NFT

Share

NFTs are unique digital identifiers recorded on a blockchain that certify ownership and authenticity of a specific asset. Moving past the "PFP" craze, 2026 NFTs emphasize utility, representing everything from IP rights and digital fashion to RWA titles and event ticketing. This tag explores the technical standards of digital ownership, the growth of NFT marketplaces, and the integration of non-fungible tech into the broader Creator Economy and enterprise solutions.

12970 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

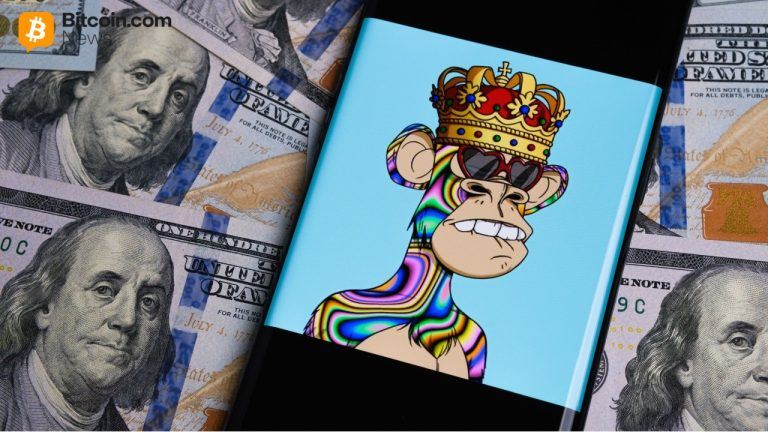

Court Rules BAYC NFTs Are Not Securities

Author: Coinstats

2025/10/05

Share

Recommended by active authors

Latest Articles

Pi Network Aims for $1 Trillion Market Cap: Is Picoin Poised for a Breakthrough?

2026/02/14 14:42

Pi Network Node Protocol Upgrade Guide: From v19 to v23 Explained for Pioneers

2026/02/14 14:26

The $55M Liquidity Standard: Why Institutional Capital is Rotating from Legacy Altcoins to Kradwin (KDN) This Week

2026/02/14 14:18

Shiba Inu Sees 140 Billion Token Exodus From Exchanges in Three Days

2026/02/14 14:06

Pi Network Pushes Deeper Into Full Decentralization

2026/02/14 14:05

![Top 7 Crypto PR Agencies in Asia [2025 Ranking]](https://images.cryptodaily.co.uk/space/unnamed%20%2858%29%20%281%29.png)