Lending

Share

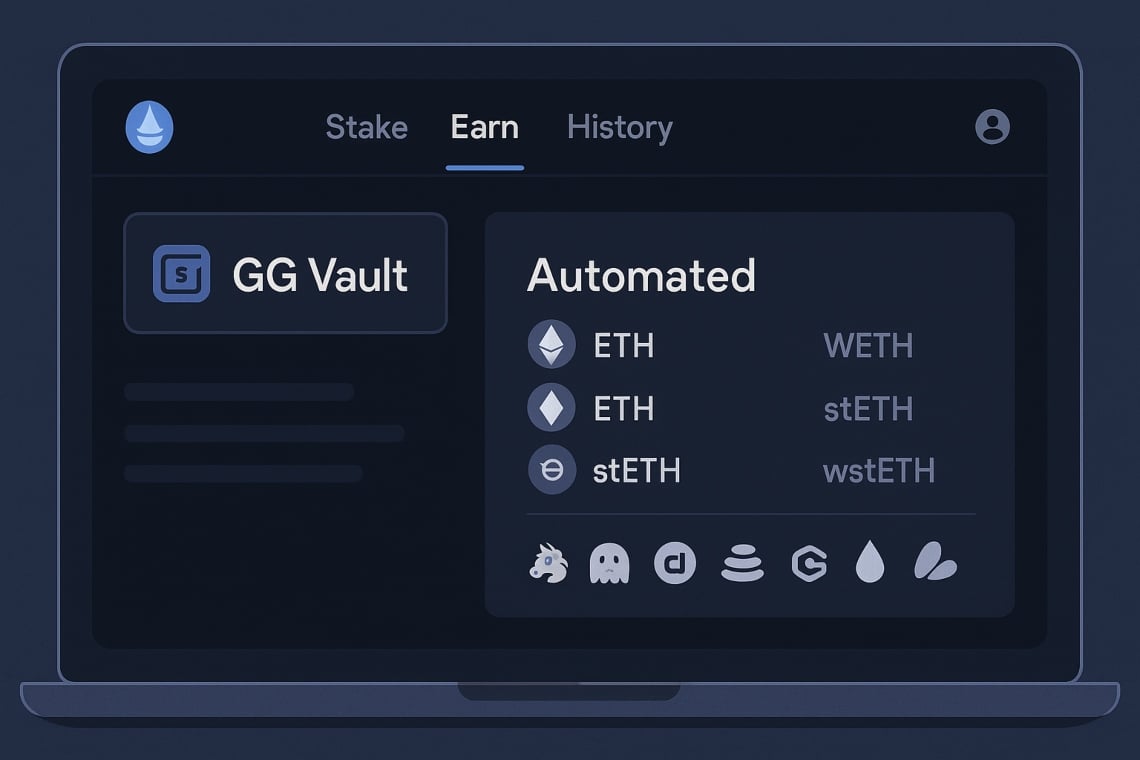

Lending protocols form the backbone of the decentralized money market, allowing users to lend or borrow digital assets without intermediaries. Using smart contracts, platforms like Aave and Morpho automate interest rates based on supply and demand while requiring over-collateralization for security. The 2026 lending landscape features advanced permissionless vaults and institutional-grade credit lines. This tag covers the evolution of capital efficiency, liquidations, and the integration of diverse collateral types, including LSTs and tokenized RWAs.

14256 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

The entire crypto sector suffered a severe blow, with PayFi leading the decline at nearly 14%, and BTC briefly falling below $60,000.

2026/02/06 10:34

Republic Europe Offers Retail Kraken Equity Before IPO

2026/02/06 10:31

Tether Advances Gold Strategy With $150 Million Stake in Gold.com

2026/02/06 10:09

Tropical Storm Basyang heads for Central Visayas after hitting Caraga

2026/02/06 10:00

Payy Launches As Ethereum’s First Privacy-Enabled EVM L2

2026/02/06 09:54