Index

Share

A crypto Index provides a way for investors to gain diversified exposure to a specific basket of digital assets through a single tokenized product. These indices often track specific sectors, such as DeFi, DePIN, or RWA, and are automatically rebalanced via smart contracts. In 2026, AI-managed thematic indices have become the gold standard for passive investing, allowing users to track the "blue chips" of the Web3 economy without manual portfolio management. This tag covers index methodology, rebalancing frequency, and the benefits of diversified crypto baskets.

25816 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

WHALE ALERT: $351 MILLION Bitcoin Dump Incoming

2026/02/07 19:36

XRP Burn Rate Hits Highest 2026 Levels as Price Makes Dramatic Comeback

2026/02/07 19:28

The Future of Metalworking: Advancements and Innovations

2026/02/07 19:24

Tuardin Token: Building Strategic Alliances to Boost Liquidity, Enhance Security, and Transform Global E-Commerce Landscapes

2026/02/07 19:01

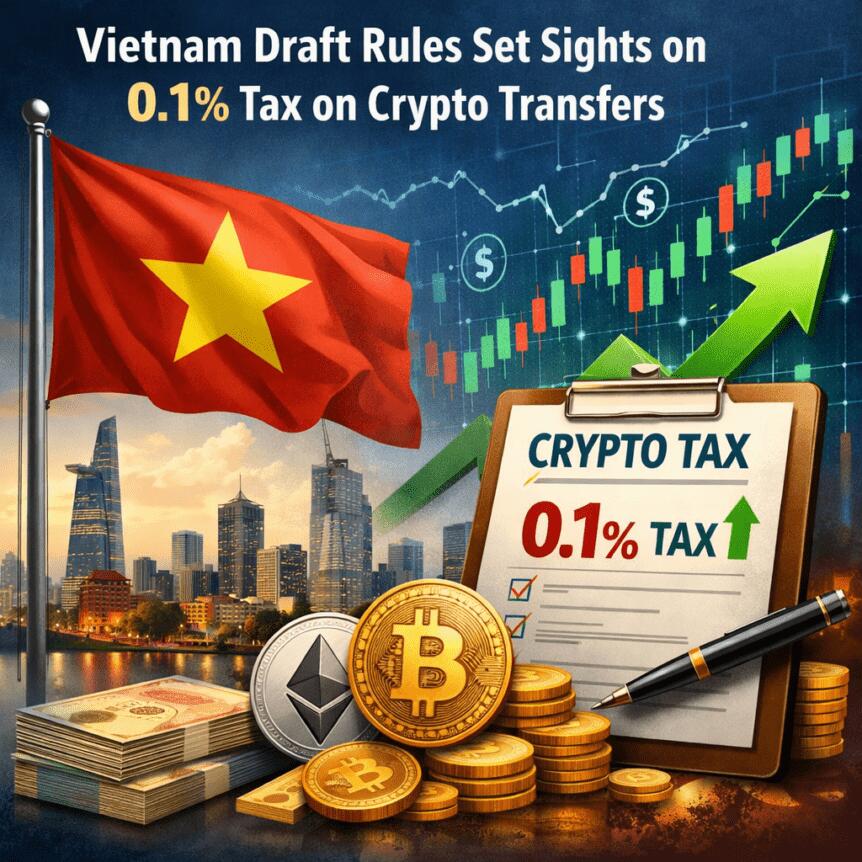

Vietnam Draft Rules Set Sights on 0.1% Tax on Crypto Transfers

2026/02/07 18:57