NFT

Share

NFTs are unique digital identifiers recorded on a blockchain that certify ownership and authenticity of a specific asset. Moving past the "PFP" craze, 2026 NFTs emphasize utility, representing everything from IP rights and digital fashion to RWA titles and event ticketing. This tag explores the technical standards of digital ownership, the growth of NFT marketplaces, and the integration of non-fungible tech into the broader Creator Economy and enterprise solutions.

12888 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

The Howard and Georgeanna Jones Foundation for Reproductive Medicine announces new $75,000 Bridge Funding Award

2026/02/13 04:45

Senate Republican shares NSFW story about late-night Trump phone calls

2026/02/13 04:43

UAE’s Central Bank Approves the DSSC Stablecoin Launch by IHC, FAB, and Sirius

2026/02/13 04:30

Unyielding Challenges Stall US Crypto Bill Progress

2026/02/13 04:04

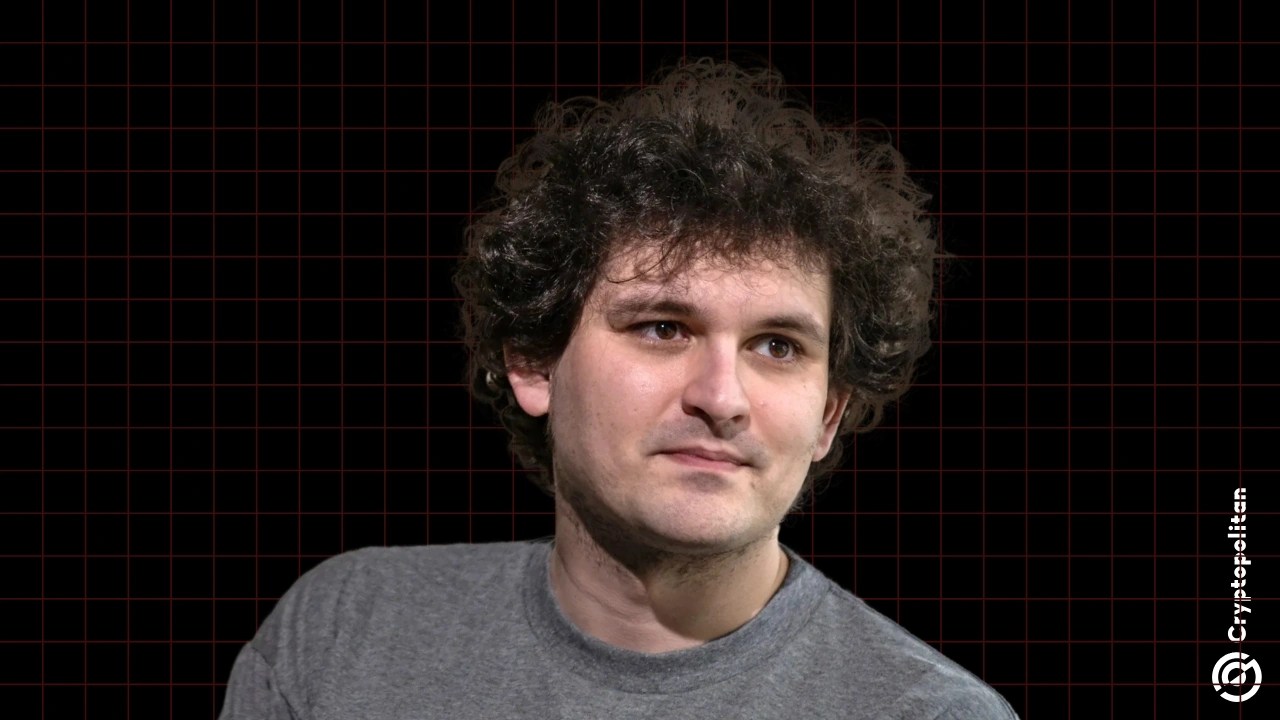

SBF enters fourth day of challenging Biden DOJ conviction, courting Trump admin

2026/02/13 03:53