NFT

Share

NFTs are unique digital identifiers recorded on a blockchain that certify ownership and authenticity of a specific asset. Moving past the "PFP" craze, 2026 NFTs emphasize utility, representing everything from IP rights and digital fashion to RWA titles and event ticketing. This tag explores the technical standards of digital ownership, the growth of NFT marketplaces, and the integration of non-fungible tech into the broader Creator Economy and enterprise solutions.

12408 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

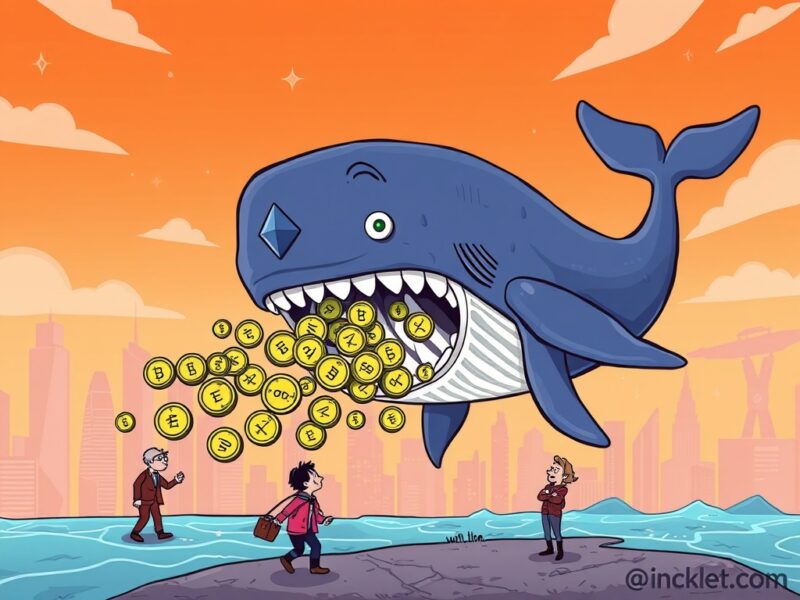

Vitalik Buterin ‘Dumping’ ETH? Co-Founder Sells Millions as Ethereum Tanks

2026/02/05 15:24

Vitalik Buterin Moves $29M-Worth of Ethereum as New Challenger $MAXI Takes Off

2026/02/05 15:24

What You Need to Know About Ethereum’s Hegota Upgrade

2026/02/05 15:24

WTI declines to near $63.50 as US-Iran talks ease supply fears

2026/02/05 15:23

“Token Hóa” Đang Tăng Tốc: CEO Bitget Gracy Chen Và Tầm Nhìn Về Một Kỷ Nguyên Tài Chính Không Biên Giới Tại “The Rollup”

2026/02/05 15:09