Index

Share

A crypto Index provides a way for investors to gain diversified exposure to a specific basket of digital assets through a single tokenized product. These indices often track specific sectors, such as DeFi, DePIN, or RWA, and are automatically rebalanced via smart contracts. In 2026, AI-managed thematic indices have become the gold standard for passive investing, allowing users to track the "blue chips" of the Web3 economy without manual portfolio management. This tag covers index methodology, rebalancing frequency, and the benefits of diversified crypto baskets.

25781 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

XRP Now Hosts Over $1B Worth of Tokenized Commodities

2026/02/07 14:28

Revealing Long/Short Ratios Show Remarkable Market Equilibrium Across Top Exchanges

2026/02/07 14:01

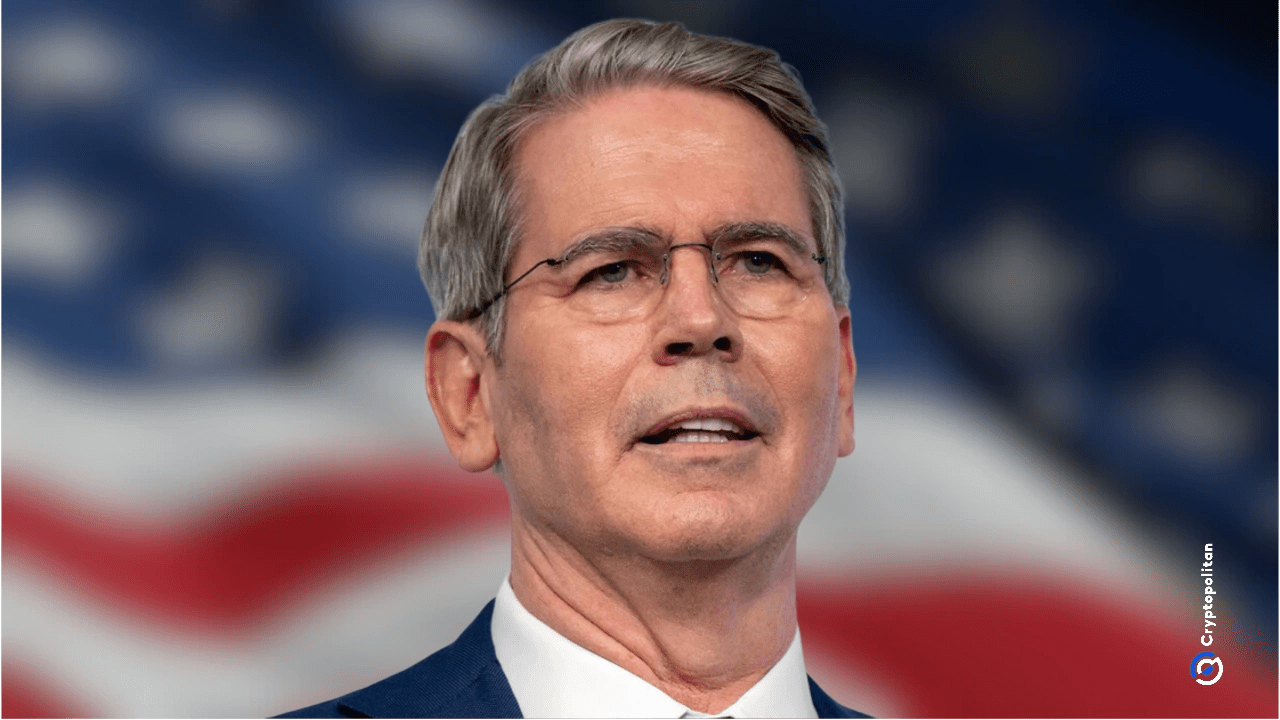

Trump’s Scott Bessent says “false choice” to pit his strong‑dollar line against the president’s

2026/02/07 13:58

The ENS will launch its ENSv2 on Ethereum, leaving its own L2.

2026/02/07 13:50

The Critical Analysis Of HBAR’s Journey To $0.5

2026/02/07 13:48