Lending

Share

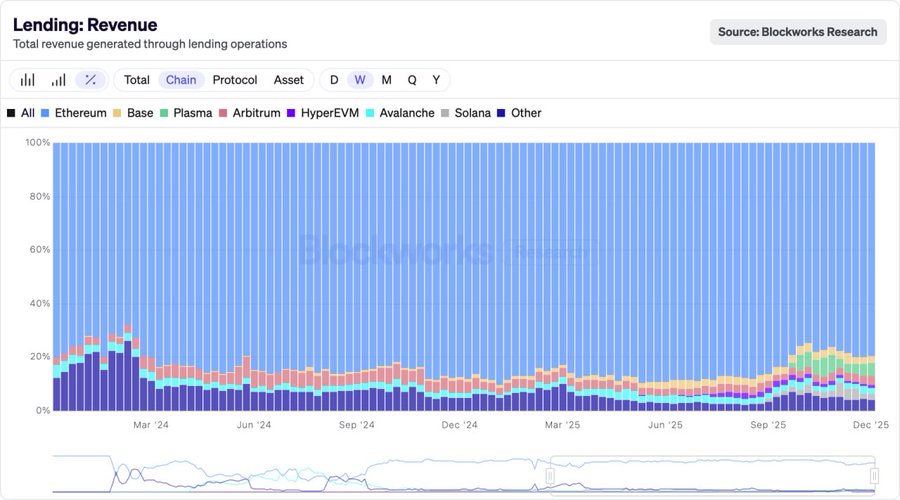

Lending protocols form the backbone of the decentralized money market, allowing users to lend or borrow digital assets without intermediaries. Using smart contracts, platforms like Aave and Morpho automate interest rates based on supply and demand while requiring over-collateralization for security. The 2026 lending landscape features advanced permissionless vaults and institutional-grade credit lines. This tag covers the evolution of capital efficiency, liquidations, and the integration of diverse collateral types, including LSTs and tokenized RWAs.

16507 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

Predictive Analysis: How Pi Network Could Become the Economic Operating System of the AI Era

2026/02/20 22:38

The Fight for Consumer Data Privacy Rights: Arjun Bhatnagar on Cloaked’s ‘My Data, Act!’ Campaign

2026/02/20 22:37

US inflation in December exceeded expectations, causing US stocks to open lower.

2026/02/20 22:30

Saluda Grade Appoints Patrick Lo as Co-Chief Investment Officer to Lead Deeper Expansion into Asset-Based Finance Strategies

2026/02/20 22:16

PCE Data Sparks Tensions: A Key Day for Bitcoin

2026/02/20 21:45