RWA

Share

RWA (Real World Assets) refers to the tokenization of tangible assets—such as real estate, private credit, and government bonds—on the blockchain. By bringing traditional financial instruments on-chain, RWA protocols like Ondo and Centrifuge provide DeFi users with stable, real-yield opportunities. In 2026, the RWA sector is a multi-trillion-dollar bridge between TradFi and DeFi, enabling fractional ownership and global liquidity for previously illiquid assets. Follow this tag for insights into on-chain credit markets, regulatory compliance, and asset-backed security innovations.

43021 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

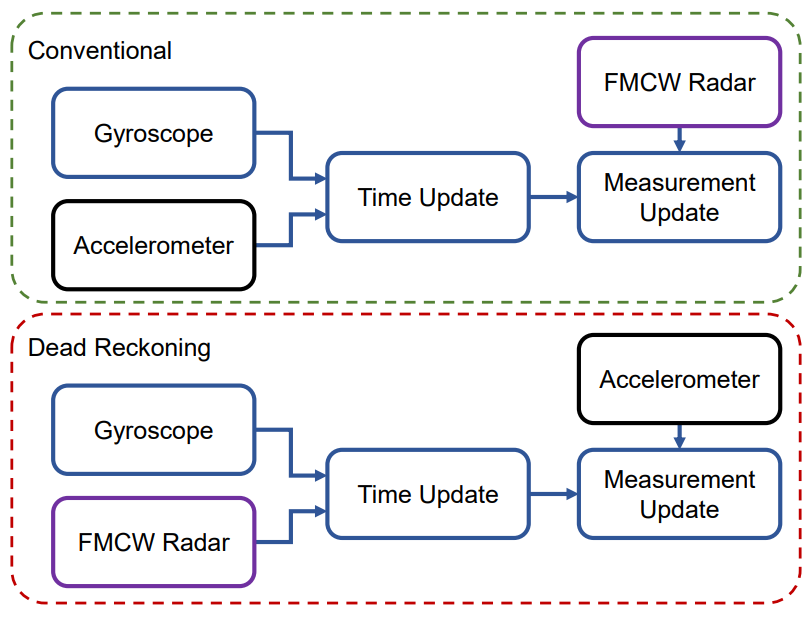

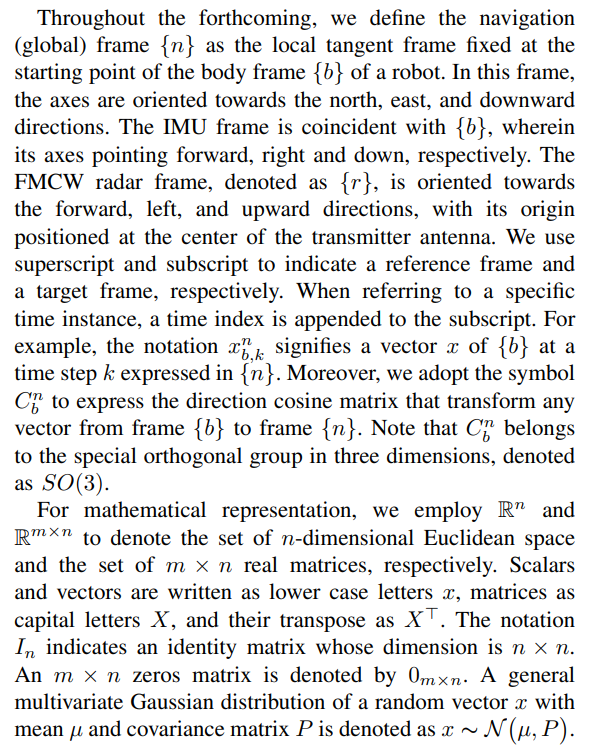

Dead Reckoning Meets Radar Odometry

Author: Hackernoon

2025/08/27

Share

Recommended by active authors

Latest Articles

US Senate Ag Committee Chair Reveals Crucial Progress On CLARITY Act

2026/02/06 08:42

Saylor's unrealized losses exceed $10.1 billion, and Tom Lee's unrealized losses exceed $8.65 billion.

2026/02/06 08:26

Once Upon a Farm Announces Pricing of Initial Public Offering

2026/02/06 08:15

Pulse Biosciences Presents Late-Breaking Data from nPulse™ Cardiac Catheter System First-In-Human Feasibility Study at the AF Symposium

2026/02/06 08:15

Trump roasts House Speaker Mike Johnson for saying grace at National Prayer Breakfast

2026/02/06 08:05