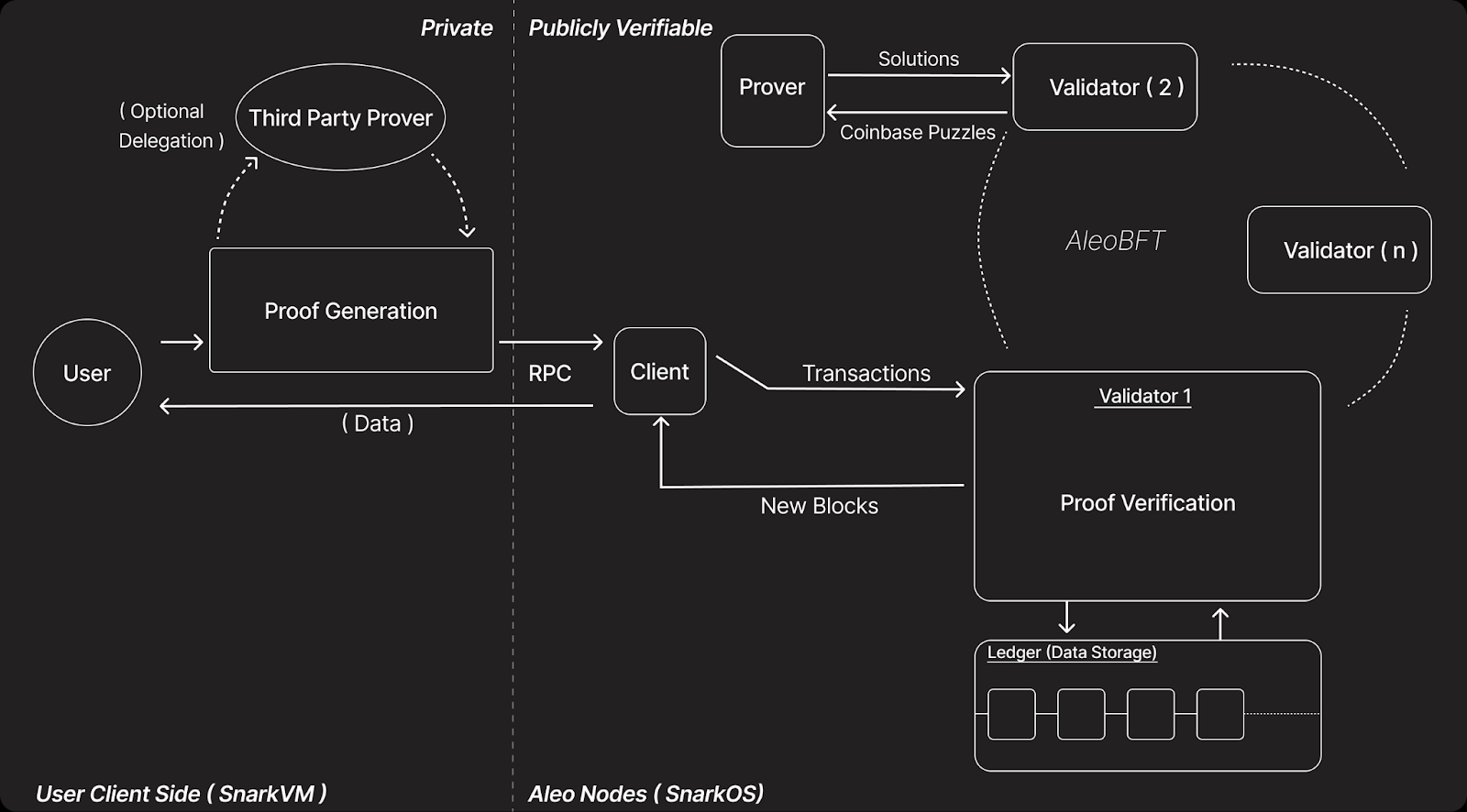

Aleo's core technology has three main breakthroughs: zkCloud (privacy computing layer), Leo language (developer tool layer), and AleoBFT consensus (network layer).

zkCloud is a core technology of Aleo, which moves complex computing tasks from the chain to the user's own device for execution, and then verifies the correctness of these calculations through zero-knowledge proof technology. This not only protects the privacy of users, but also improves the operation speed of the blockchain.

The key is to execute off-chain. The blockchain is like a shared ledger where all transactions and calculations are publicly recorded. But if everyone writes in this ledger, it will be very slow and privacy will not be guaranteed. zkCloud is like giving everyone a "private notebook" where you can quietly complete the calculation in your own notebook and then only submit the result to the public ledger. This is fast and will not leak details. According to a report by Messari, zkCloud can reduce the processing time of private transactions from a few seconds to milliseconds, and the computing cost can be reduced by more than 90%.

