Lending

Share

Lending protocols form the backbone of the decentralized money market, allowing users to lend or borrow digital assets without intermediaries. Using smart contracts, platforms like Aave and Morpho automate interest rates based on supply and demand while requiring over-collateralization for security. The 2026 lending landscape features advanced permissionless vaults and institutional-grade credit lines. This tag covers the evolution of capital efficiency, liquidations, and the integration of diverse collateral types, including LSTs and tokenized RWAs.

15596 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Next Move Could Be Big

Author: BitcoinEthereumNews

2025/11/13

Share

Recommended by active authors

Latest Articles

Trump Media Submits New Bitcoin, ETH and Cronos ETF Filings

2026/02/14 22:44

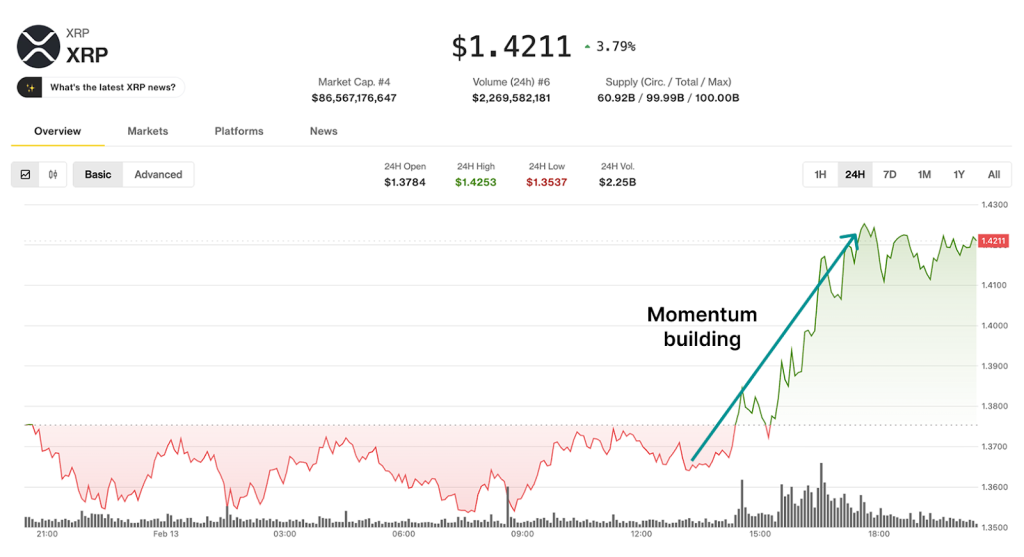

XRP Price News: Momentum Is Building for XRP and HYPE Is Surging, but the True Explosive Price Acceleration in 2026 Is Expected for DeepSnitch AI

2026/02/14 22:30

San Francisco native loses $200k to crypto scammers

2026/02/14 21:58

Historical Data Shows “HUGE” Move Coming for XRP with $5 Monthly Candle in March

2026/02/14 21:49

Meme coin market flashes bottoming signal, per Santiment

2026/02/14 21:45