NFT

Share

NFTs are unique digital identifiers recorded on a blockchain that certify ownership and authenticity of a specific asset. Moving past the "PFP" craze, 2026 NFTs emphasize utility, representing everything from IP rights and digital fashion to RWA titles and event ticketing. This tag explores the technical standards of digital ownership, the growth of NFT marketplaces, and the integration of non-fungible tech into the broader Creator Economy and enterprise solutions.

12955 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

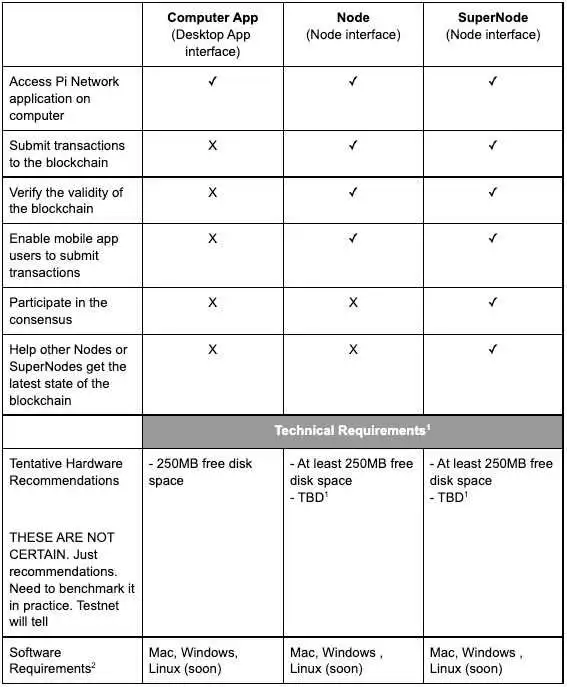

Pi Network Sets Feb 15 Deadline for Mainnet Node Upgrade

2026/02/14 04:39

Warren vs Trump’s SEC: U.S. Senate Clash Over Crypto Policy

2026/02/14 04:38

Pi Network Sets February 15 Deadline for Mandatory Mainnet Node Upgrade

2026/02/14 04:02

Singapore FY26 Budget: A Visionary Blueprint for AI-Driven Growth – MUFG Analysis

2026/02/14 03:55

Wall Street analysts slash Coinbase (COIN) price targets after Q4 miss — but shares still rally

2026/02/14 03:51