For this purpose, Aleo has specially designed a programming language, Leo, to develop decentralized applications that require privacy protection. It simplifies the complex zero-knowledge proof (ZKP) technology, allowing developers to write privacy applications without becoming cryptography experts. ZKP technology itself is very complex, and it is difficult for ordinary programmers to get started directly. Leo is like a "translator", turning advanced cryptographic concepts into simple programming syntax. Developers use it just like writing ordinary programs, and the ZKP details behind it are automatically handled by Leo. With the help of this low threshold, Aleo official data shows that the number of dApps developed with Leo increased by 150% in 2024.

AleoBFT is the consensus mechanism used by Aleo. It combines the advantages of PoW and Proof of Stake (PoS) to quickly confirm transactions through a dynamic committee while maintaining the decentralization and security of the network. AleoBFT first uses PoW to select a committee, and then this committee uses PoS to quickly confirm transactions. This ensures decentralization and improves efficiency. According to the Aleo test network data, the average confirmation time of AleoBFT transactions is 2 seconds, which is much faster than Ethereum's 15 seconds, and is suitable for scenarios that require fast transactions. zkCloud protects privacy and improves efficiency, the Leo language lowers the development threshold and promotes innovation, and AleoBFT ensures fast decentralized transactions.

Giants join hands, Google Cloud and Coinbase become trust anchors

Although zero-knowledge proof and privacy computing are obscure to ordinary users, the giants seem to have already seen the potential of this track. Before the mainnet was launched, Aleo raised a total of more than 200 million US dollars, setting a record for the largest financing in the zero-knowledge track. Investors include well-known institutions such as a16z, SoftBank, Coinbase, and Samsung.

Advanced technological concepts and endorsements from industry giants have obviously brought Aleo more industry recognition and further advanced the pace of Aleo's ecological governance.

On February 27, 2025, Aleo announced a strategic partnership with Google Cloud, becoming the first zero-knowledge Layer 1 network in the Google Cloud ecosystem. In this partnership, Google Cloud also participated in the operation of the Aleo mainnet verification node to enhance the decentralization and stability of the network. For Aleo, developers can use Google Cloud's BigQuery tool to analyze Aleo network data (such as transaction volume, on-chain records) to improve development efficiency. In addition, Coinbase became one of the first validators when the mainnet was launched.

In the fourth quarter of 2024, Aleo's ecosystem continued to grow, with daily active addresses increasing by 10.6% and new addresses increasing by 34.4%. As of March, Aleo's verification nodes have reached 25.

At the same time, Aleo's governance route is also being actively promoted. In May 2024, the Aleo Foundation governance platform was launched before the mainnet was launched. Aleo token holders can vote on protocol upgrades and improvement proposals through the platform. After the mainnet, the Ambassador Program is divided into three levels: Apprentice, Voyager, and Maestro. Participants need to submit content to accumulate AleoPoints and promote community governance. The platform uses ZKP technology to achieve privacy voting to avoid external interference. As of March 2025, the governance platform has processed a number of proposals, such as ARC-0042 in December 2024 (dynamic reward adjustment, community support rate reached 93%).

From on-chain privacy to real-world “data passports”

Aleo's capital layout and strategic cooperation have paved the fast lane for it. Technological breakthroughs need the support of ecological prosperity. Technological dividends have begun to be transformed into actual use cases, and the zPass protocol launched by Aleo is gradually being implemented.

“Without built-in privacy, cryptocurrency can never truly enter the real world.” Howard Wu’s declaration on the X platform revealed that Aleo’s real goal is to open the door to more industries for blockchain through privacy computing.

zPass is a protocol developed by Aleo, based on zero-knowledge proof technology, which allows users to securely verify identity-specific attributes (such as age, nationality) without disclosing all personal information. It is like a "privacy passport", allowing you to prove "I am an adult" or "I am a US citizen" without revealing your name or address.

In February 2025, Aleo announced that the first five projects implemented zPass in production environments, including Playside, World3, Humine, GeniiDAO and ThreeofCups (3oC), covering the fields of gaming, finance, healthcare, education and social networking.

Among them, Playside uses zPass for age verification to ensure that young users have a safe and age-appropriate experience when interacting with AI agents. For example, verifying whether a user meets the age requirement to enter certain game content.

Humine is a decentralized clinical trial platform that uses zPass to allow patients to prove study eligibility (such as specific disease or age) without exposing their full medical records.

Obviously, the application of zero-knowledge proof seems to be able to cover more traditional industries, not just limited to the fields of encryption and finance. This is also the driving force behind Aleo's vision of returning to user data sovereignty and building a new Web3 ecosystem with "privacy as a service" as the core.

From the $1 billion loss in on-chain attacks to CZ's MEME coin blunder, Aleo's narrative features actually confirm the evolution of blockchain value: when technology shifts from the pursuit of "absolute transparency" to "controllable anonymity", a new social contract is born - in the digital world, the true meaning of freedom is not unreserved disclosure, but the right to control the boundaries of one's own data.

You May Also Like

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council

BlackRock boosts AI and US equity exposure in $185 billion models