GameFi

Share

GameFi merges blockchain technology with the gaming industry, enabling Play-to-Earn (P2E) and "Play-to-Own" economies. Through decentralized assets, players have true ownership of in-game items as NFTs. In 2026, the sector has matured into High-Quality AAA Gaming experiences with seamless on-chain integration. Explore this tag for insights into Web3 gaming guilds, metaverse infrastructure, and how blockchain is redefining player incentives and virtual economies in the 2026 gaming landscape.

1175 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

U.S. Treasury Rules Out BTC Buys as GOP Senators Push For Use Of Gold Reserves

2026/02/05 04:35

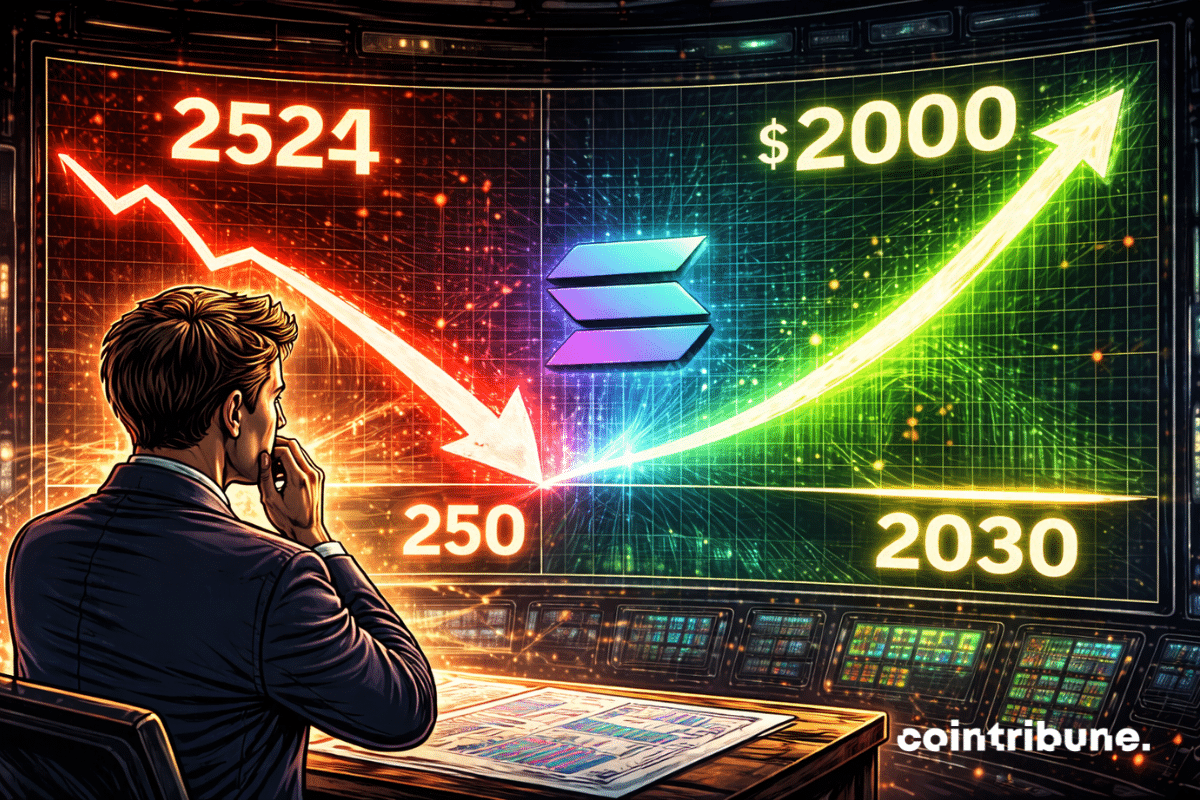

Solana To Hit $250 In 2026 ? Bank Explains Why

2026/02/05 04:05

Securities Fraud Investigation Into Corcept Therapeutics Incorporated (CORT) Announced – Shareholders Who Lost Money Urged To Contact Glancy Prongay Wolke & Rotter LLP, a Leading Securities Fraud Law Firm

2026/02/05 04:00

This is Trump's plot to rig the midterms — we must unite to beat it

2026/02/05 03:57

Over 80% of 135 Ethereum L2s record below 1 user operation per second

2026/02/05 03:52